Published Oct. 31, 2017

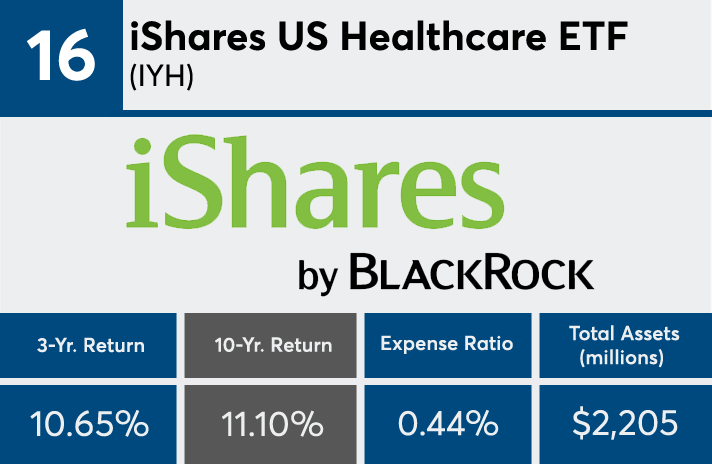

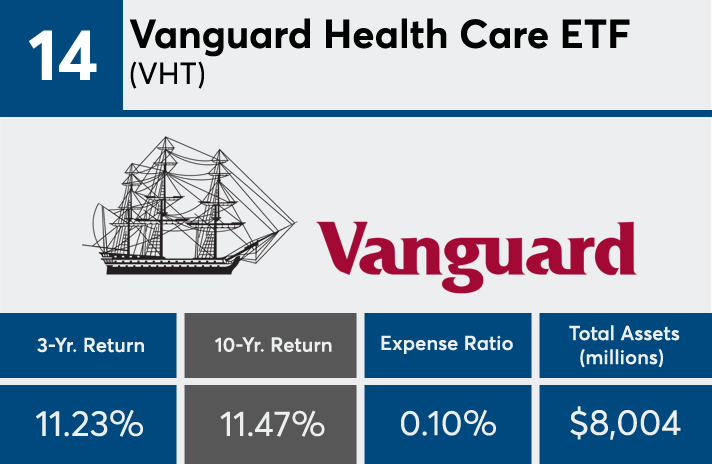

Passively managed funds have changed the face of the markets since their introduction. Indeed, they’ve fueled the growth of the two largest asset managers in the world by assets (Vanguard and BlackRock). The convenience and inexpensive access to the markets are hard to beat.

The debate that rages is whether they offer the same potential upside to investors as actively managed funds. An S&P 500 ETF usually will pale in comparison to the best active funds in any given year. But over time, they tend to catch up, unless of course clients are lucky enough to reallocate every year to buy the active funds that will become one of the best over the next 12 months. In other words, unless they continually beat the markets, which is like winning the World Series year after year after year.

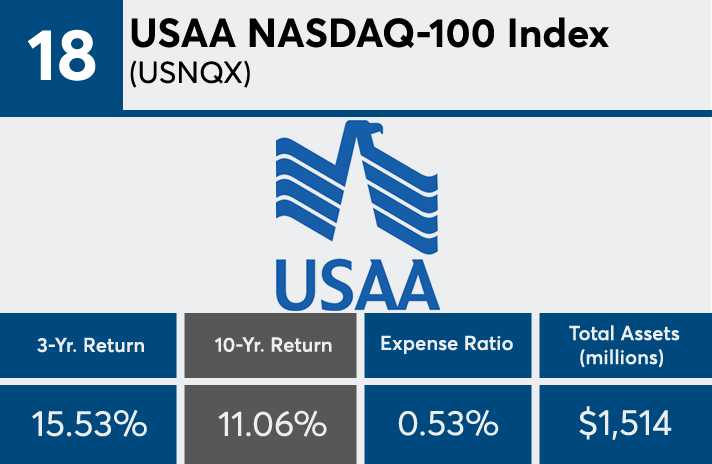

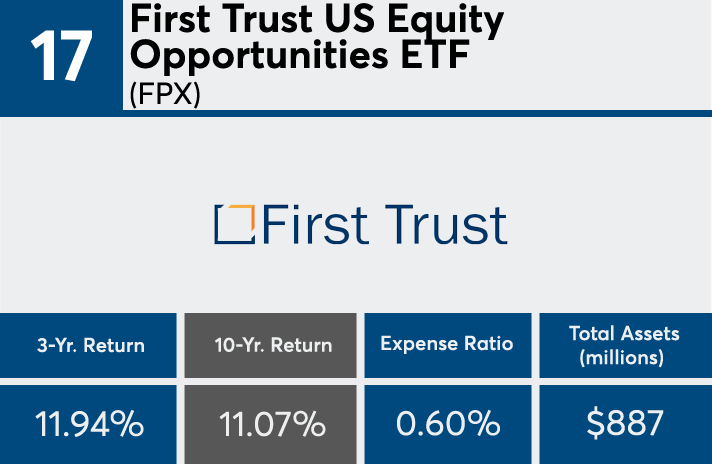

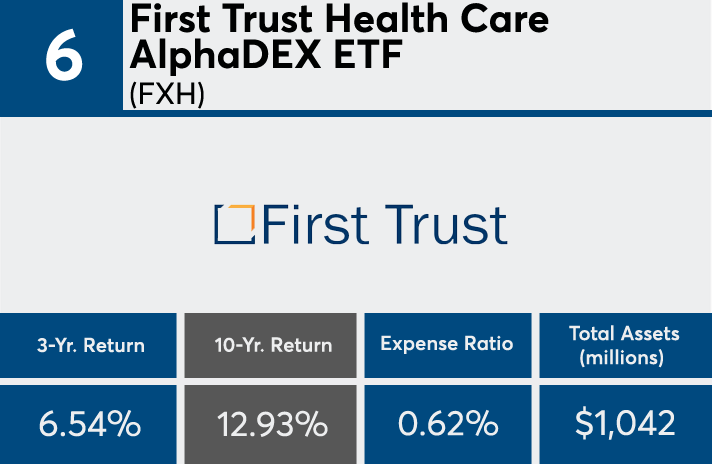

Eventually, winning streaks or investment strategies break down. So we’ve collected the best passive funds (with a minimum of $500 million in assets) based on 10-year returns. These funds, similar to our list of

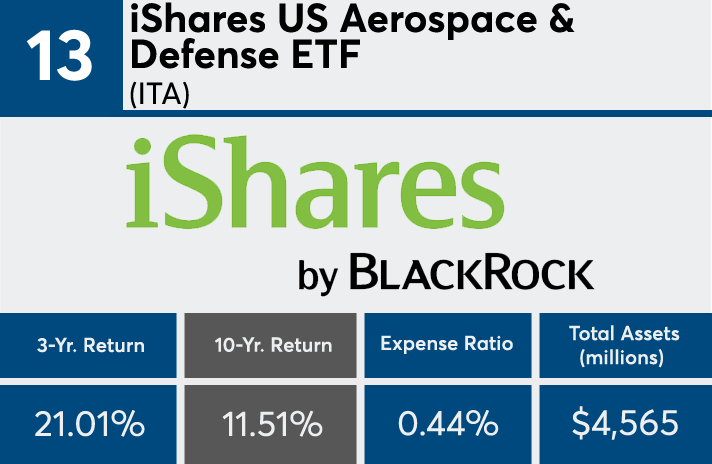

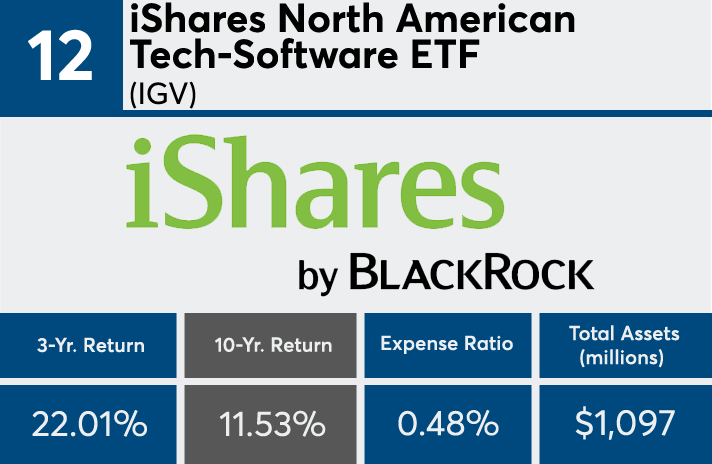

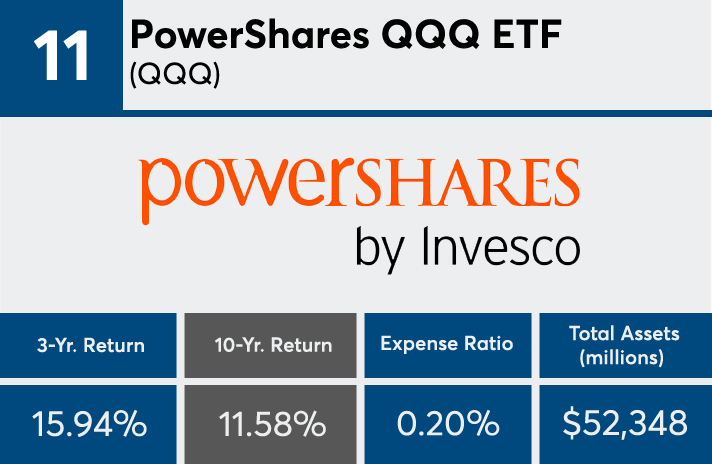

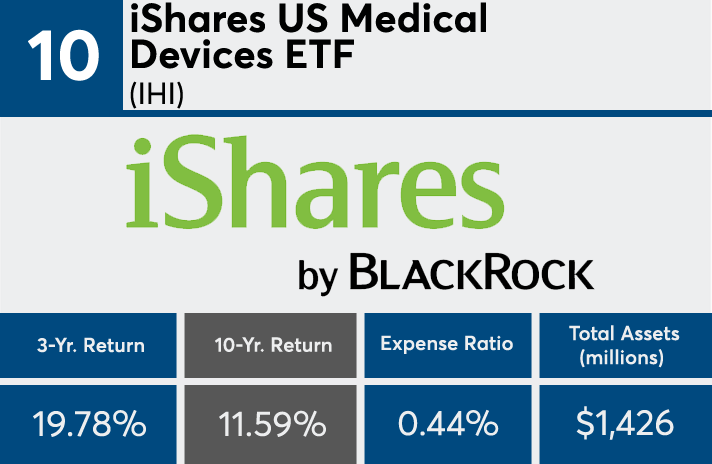

The average annual return was 12.6%. The S&P 500 posted a 7.6% annual gain in that period, as measured by SPY, the biggest S&P 500 ETF. Over three years, the average return of these 20 funds was 13.1%; for SPY, it was 11.6%.

In addition to 10-year and three-year return, we also show expense ratios, which averaged 42 basis points, slightly less than half the average expense ratio of our active funds list last week.

Scroll through to see all 20 of the best-performing passive funds over 10 years. All data from Morningstar Direct.