MLPs with the highest 5-year return

But the boom turned to bust in the oil patch has punished investors; indeed, while one-year returns among 14 prominent funds investing in MLPs have been respectable, only two funds managed to avoid annualized losses the past three years and just one posted double-digit annualized gains over the past five years.

During periods of strong gains, the tax advantage of MLPs can be significant. The partnership structure allows for pass-through income in which the MLP is not liable for corporate income taxes. Shareholders, of course, must pay personal income taxes on income from the investments.

Costs have declined in recent years, but are hardly cheap compared with broad index funds.

How did these funds fare? Click through to see the results.

Data from Morningstar as of Sept. 26.

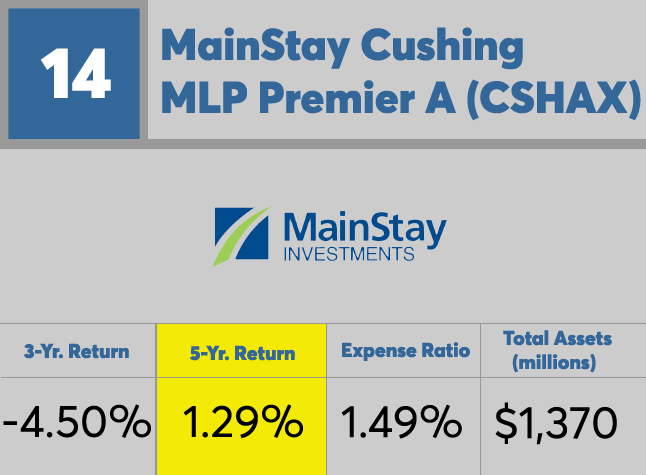

14. MainStay Cushing MLP Premier A

5-Yr. Return: 1.29%

Expense Ratio: 1.49%

Total Assets (millions): $1,370

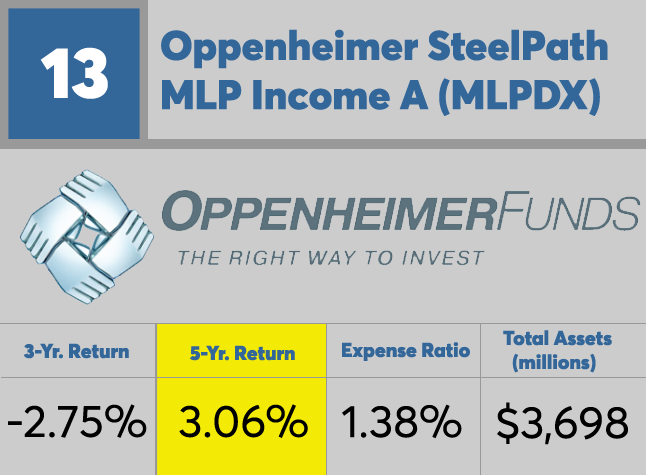

13. Oppenheimer SteelPath MLP Income A

5-Yr. Return: 3.06%

Expense Ratio: 1.38%

Total Assets (millions): $3,698

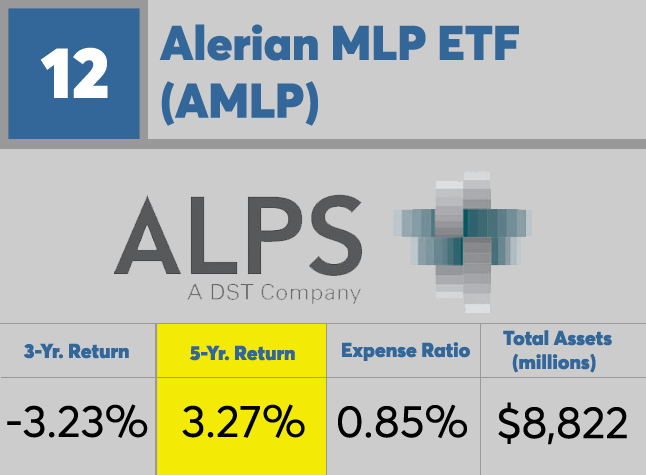

12. Alerian MLP ETF

5-Yr. Return: 3.27%

Expense Ratio: 0.85%

Total Assets (millions): $8,822

11. JPMorgan Alerian MLP ETN

5-Yr. Return: 3.83%

Expense Ratio: 0.85%

Total Assets (millions): $3,719

10. Center Coast MLP Focus A

5-Yr. Return: 3.83%

Expense Ratio: 1.47%

Total Assets (millions): $2,610

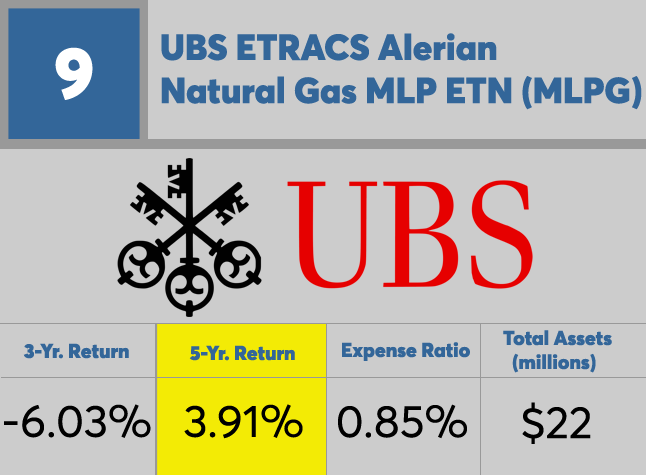

9. UBS ETRACS Alerian Natural Gas MLP ETN

5-Yr. Return: 3.91%

Expense Ratio: 0.85%

Total Assets (millions): $22

8. Credit Suisse X-Links Cushg MLPInfrasETN

5-Yr. Return: 4.33%

Expense Ratio: 0.85%

Total Assets (millions): $510

7. Oppenheimer SteelPath MLP Alpha A

5-Yr. Return: 4.85%

Expense Ratio: 1.52%

Total Assets (millions): $3,592

6. Oppenheimer SteelPath MLP Select 40 A

5-Yr. Return: 4.90%

Expense Ratio: 1.12%

Total Assets (millions): $3,066

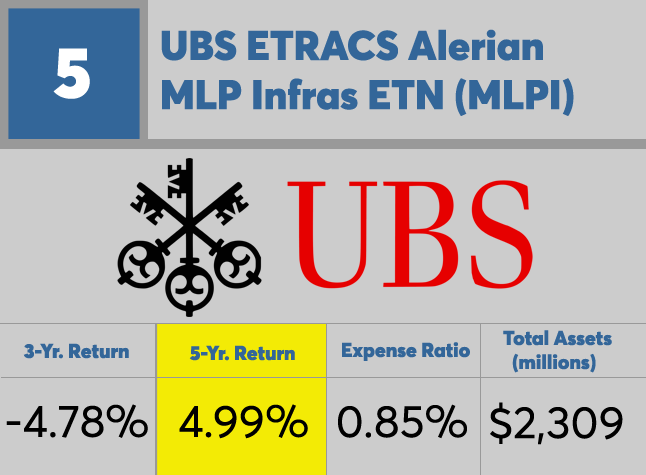

5. UBS ETRACS Alerian MLP Infras ETN

5-Yr. Return: 4.99%

Expense Ratio: 0.85%

Total Assets (millions): $2,309

4. Advisory Research MLP & Energy Infras I

5-Yr. Return: 6.16%

Expense Ratio: 1%

Total Assets (millions): $480

3. Advisory Research MLP & Energy Income I

5-Yr. Return: 6.40%

Expense Ratio: 1.69%

Total Assets (millions): $853

2. MainGate MLP A

5-Yr. Return: 6.60%

Expense Ratio: 1.69%

Total Assets (millions): $1,741

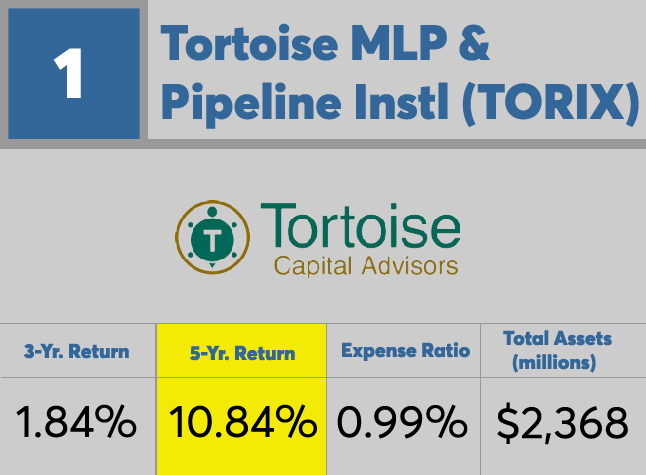

1. Tortoise MLP & Pipeline Instl

5-Yr. Return: 10.84%

Expense Ratio: 0.99%

Total Assets (millions): $2,368