Following last year’s acquisition, LPL Financial lost out on hundreds of advisors fleeing to rivals rather than coming into its fold. Now, the No. 1 independent broker-dealer is turning the tables.

Advisor Steve Jones and operations manager Loren McEwan of Seattle First Asset Management, a practice managing about $800 million in client assets,

The team would have otherwise moved this quarter to Advisor Group’s Royal Alliance Associates — the private equity-backed IBD network

Advisor Group has

LPL’s

Since the completion of the deal, LPL has tapped Rich Steinmeier from UBS

Jones opted for LPL with an eye toward a long-term partner, he says. The two-person team officially aligned with LPL on Oct. 26 after five years with Signator and 23 years with First Washington, according to FINRA BrokerCheck.

“LPL’s technology can help us deliver better service and more value to our clients,” Jones said in a statement. “The capabilities that come with having an integrated platform were important features, as well. Being able to streamline many processes will create a better experience for our clients.”

-

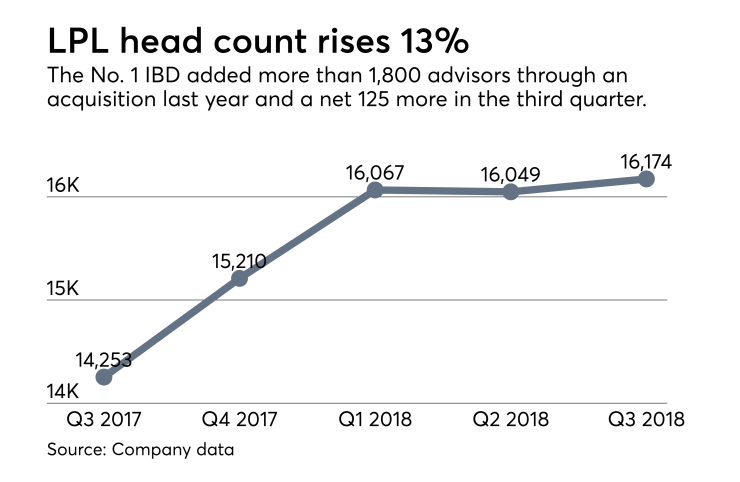

The No. 1 IBD unveiled positive recruiting numbers for the third quarter, alongside an 84% jump in profits.

October 26 -

The No. 1 IBD poached two more teams from the largest firm in rival network Cetera Financial Group.

October 25 -

The No. 1 IBD added a practice with $520 million in client assets from rival Cambridge before walking back a new policy that has resulted in departures.

October 23

Planners ranging from sole practitioners to the largest OSJ enterprises welcomed the CEO’s comment that the firm's culture was not aligned with its strategy.

Advisor Group spokeswoman Srishti Assaye had no comment on the practice’s departure, but she says the network will retain more than 1,800 advisors from Signator. The closing is slated for Nov. 2, after which the 5,000-advisor IBD network will have exact retention figures.

A spokeswoman for Signator Investors declined to comment on Seattle First’s exit.

The history of Jones’ practice goes back to 1954, when his father Floyd started his career as an investment advisor. Jones began his financial services career in 1986 with Drexel Burnham Lambert. Seattle First is a client-facing practice rather than a traditional asset manager, despite its name.

“What sets us apart is that we practice value investing and typically own what we recommend,” Jones said. “We invest with a long-term perspective with low portfolio turnover to help manage the customer’s tax exposure.”

McEwan, who has prior tenures with RBC Capital Markets and UBS in her 14-year career, also holds Series 7 and Series 66 licenses as the sole other member of the team, per FINRA BrokerCheck. The team is placing its advisory assets with LPL’s corporate RIA.

LPL’s loans to advisors, which include transitional assistance for recruits, have risen by 19% year-over-year to $261.2 million,

LPL has

“Advisors that joined the corporate platform use more of our services and thus drive more profitability, right?” he said. “We shifted and pivoted away from that historical way of doing transition assistance. And what we did was we aligned our transition assistance to the relative returns on these platforms.”