-

Some owners are reluctant to give away an equity stake. Here is one solution.

January 30Momentum Advisors -

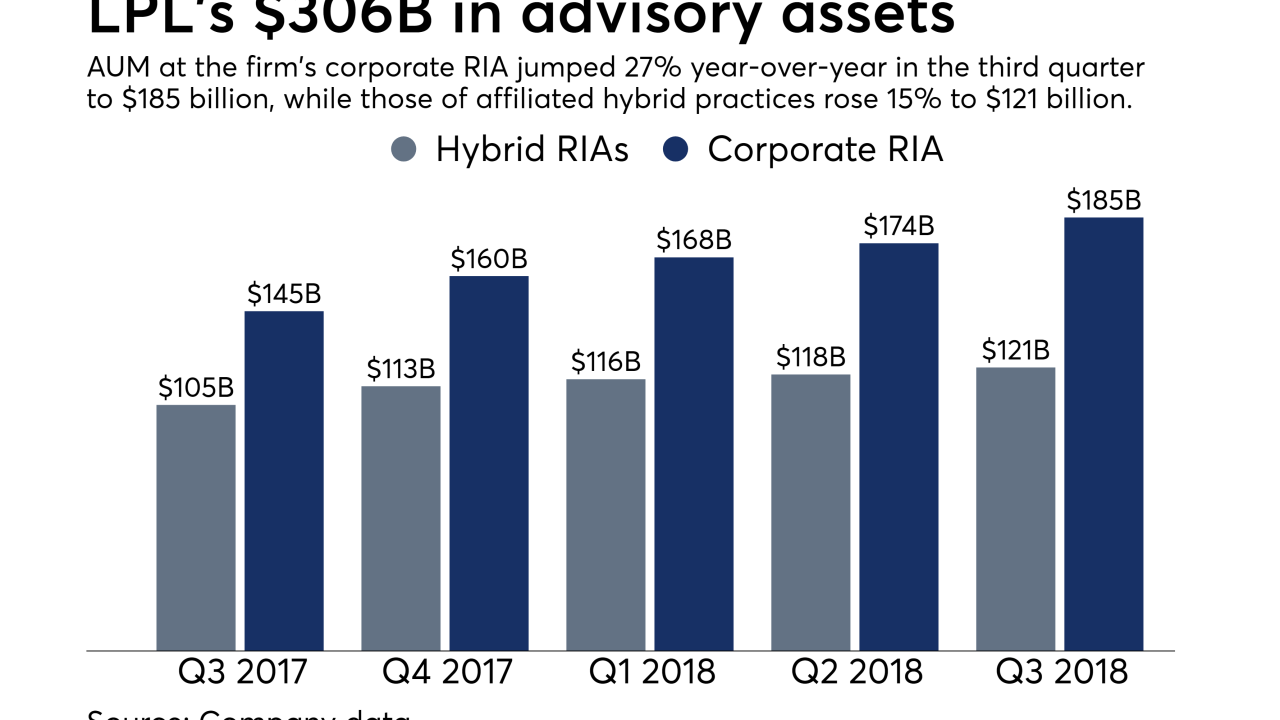

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

Executives say valuing friendliness alongside other factors is helping to drive a record $66 million in incoming production this year.

November 28 -

The advisors retained from shuttering Broker Dealer Financial Services will add more than 80 advisors now able to tap into the buying firm’s offerings.

November 14 -

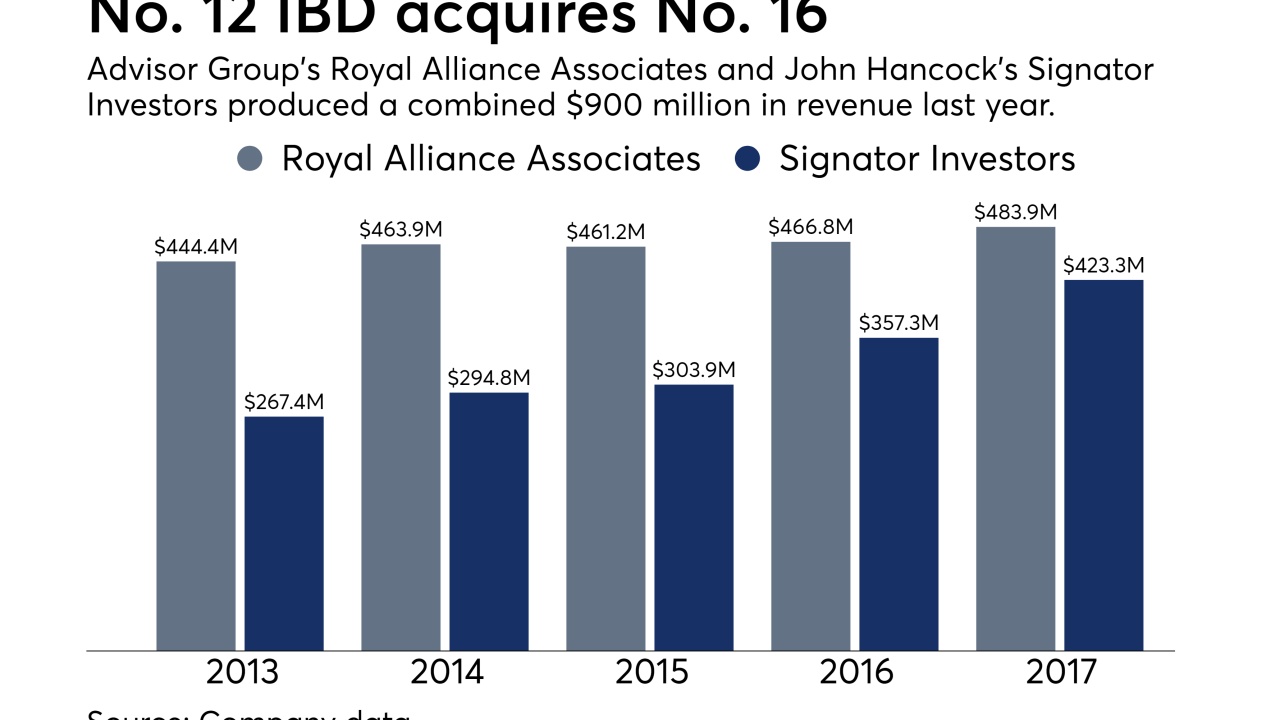

CEO Jamie Price and other executives met with some 1,000 prospective advisors after inking one of the largest M&A deals in the IBD space this year.

November 6 -

The No. 1 IBD’s major spending on recruiting, technology and organic growth is yielding big returns.

October 30 -

Seven IBDs turn 50 this year. Here's why most of them won't survive another half-century.

October 30

-

The No. 1 IBD poached two more teams from the largest firm in rival network Cetera Financial Group.

October 25 -

The No. 7 IBD expects such moves by advisors to increase in coming years, so it's ramping up offerings aimed at fee-only services.

October 12 -

As mega firms scale up and niche advisors specialize further, profits for a vast swath of the advisory market are getting squeezed.

October 12 -

Allianz became the second multinational insurance firm to step away from the IBD space this year under a plan to shutter Questar Capital.

October 11 -

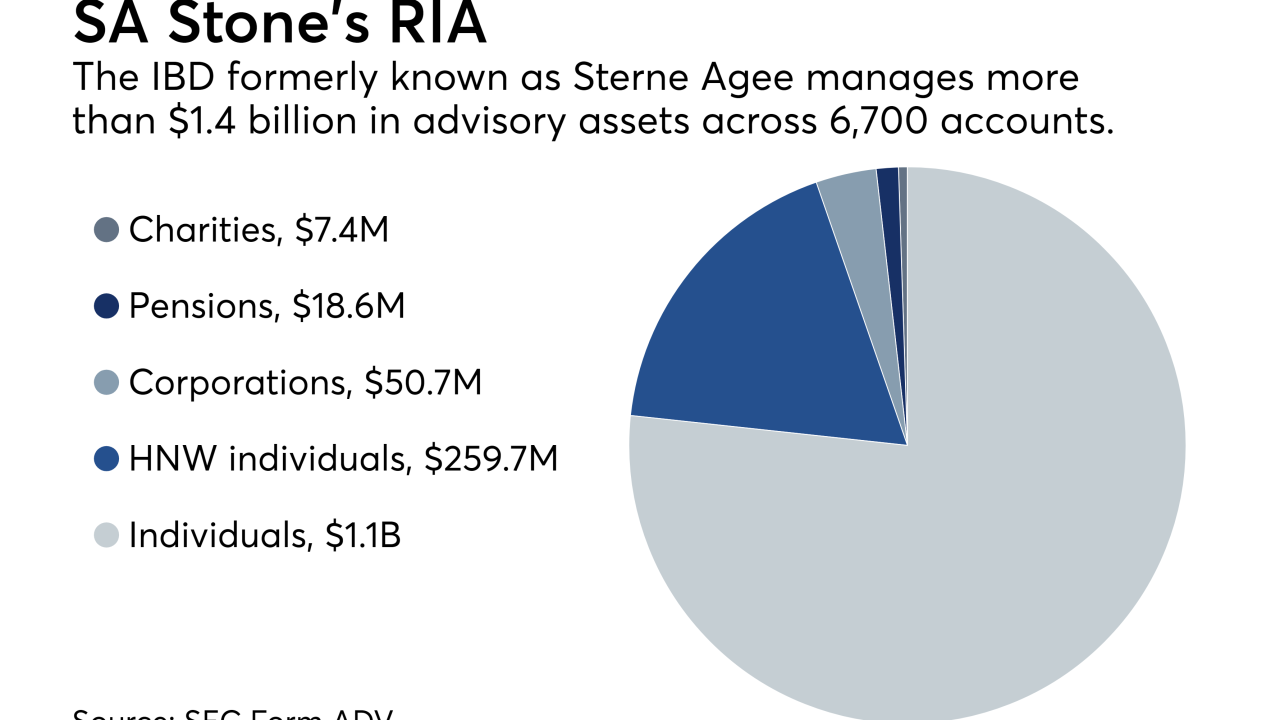

Sterne Agee changed its name after Stifel sold the firm in 2016 to INTL FCStone for about $50 million.

October 9 -

The private equity firm completed the largest IBD purchase of the year by acquiring the majority of the 7,700-advisor network.

October 9 -

Charged with leading the firm’s recruiting and sales strategy, Scott Posner will report to the recent successor to Bill Morrissey, who left the firm last month.

September 28 -

Establishing personal key performance indicators is vital, planners say at XY Planning Network conference.

September 25 -

Amid industry concerns, the largest RIA lender promises not to share data between the bank and its new wealth firm.

September 18 -

Retired former CEO Mike Sherzan ran unsuccessfully for Congress in 2016, and he became chairman of the board prior to the deal.

August 23 -

Dan Arnold says the firm remains interested if deals are a match for the No. 1 IBD.

July 27 -

The owner of RIA aggregator Mercer Advisors has pledged to maintain the IBD network’s current structure under the deal.

July 17