-

The property should allow them to live close to their loved ones and fit their financial plan, according to a CFP.

June 28 -

Only 4% of U.S. retirees are waiting until they turn 70 to claim benefits, the age when payments reach their maximum level.

June 28 -

Careful planning can help prevent them from shrinking their benefits based on misperception.

June 27 -

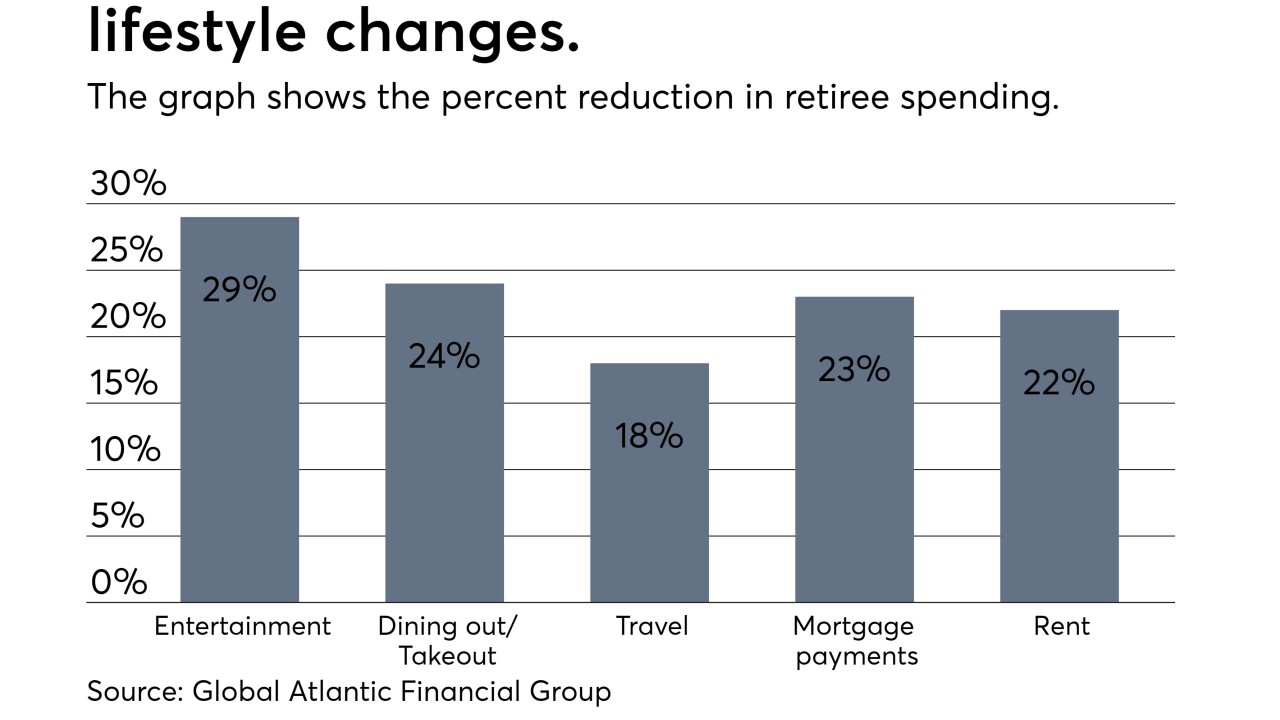

It's important for advisors to help clients get ready for the side effects of this radical lifestyle change.

June 25 -

Target-date funds can help risk-averse young clients ease into investing.

June 21 -

Dual-income couples benefit less from Social Security.

June 19 -

Clients can expect investment returns through compounded growth as long as they don’t lose from a market downturn.

June 18 -

Well over half say they would back Sen. Elizabeth Warren’s plan to tax those with more than $50 million in assets, a survey finds.

June 18 -

Especially for couples in which one spouse retires early, savvy planning can translate into thousands of dollars in Social Security benefits.

June 17 -

Early planning for potential tax hikes is key.

June 17 -

Tariffs associated with the U.S.-China trade war could cause a bigger than expected adjustment.

June 11 -

The legislation nullifies a strategy that previously allowed heirs to stretch an inherited account's tax-deferred growth based on their life expectancy.

June 11 -

Depression can be a big risk for seniors as they transition to retirement.

June 7 -

The legislation includes a provision that would raise the age limit for making contributions and taking required minimum distributions.

June 6 -

Retirees should live a frugal, flexible lifestyle and consider buying insurance to cover big ticket items.

June 5 -

"Part of the conversation should be exploring how your client uses the health-care system," says a CFP.

May 30 -

As much as 46% believe Medicare will cover the costs of long-term care.

May 23 -

The number of recipients has increased as the baby boomer generation reaches retirement age.

May 23 -

Clients who consider contributing to their health savings accounts past their full retirement age are advised to rethink their plan.

May 17 -

Seniors in this position may face a tax bill and possibly a penalty if they dip into their 401(k) prematurely, says an expert.

May 10