-

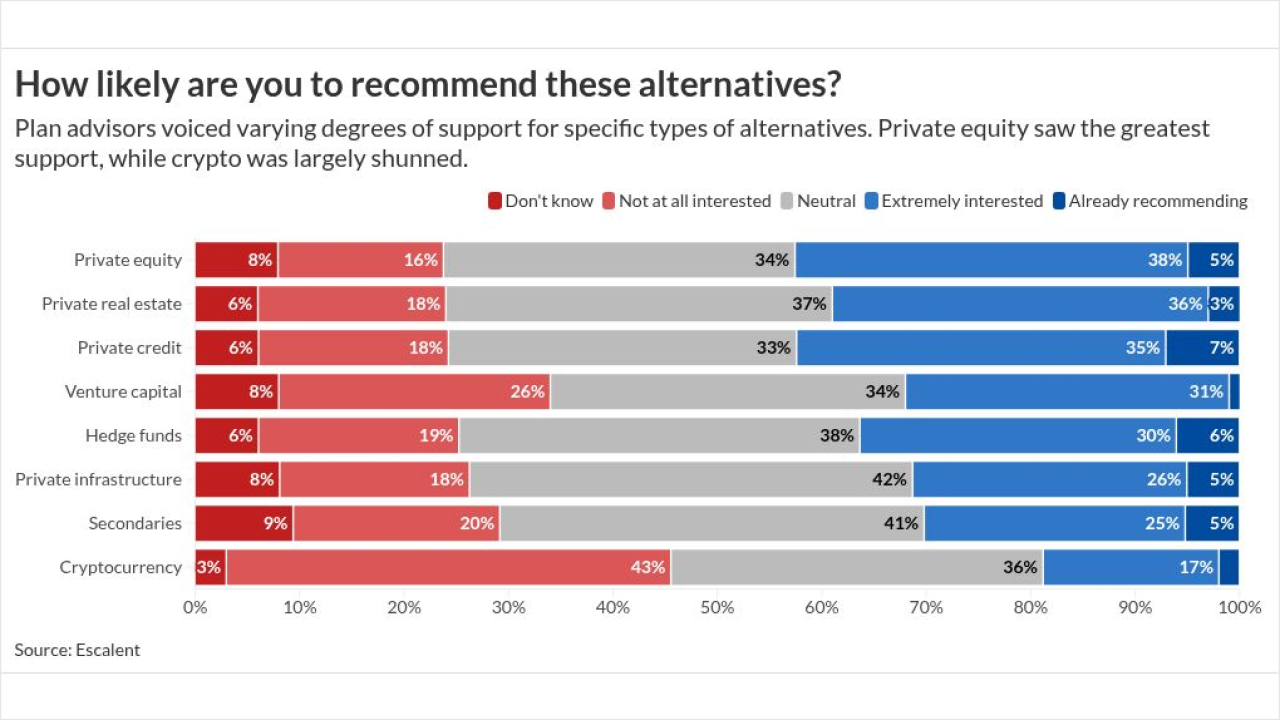

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18 -

Two former advisors accuse JPMorgan of assigning them to poorer parts of Brooklyn, New York, and allowing their White male colleagues to poach their clients.

December 18 -

Ameryn Seibold was tasked with manipulating the Excel data that the subprime auto lender regularly sent to its financiers.

December 18 -

FINRA identifies new ways firms and investors are using technology like AI to spot changes in market sentiment and asks the industry to chime in on how finfluencers and others are using social media.

December 17 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

The broker-dealer veteran saw her firm's revenue model as a fair trade — even a badge of honor — before going independent.

December 17 The Erskine Group

The Erskine Group -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

An industry lawyer warns that RIAs often don't do enough to delineate their responsibilities and shield themselves from liability when they add tax preparation to their service offerings.

December 16 -

From crypto to private markets to AI and beyond, here are the investing trends and themes to watch in the new year.

December 16 -

Founders Elissa Buie and Dave Yeske are leaving a legacy in the profession and at the firm under three successors taking over in 2026.

December 16 -

With no guidance available, tax practitioners and their clients have to figure out how much risk they want to take.

December 16 -

Charles Schwab CEO Rick Wurster, IRS CEO and Social Security Administration Commissioner Frank Bisignano and iCapital's Chief Investment Strategist Sonali Basak made the list — see who else did.

December 16 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

President Donald Trump is reportedly considering moving cannabis from a Schedule I to Schedule III substance. Experts say this could go a long way toward establishing the industry's legitimacy.

December 15 -

The One Big Beautiful Bill Act makes the opportunity zone program permanent and also introduces some changes in the real estate investor tax breaks.

December 15 -

Michael Nathanson oversaw Focus Financial Partners as it reorganized into five internal hubs. Industry experts say the long overdue consolidation still has far to go.

December 15 -

Wealthy taxpayers in high-tax states like California, New York and New Jersey are the biggest winners, as are workers who collect tips or overtime, and seniors.

December 15 -

Yes, AI is saving many advisors time and helping them reach prospects. But some say the rapid rate of adoption and automation could put them out of a job in the future.

December 12