-

The $10.1 billion fund’s star manager, well known for his contrarian investments, held on to a short position against U.S. Treasurys even as bonds rallied.

October 24 -

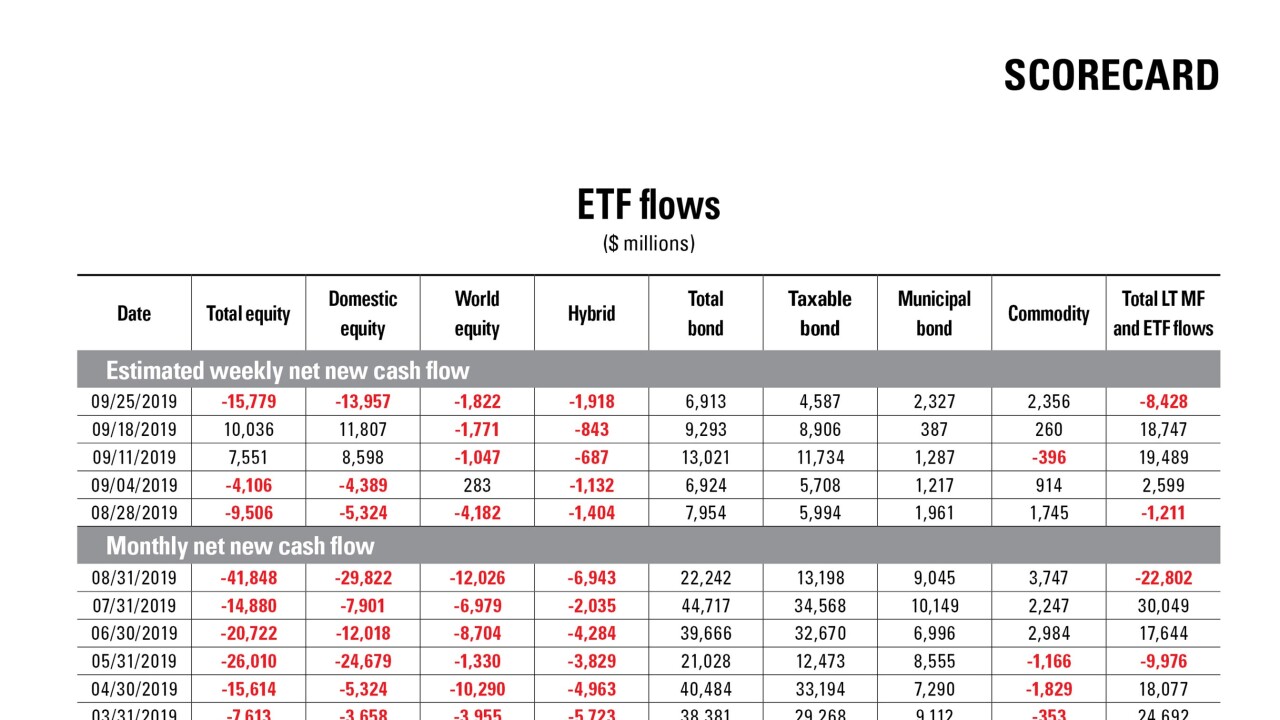

Data reported by the Investment Company Institute.

October 23 -

More than $1 trillion is invested in bond ETFs, with trading leaping 41% in 2018 from a year earlier, according to research.

October 23 -

The five-month-old fund from Tabula Investment Management just became one of the largest of its kind after taking in $68 million last week.

September 24 -

The underperformance is a rarity for the fund, which has beaten the benchmark for nine of the past 10 years.

August 19 -

Nearly all bested the broader market at roughly a third the price of the average fixed income product.

August 17 -

Data reported by the Investment Company Institute.

August 5 -

Some of the same features that led to their unpopularity may also be what uncorrelated them from their peers, an expert says.

July 31 -

While bond investor anxiety previously focused on how the funds respond to abrupt withdrawals, skeptics are now homing in on secondary trading.

July 25 -

Fixed-income products designed to minimize interest rate risk are among the leaders.

July 24 -

With markets near certain that the Fed will lower rates this month, debate has shifted to the size of the cut and its impact.

July 23 -

Investors wary of an intensifying trade war have piled into the firm's bond products, boosting net flows to $151 billion, according to the company.

July 22 -

The decision marks a shift for firm, which has largely ridden its equity-fund offerings.

July 17 -

Expense ratios associated with the new products range from 0.05% to 0.07%.

July 16 -

A new report asks whether the products have the potential to spark another crisis despite being created at the urging of the SEC to reduce risk.

July 15 -

Outstanding options riding the world’s most heavily traded government debt product are near the highest level this year.

July 10 -

Ukraine, Nigeria and Kazakhstan offer opportunities because local developments dominate the direction of their markets, the M&G fund manager said.

July 3 -

Many relatively straightforward products have boosted their holdings of lower-rated bonds and emerging markets to juice returns.

July 3 -

Real estate, communications, utilities and consumer staples funds have seen the most appetite, with every other sector experiencing outflows.

July 2 -

Geopolitical risk, dovish central banks and an aging business cycle are reinforcing bullish moorings in global debt.

June 26