-

The brokers are offering their practice management lessons and resources as scale becomes increasingly crucial to wealth managers.

March 24 -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17 -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

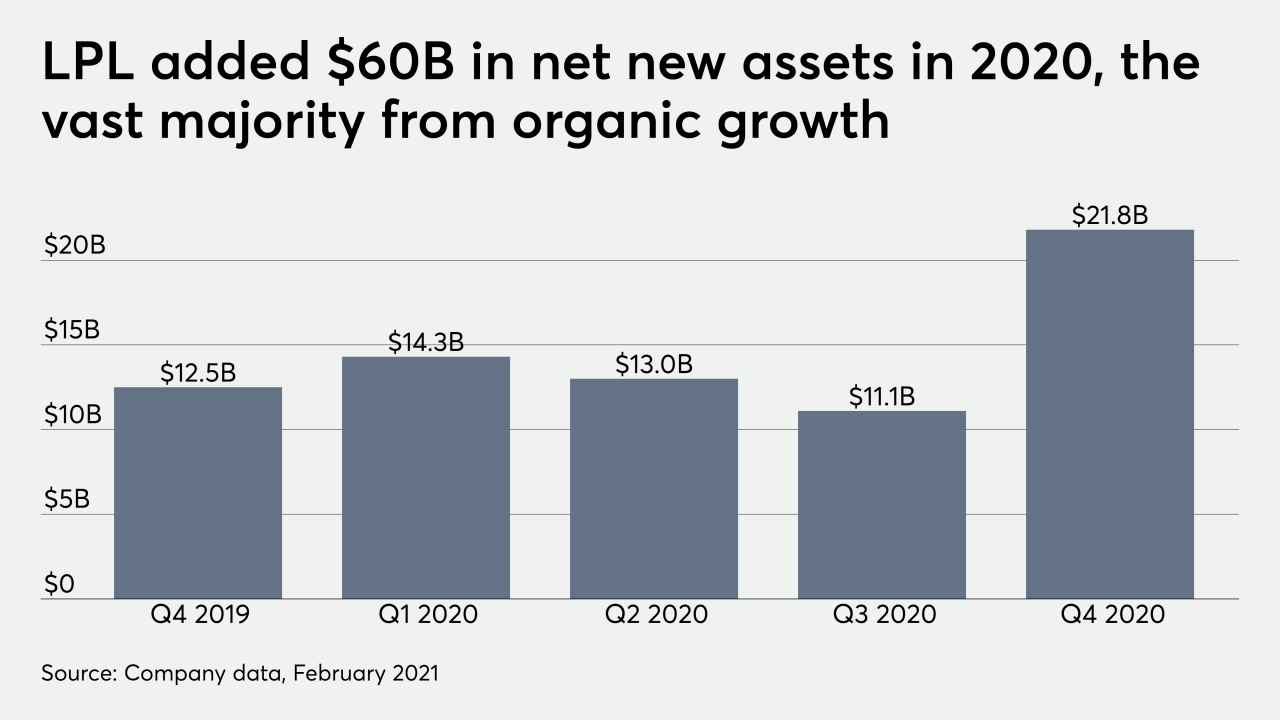

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

The practice received a recommendation from a surprising source and wound up picking its suitor after only a three-month search.

February 5 -

The acquisition of another midsize wealth manager will boost the holding company above 2,500 reps with nearly $95 billion in AUA.

February 3 -

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

A team that has grown through acquisitions dropped the No. 1 IBD after the institution purchased another one for more than $600 million.

January 27 -

Arete Wealth’s niche focus on alts for HNW and UHNW clients has given it a strong foothold in a fractured sector, experts say.

January 22 -

-

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

The private equity-backed firm’s bottom line has been less affected by coronavirus-related low interest rates than its rivals, Moody’s says.

November 4 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

Know a talented young advisor? Now’s your chance to nominate them for our annual rankings.

October 27 -

If approved for an IPO, the blank check company will face stiff competition among the growing ranks of RIA acquirers.

October 22 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15 -

The group of fee-only practices and networks have 1,187 IARs who manage a combined $95.7 billion.

October 13 -

These firms oversee more than $185 billion in combined assets.

October 1 -

The firm is maintaining control but dropping its FINRA registration as the sector’s rising expenses and lower margins fuel consolidation.

September 30 -

Focusing on “investment in leadership and access to markets,” the IBD aims to support reps and clients of diverse backgrounds, its head recruiter says.

August 18