A London-based wealth manager with global ambitions aims to extend its reach into the U.S. marketplace via a special purpose acquisition company.

Kingswood Acquisition’s plan is to raise $150 million through an IPO of 15 million units at $10 apiece to make acquisitions focusing on the “highly fragmented” independent wealth management industry,

Last month, Kingswood

The firms’ new parent has 174 employees in offices on three continents with more than $6 billion in client assets, according to its website, which also says the firm aspires to be “a leading global provider” in wealth management.

Kingswood’s SPAC could help it move toward that goal by adding a source of capital on top of the resources already committed by the U.K.-based parent and its other backer, alternative asset manager Pollen Street Capital, the filing shows. Kingswood has also tapped former Cetera Financial Group and Advisor Group CEO Larry Roth as its lead independent director.

“Given the growth trends and fragmented nature of the industry, we believe there is a significant opportunity for us to capitalize on the consolidation activity taking place in the global wealth management industry,” the filing states. “We believe we are well-positioned to partner with a growing wealth management firm that can gain market share and use publicly traded equity to fund new business initiatives and execute roll up acquisitions of additional wealth managers.”

Kingswood CEO Gary Wilder will serve as the SPAC’s executive chairman. Michael Nessim, the CEO of Benchmark Investments, an independent broker-dealer with 180 advisors, will act as the CEO of the new SPAC on Kingswood’s behalf. Other board members have experience with BNY Mellon’s Pershing, Royal Alliance Associates and Equitable.

Citing the quiet period while awaiting SEC approval, representatives for Kingswood declined requests for an interview to discuss their plans more specifically.

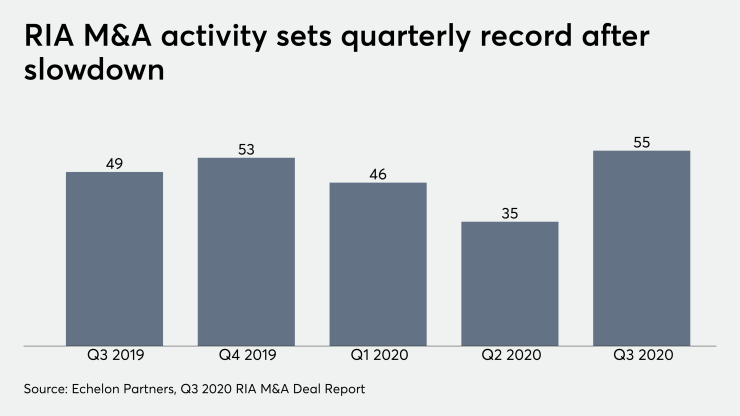

The newcomer to the U.S. wealth management arena can expect to face stiff competition, according to Carolyn Armitage, a managing director of investment bank and consulting firm Echelon Partners. She notes that M&A transactions across wealth management reached a new high of 55 in the third quarter following a slowdown amid the coronavirus pandemic earlier this year, according to Echelon.

Buyers of RIAs and other U.S. wealth management firms “are experienced doing deals, so they’re not fumbling around in the dark as if it’s their first time,” Armitage wrote in an email. On the other hand, she continued, “SPACs are under pressure to spend — read: invest — the raised cash in a limited time frame.”

Armitage notes another potential pitfall: that most sales take a year to 18 months to close and “that timeframe may be tight for most SPACs to properly invest in the U.S. wealth management marketplace. It could lead to overpaying for a deal or purchases of less than optimal firms that others passed on for a variety of reasons.”

In its filing to form what is known as a blank check company, Kingswood cites a “a significant number of target companies globally” and several factors it predicts will continue to drive growth in the U.S. wealth management industry.

“Over the medium to long term, we intend to build a substantial integrated global wealth and investment management platform, underpinned by disciplined capital allocation, rigorous due diligence, and our in-place operational, technology, risk and compliance framework,” the filing states.