The double-digit returns attached to any one of the decade’s top-performing technology funds came at a high price to investors.

All of the 20 best-performing technology sector mutual funds and ETFs recorded stellar gains over the last 10 years, Morningstar Direct data show. With nearly $78 billion in combined assets under management, the funds had average 10-year returns ranging from as much as 19% to nearly 24%. Robby Greengold, manager research analyst at Morningstar, says asset allocation is a primary driver of fund returns, and these top-performers followed the trend despite carrying higher fees than the industry average.

“Superior execution of allocation decisions should lead to superior performance,” Greengold says. “While tech-focused funds have earned excellent returns in the past, they tend to be expensive.”

The top-performers had above-average expense ratios when compared to the broader market. At 0.74%, the average net expense ratio was significantly higher than the average 0.48% investors paid for fund investing last year, down from 0.51% in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. For the technology sector, however, the median expense ratio across all share classes was 1.21%, while the average came in at roughly 1.30%, Greengold notes.

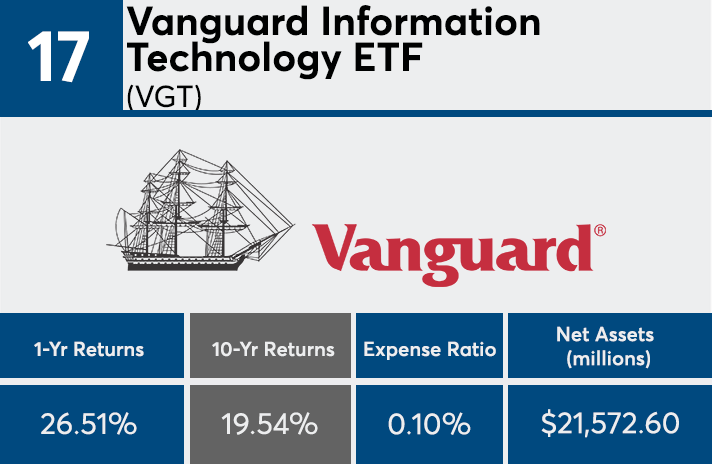

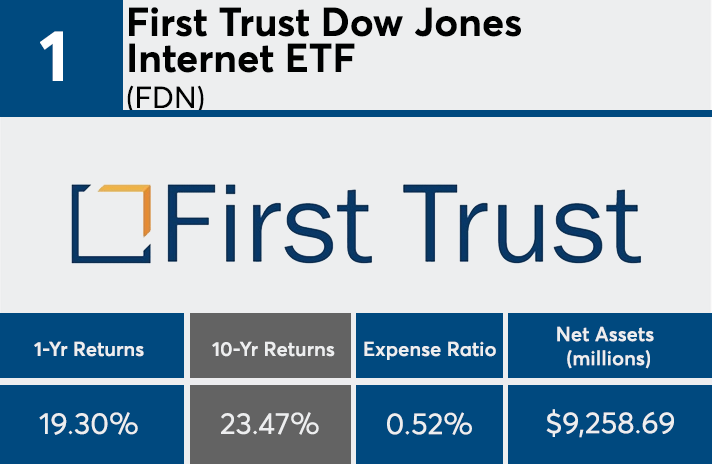

With around $21.6 billion in AUM, the industry’s largest technology sector fund, the First Trust Dow Jones Internet ETF (VGT), appears in this ranking with a 10-year return of 19.54% and 0.10% expense ratio, data show. A similar screen of the industry’s largest 20 technology sector funds, home to $120.8 billion in AUM, had an average return of 19.78% over 10 years. Those funds carried an average expense ratio closer to the industry average at 0.66%.

“Over the past five years … software was the sector’s best-performing industry — Microsoft, Adobe and Salesforce led the way,” Greengold explains. “Payments firms, including Visa, MasterCard and PayPal, have also been top contributors to the sector’s returns.”

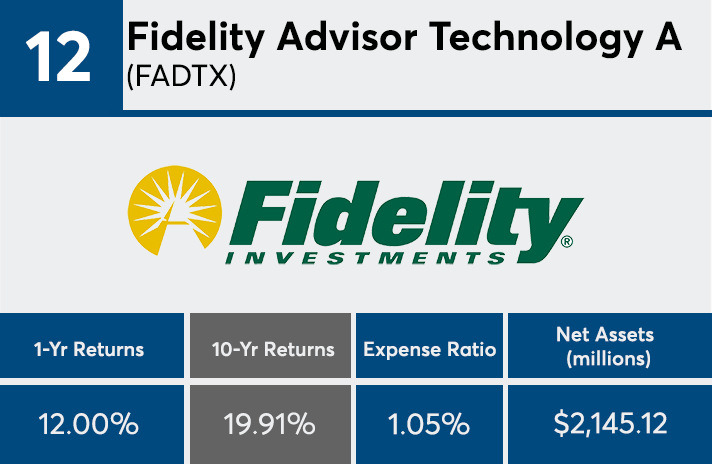

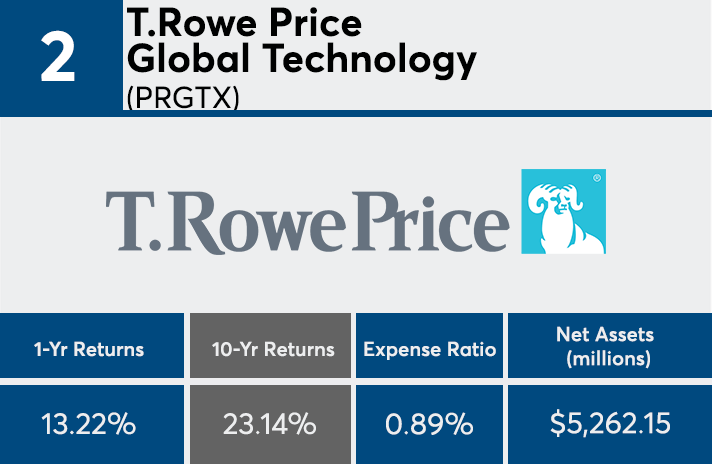

Greenwald warns advisors with clients in any of these funds that although the products are providers of great returns, they are hard to compare with one another without taking a detailed look under the hood. “While they all broadly invest in technology, some have industry specializations — the First Trust Dow Jones Internet ETF targets internet companies, while Fidelity Select Semiconductors focuses on semiconductors,” Greenwald said of the top-performers, adding, “that means that their performance could be driven primarily by the relative performance of their underlying industries rather than stock-picking skill of their managers.”

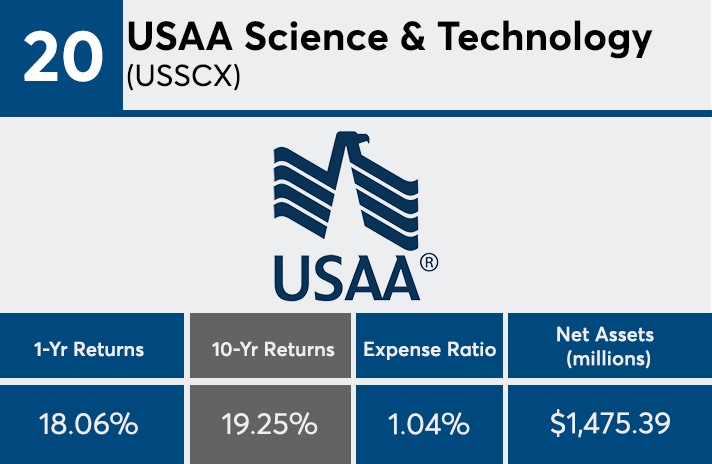

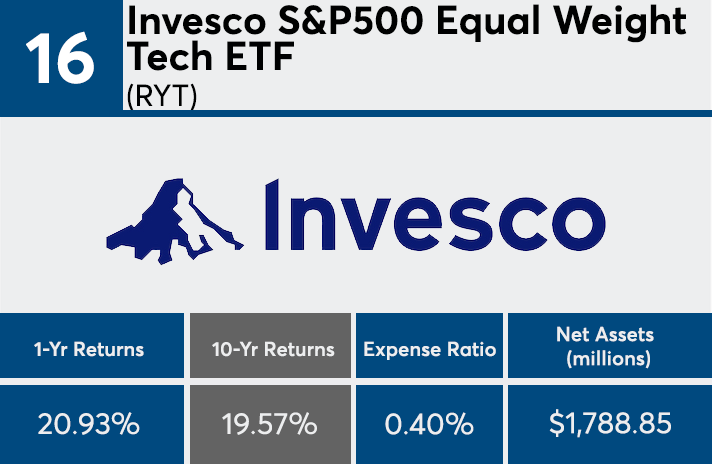

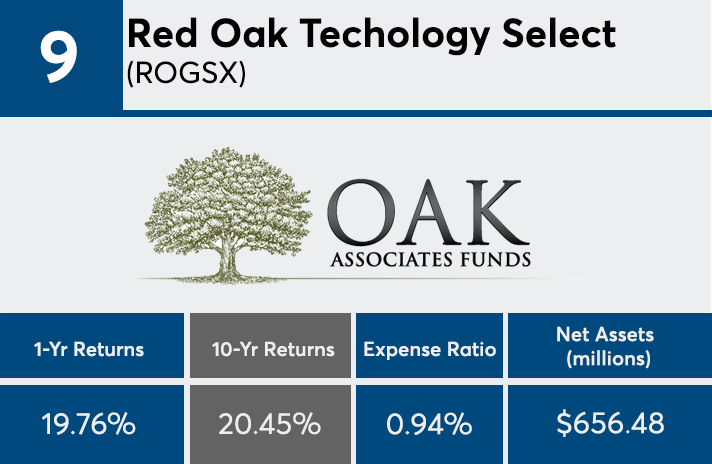

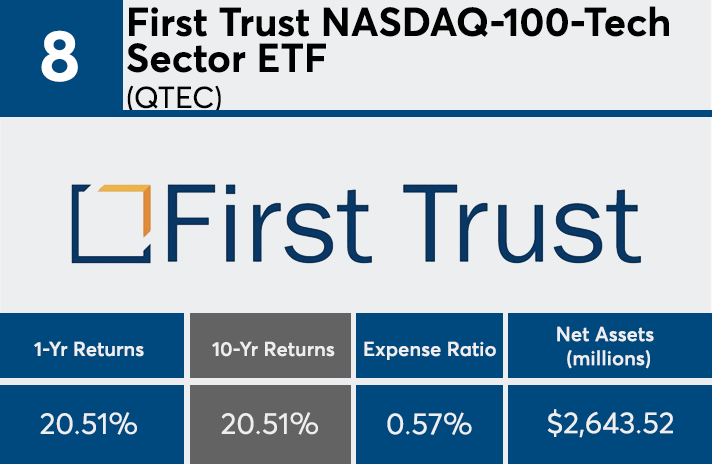

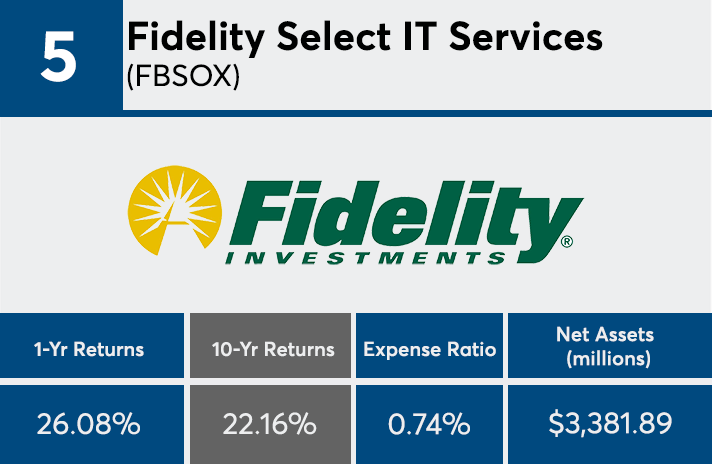

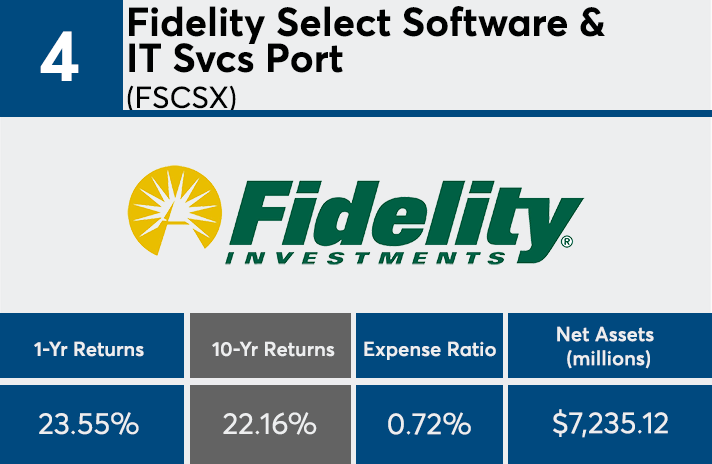

Scroll through to see the 20 technology category funds ranked by the highest 10-year returns through April 30. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund, as well as 1-year returns, are also listed. The data shows each fund's primary share class.