Big bond funds have had a fine 10-year run: Nearly all of the industry’s 20 largest have bested the broader market over the past decade.

With a combined $1.2 trillion in assets under management, the steady gains of the 20 fixed-income mutual funds and ETFs with the most AUM outperformed the broader market by more than a percentage point over the past decade, Morningstar Direct data show.

At 4.30%, the average return of the largest bond funds posted a bigger gain the Bloomberg Barclays U.S. Aggregate Bond index, as measured by the iShares Core US Aggregate Bond ETF (AGG), which had a 3.88% return over the same period. But Greg McBride, senior analyst at Bankrate, says chances of another 10 years of the same outperformance aren’t likely.

“When there are concerns about an economic slowdown or recession, investors put a bigger premium on quality and performance [and that] can differ materially from what investors have seen in a decade-long expansion,” McBride says.

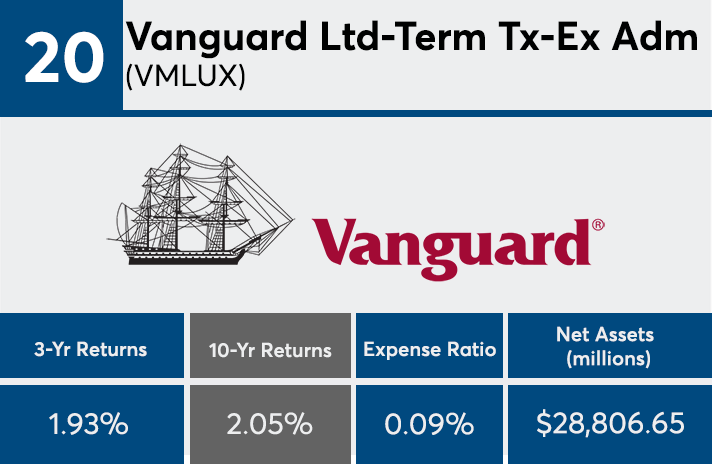

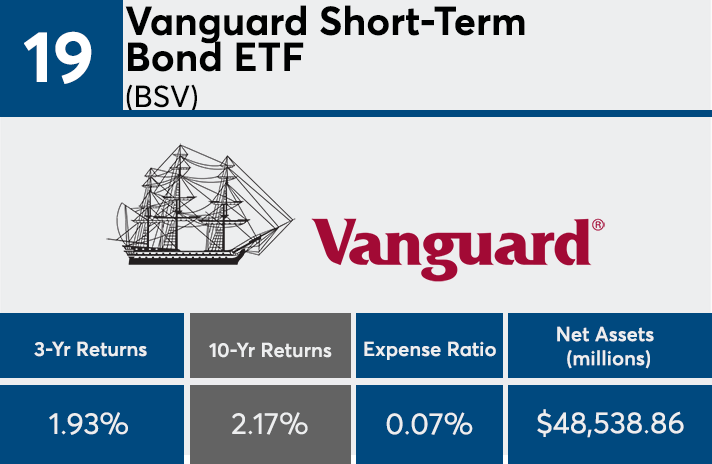

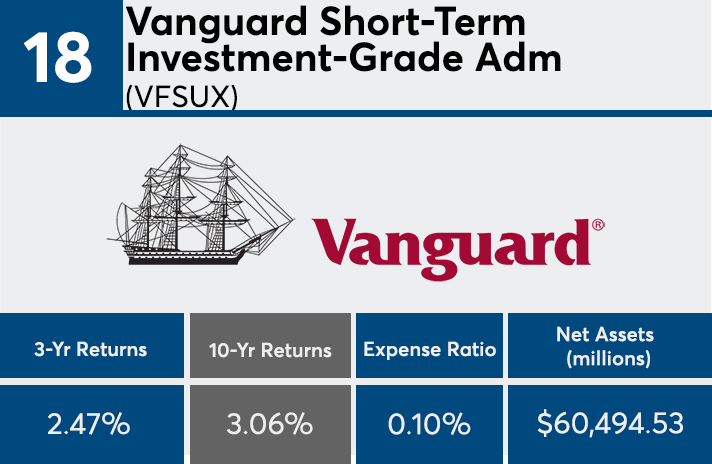

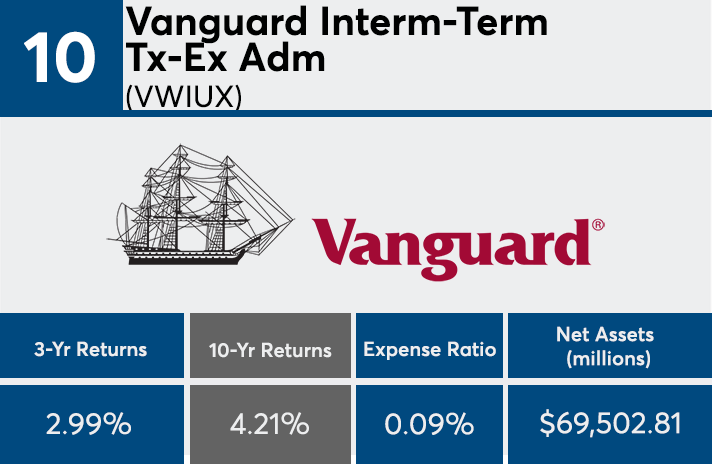

Fees among the largest 20 bond funds are low by industry standards. With an average net expense ratio of 0.26%, the funds are significantly cheaper than the average bond fund’s fee of 0.85%, data show. The funds are roughly half the cost of the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. With $232 billion in AUM, the industry’s largest bond fund, the Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX), has an expense ratio of 0.05% and 10-year return of 3.95%, data show.

Advisors must do their due diligence and take a detailed look under the hoods of many of these high-touch products, McBride warns, before including any of these funds in their clients’ portfolios.

“Unlike equities, among the largest bond funds the best performance over the past decade was more likely to come from active rather than passive funds,” he says, adding that “past performance is no guarantee of future results, and fortunes could easily change in the decade ahead.”

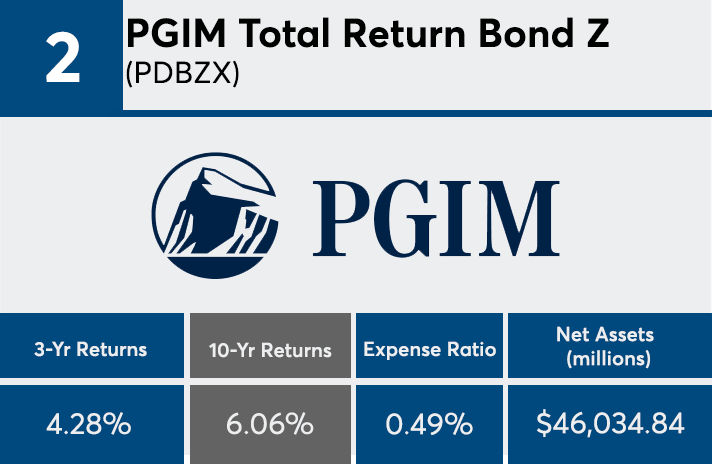

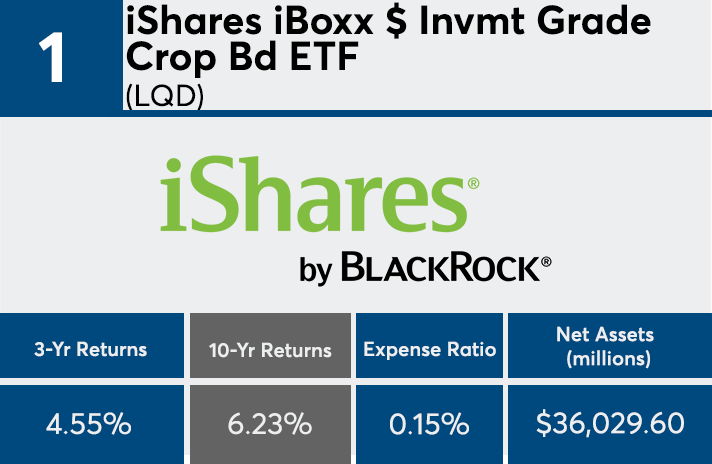

Scroll through to see the 20 largest bond funds ranked by their 10-year returns through July 7. Funds with investment minimums over $100,000 were excluded, as were ETNs, leveraged and institutional funds. Assets and expense ratios for each fund, as well as three-year daily returns, are also listed. The data is based on each fund's primary share class.