-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

February 27 -

RBC Wealth Management-U.S. sees a 12% surge in assets under administration — thanks largely to skyrocketing market gains.

February 26 -

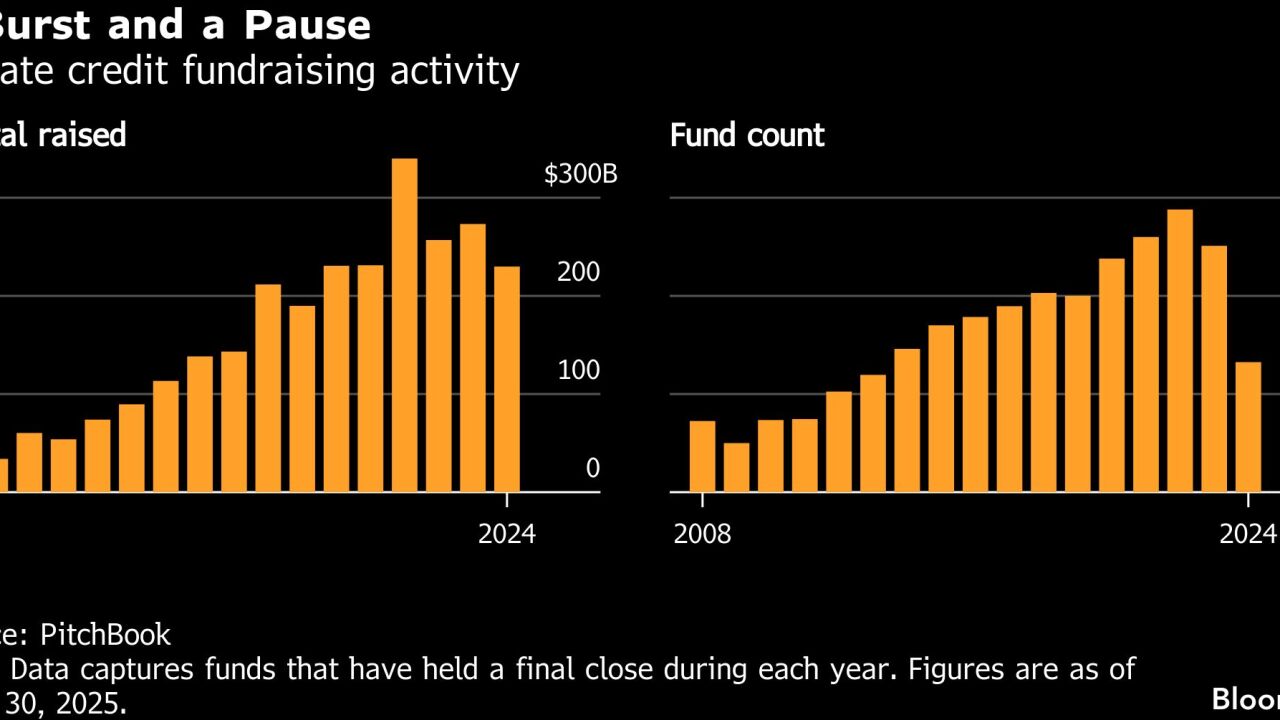

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

February 23 -

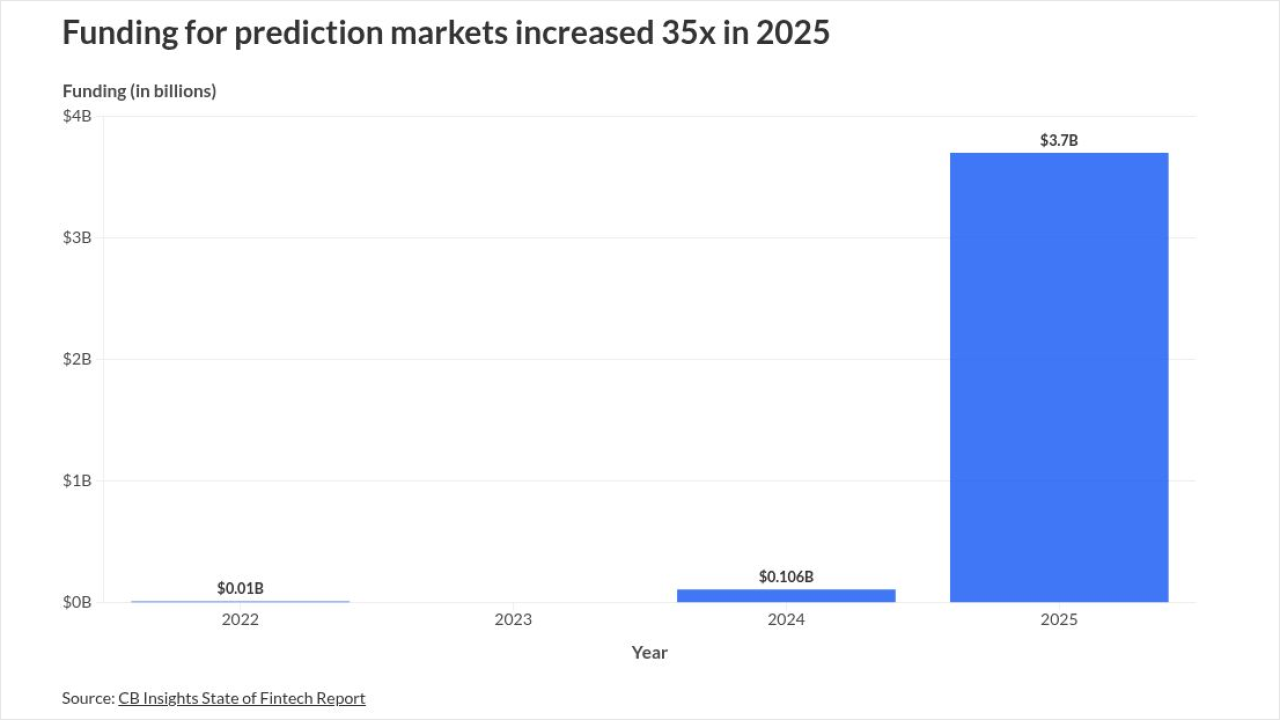

The platforms, where bets are placed on everything from U.K. soccer teams to the price of bitcoin, are getting traction from investors and attention from regulators.

February 23 -

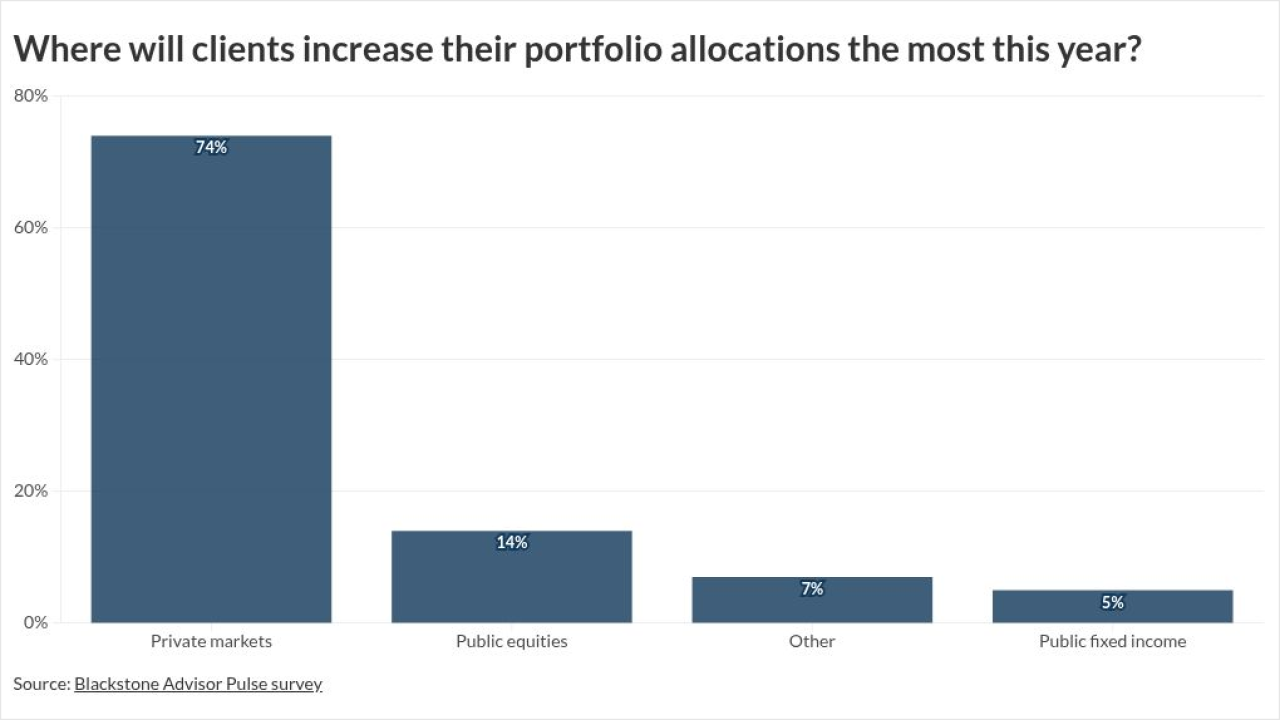

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

February 19 -

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

February 6 -

Private equity-backed M&A activity has steadily risen. Owners may do great in a sale, but what about advisors lower in the organization?

February 5 -

Internal succession planning is messier but aligns with a true fiduciary firm's core values, argues Neela Hummel of Abacus Wealth.

February 3 Abacus Wealth Partners

Abacus Wealth Partners -

An organic growth technology firm launched out of Fidelity Investment's incubator spoke with 18 big RIAs about their marketing. The results speak for themselves.

January 14 -

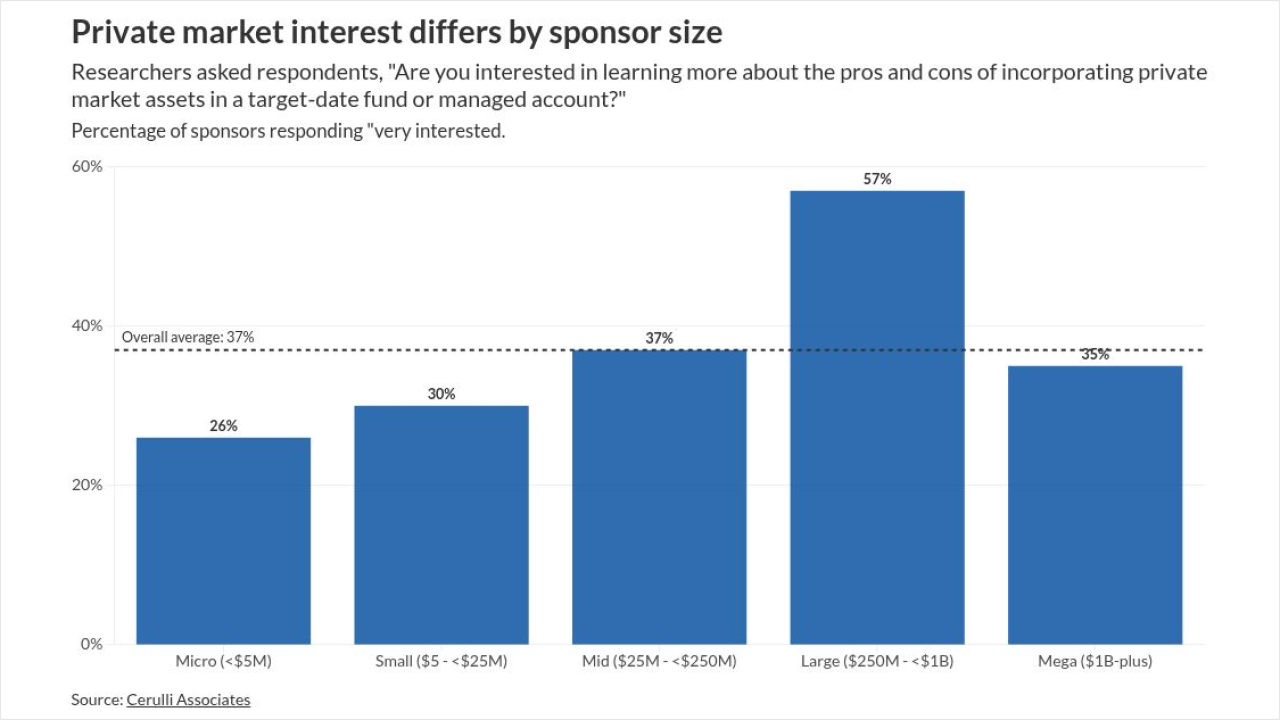

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

The loss of a $129 billion team for Merrill set the high-water mark in a year that also saw the departure of huge teams from UBS, JPMorgan, Wells Fargo and Oppenheimer.

December 29 -

Rockefeller becomes the latest firm to benefit from a steady stream of advisor defections from UBS this year.

December 26 -

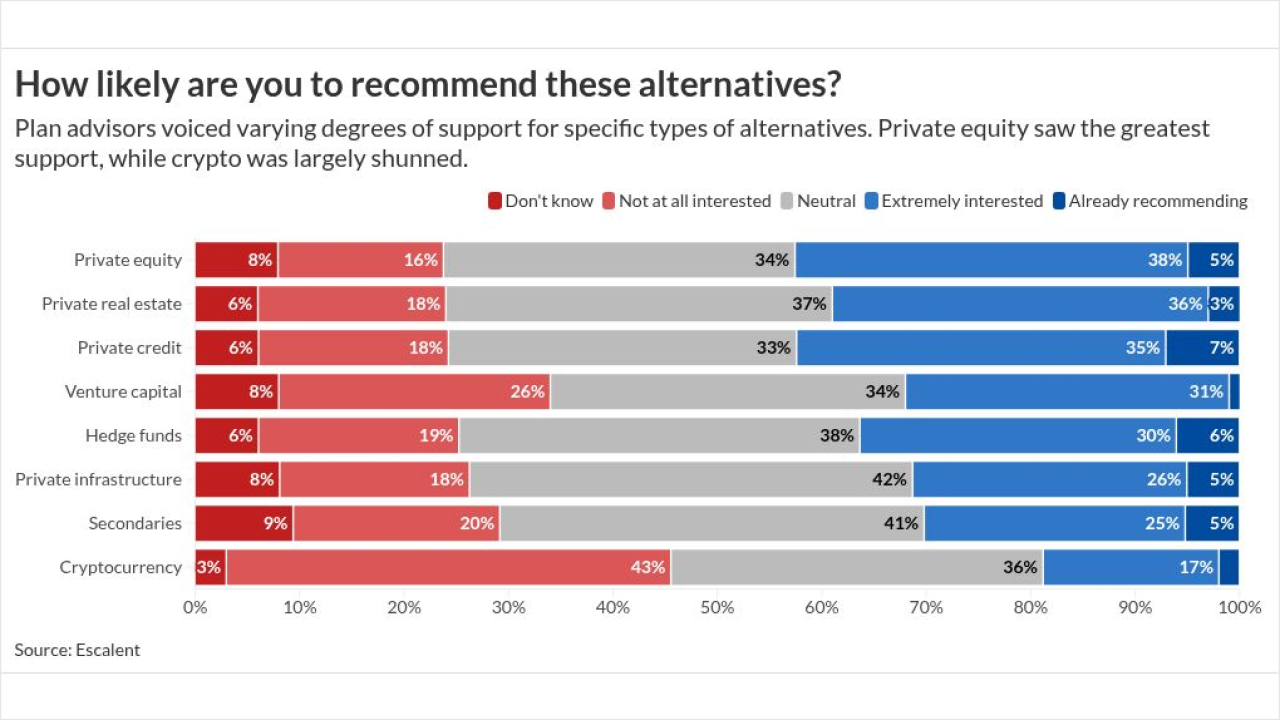

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

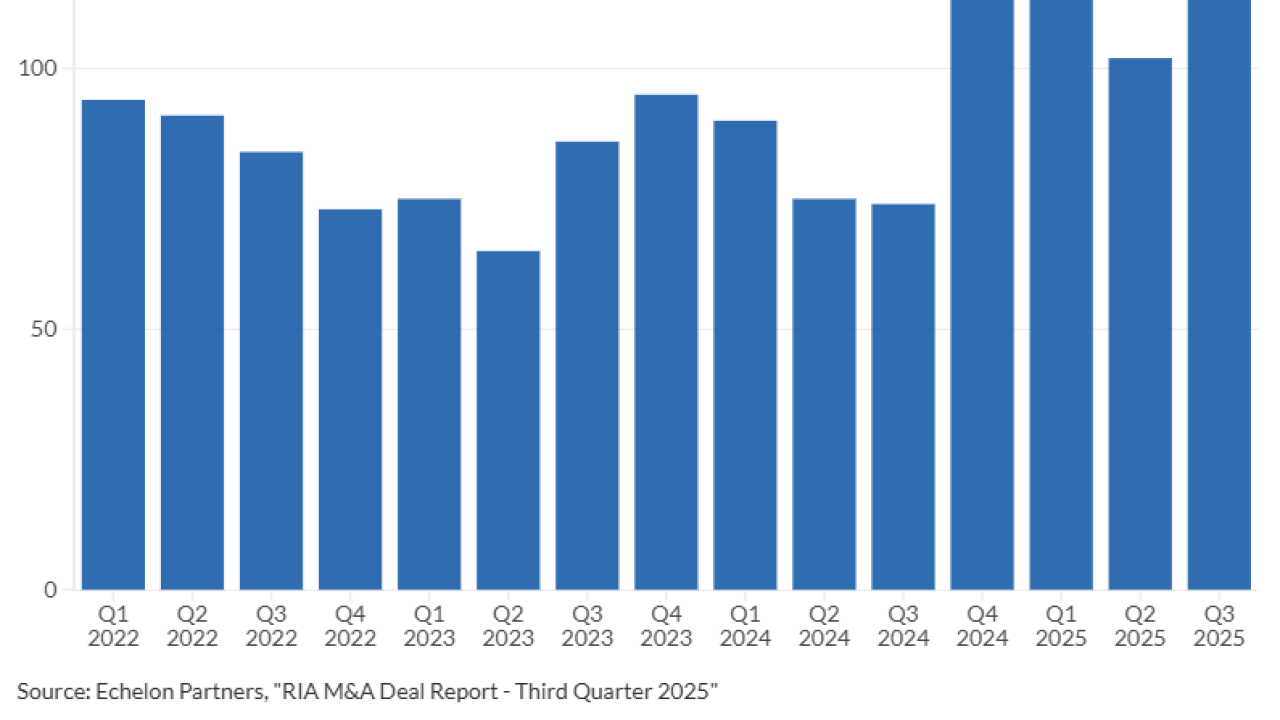

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

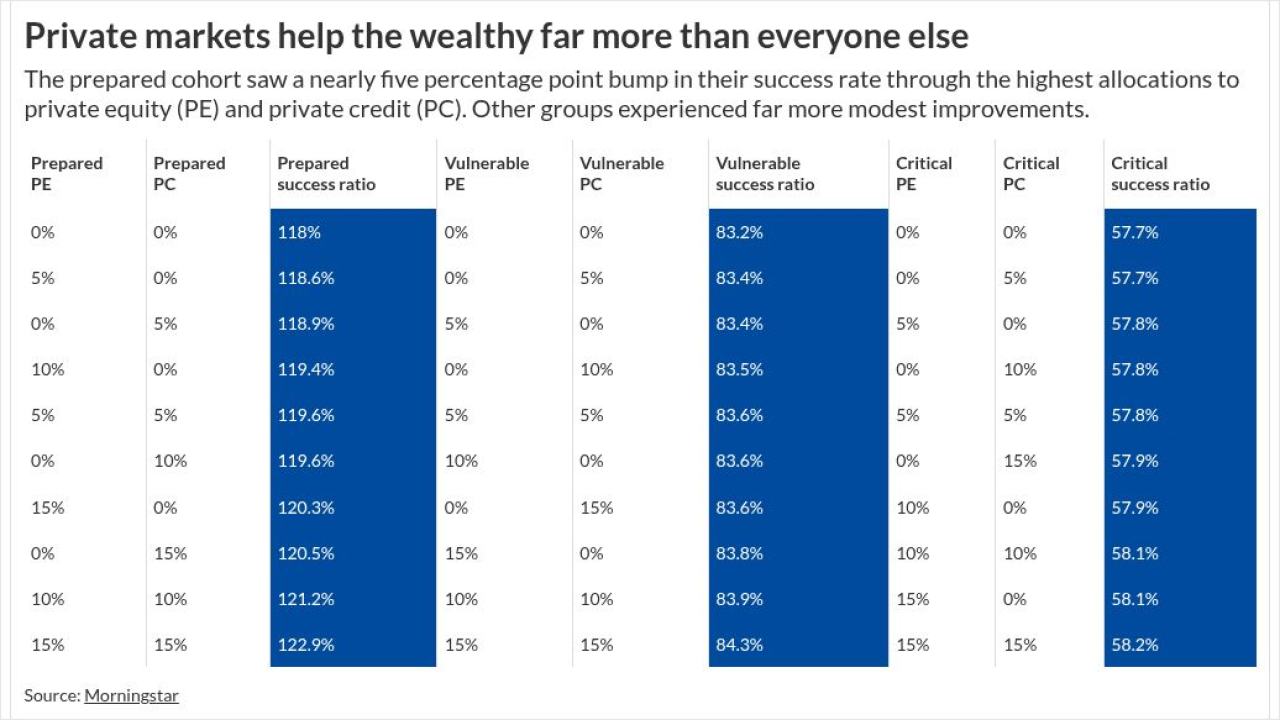

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

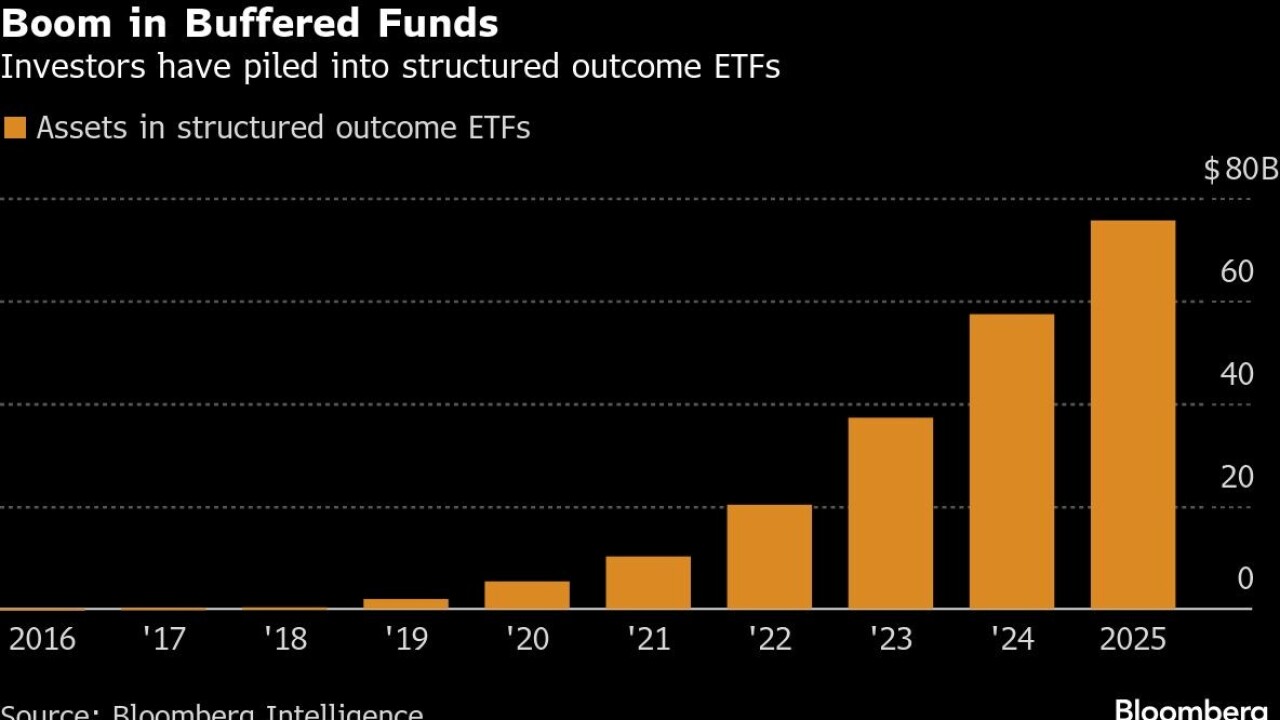

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

A new Cerulli report finds that advisors who outsource investment management spend more time in direct dealings with clients.

November 24 -

Concerns grows that the the $1.7 trillion private credit industry could be adding hard-to-detect risks to the U.S. financial system.

November 21 -

A hedging product tied to bitcoin offers investors enhanced gains and downside protection — as long as an underlying ETF doesn't lose more than 25% of its value.

November 19