-

The hedge fund he founded, Appaloosa Management, has returned 25% a year since inception in 1993.

May 29 -

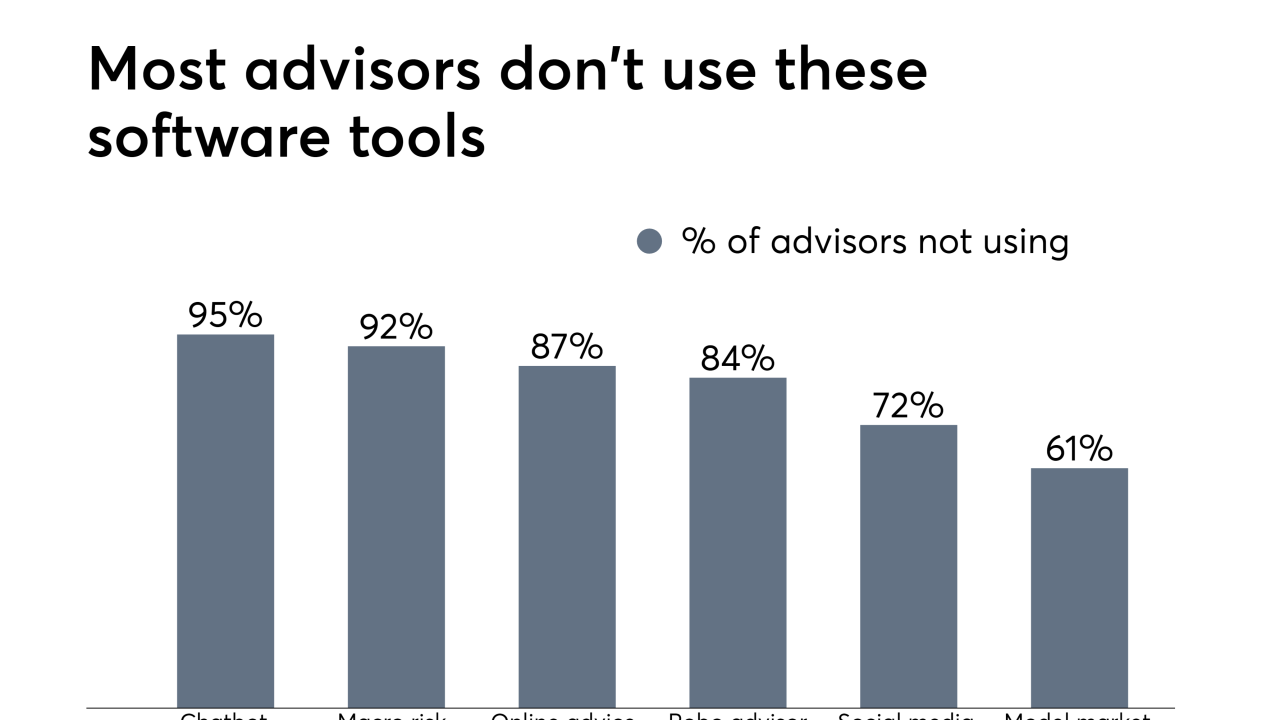

Technology has created efficiencies for RIAs. It’s also a danger, says the firm’s COO.

May 22 -

The top 20 collected nearly $1 trillion in combined assets.

May 21 -

The delay does not “indicate that the commission has reached any conclusions,” the regulator said.

May 21 -

Nearly all posted losses over the last year.

May 15 -

More money has been pulled from hedge funds than added over the past four quarters, while ETFs reeled in $312 billion last year.

May 14 -

The SEC has just approved an ETF with negative fees — a sign that fund managers need to continue adjusting to their straitened circumstances.

May 14 -

An AQR executive just sketched a blueprint for traders seeking to hitch a high-octane ride on the global credit cycle.

May 14 -

These double-digit returns came at a price lower than the rest of the sector.

May 8 -

Asset managers are seeking alternatives to standard mutual fund products.

May 6 -

Clients are paying about half as much to own funds as they were 20 years ago.

May 6 -

One of its products added a record $368 million after the firm discreetly slashed its fee in March.

May 6 -

Rather than developing a new family of ETFs, the asset manager created them as a share class within its existing mutual funds.

May 6 -

The expanded line up of index funds demonstrates one way the brokerage industry is grappling with an ongoing race to offer products at the lowest price.

May 6 -

As she advanced in her career, Franklin Templeton's Dina Ting had many mentors who helped her navigate challenges.

May 3 -

The first of her family to work in financial services, Dina Santoro leads the strategic product and marketing agenda for Voya Investment Management.

May 3 -

Since joining Mackay Shields as an investment management assistant 46 years ago, Lucille Protas is now president, executive managing director and COO.

May 2 -

Since making the decision to join Jeffrey Gundlach at DoubleLine, Luz Padilla now oversees a 16-person team with nearly $9 billion in AUM.

May 2 -

Since starting her career at Vanguard more than a decade ago, Denise Krisko has launched her own sub-advisory business that manages $4.5 billion.

May 2 -

The hiring will “reflect the changing nature of fund management,” a company spokeswoman said.

May 2