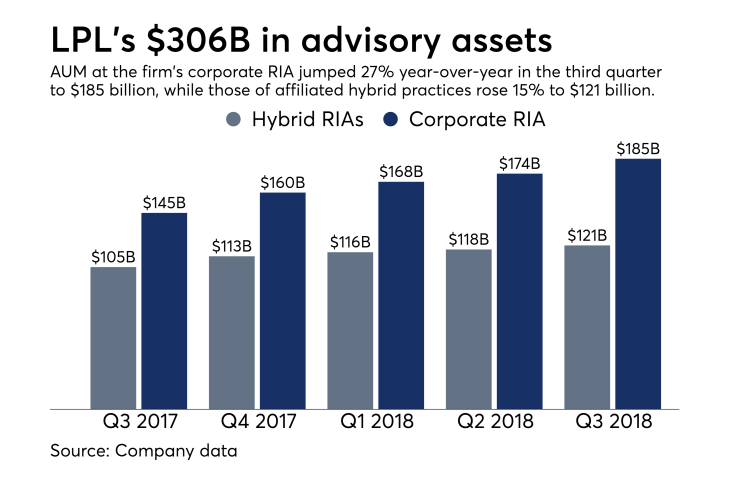

In a reversal from a year ago, advisory assets under management on LPL Financial’s corporate RIA are growing at nearly double the rate of AUM on the hybrid channel.

LPL has in the last four weeks alone welcomed 25 new advisors with $1.4 billion in brokerage and advisory assets to the corporate RIA. In addition, two major enterprises with $4 billion in client assets under advisement merged in December within the corporate advisory platform.

According to CEO Dan Arnold, LPL decided earlier this year to offer prospective advisors a higher transition assistance rate for the corporate RIA — where LPL has custody of the assets — than the hybrid platform, where outside firms like Charles Schwab or TD Ameritrade take on a big chunk of the AUM.

In

“Advisors that joined the corporate platform use more of our services and thus drive more profitability, right?” he said. “We shifted and pivoted away from that historical way of doing transition assistance. And what we did was we aligned our transition assistance to the relative returns on these platforms.”

The two platforms’ AUM already reflects the impact.

Corporate RIA assets jumped 27% year-over-year to $185 billion in the third quarter, compared to a rise of 15% to $121 billion for hybrid RIAs. That is in marked contrast to a year ago, when in the same period, the corporate RIA boosted its AUM by just 16 percent, versus 31 percent for the hybrid RIAs.

For the most recent quarter, LPL added advisors with $9.1 billion in client assets, its highest recruited assets in at least the past seven quarters. The “vast majority” of reps joined the corporate RIA, according to CFO Matthew Audette.

LPL does not publicly disclose the amount of its recruiting offers, but industry experts have said

Still, Arnold has pledged to continue to invest in both the corporate and hybrid RIA platforms.

LPL also

-

Independent Advisor Alliance and Private Advisor Group — two of the firm’s largest hybrid RIAs — say they’ve added billions in clients assets from IFP.

December 13 -

The firm has seen a number of planners exit in recent months.

November 28 -

AdvisoryWorld will operate as an independent subsidiary under the No. 1 IBD while adding new offerings for its 30,000 advisor and institutional clients.

December 3

Planners ranging from sole practitioners to the largest OSJ enterprises welcomed the CEO’s comment that the firm's culture was not aligned with its strategy.

At least one of LPL's hybrid firms, Joe Ruzycki’s Troy, Michigan-based Center For Wealth Planning, decided to shut down its outside RIA and later merge with another OSJ on LPL’s corporate platform.

“Having the extra scale and support of LPL was the main factor,” says Ruzycki, whose office of supervisory jurisdiction merged with Craig Snyder’s Southfield, Michigan-based OSJ, America Group Retirement Strategy Centers this month. The combined OSJ generates about $35 million per year in production, Snyder says.

Under the new setup, Ruzycki oversees 100 independent advisors that had been at either OSJ, while Snyder handles 20 advisors based at banks, credit unions and other institutions. Snyder, 67, opted for Ruzycki as his eventual succession partner rather than seeking a buyout from other OSJ suitors, he says.

While Snyder never had a hybrid RIA, he says the spread between the extra payout from an outside RIA and the compliance costs of operating one has been dwindling in recent years.

“You have to sit back and say, ‘Is it worth the risk?’ And the answer to that question is, it’s not, it’s not worth the risk,” says Snyder. “We’re going to try to build value-added systems for the advisors — at no or minimal cost — that help them grow.” He says his goal is to reach $50 million in annual production.

Of the 25 new advisors that LPL announced since late November, two teams came from Raymond James Financial Services, two joined from Cetera Advisor Networks, and one each were recruited from PNC Investments and Cadaret, Grant:

- Greg Spicer’s Red Bank, New Jersey-based Wellesley Financial Planners

has five advisors on his team and four others under his supervision. They manage $400 million in client assets. - Managing Director David Tolson and five other credit union-based advisors with Founders Investment Services of Lancaster, South Carolina

have about $300 million in client assets. - Advisors Steve Pollock, Jane Rocks, Robert Litwin, Tom Becker and Michael Schneider, who have about $225 million in client assets, joined LPL’s Bedminster, New Jersey-based practice Gladstone Wealth Group. The ex-PNC advisors have

launched two new Gladstone offices. - Tom Quirk’s Catonsville, Maryland-based practice, Retirement & Investment Group,

has three support staff members and $200 million in client assets. - John Marshall, Daniel Sickles and Sean Goldney of Lake Havasu City, Arizona-based John Marshall & Associates Investment Center

have about $185 million in client assets. Marshall is retiring and selling his business to LPL advisor Heath Haynes, who’s also joining the practice. - Fred Burke of Athens, Tennessee-based Athens Federal Community Bank,

where the investment program has about $150 million in client assets, came to LPL from Raymond James after CapStar Bank acquired Athens Federal.