Compensation

Compensation

-

The epic OBBBA tax law brings glad tidings to most families, but complacency can lead to costs for financial advisors and their clients.

December 23 -

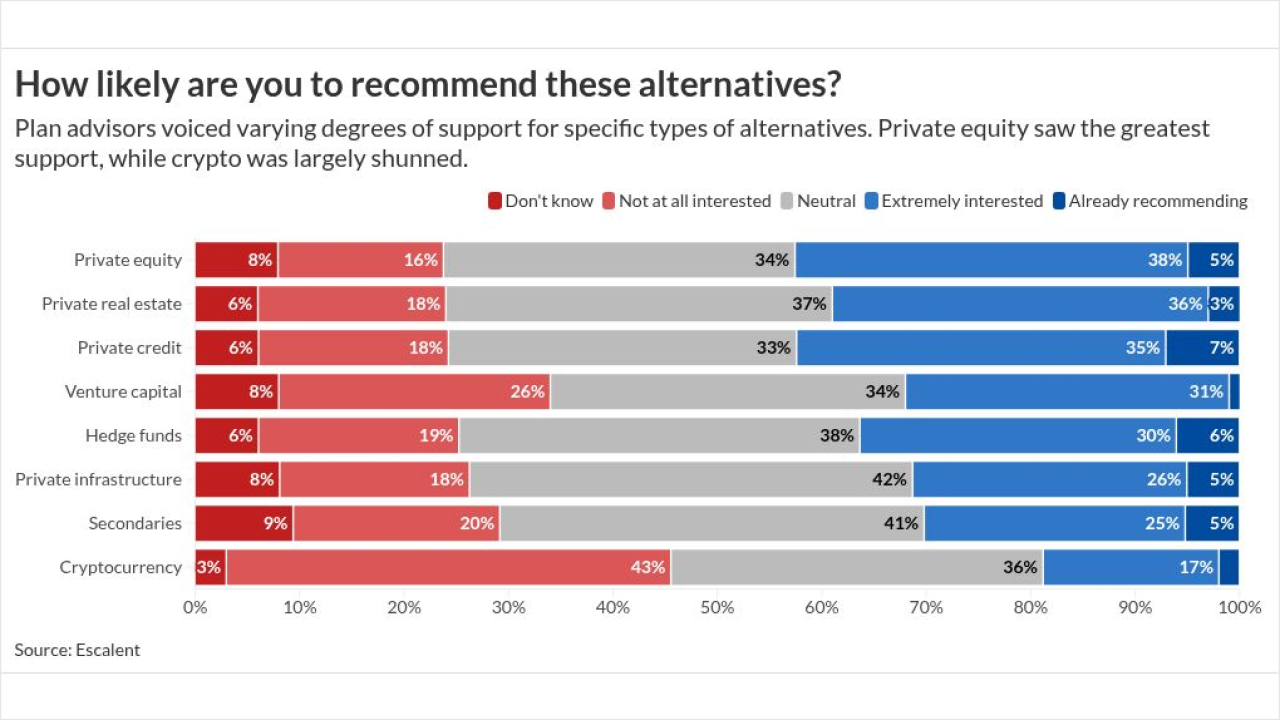

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Founders Elissa Buie and Dave Yeske are leaving a legacy in the profession and at the firm under three successors taking over in 2026.

December 16 -

Brett Griffin was given two months' notice that he would lose his job when Charles Schwab closed the office where he was working in Temecula, California. Now the firm accuses him of using some of that time to help move client data to a rival RIA.

December 12 -

Steve Lockshin and Michael Kitces tied what they view as some mistaken assumptions around fees to the competitive need for more estate planning services.

December 11 -

Also, Independent Financial Partners secures a $700M team from Commonwealth/LPL, and NewEdge Capital names a new CEO.

December 11 -

This year, 60 RIAs made the cut. See the firms that advisors say excel in culture, leadership and the benefits that matter most.

December 11 -

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

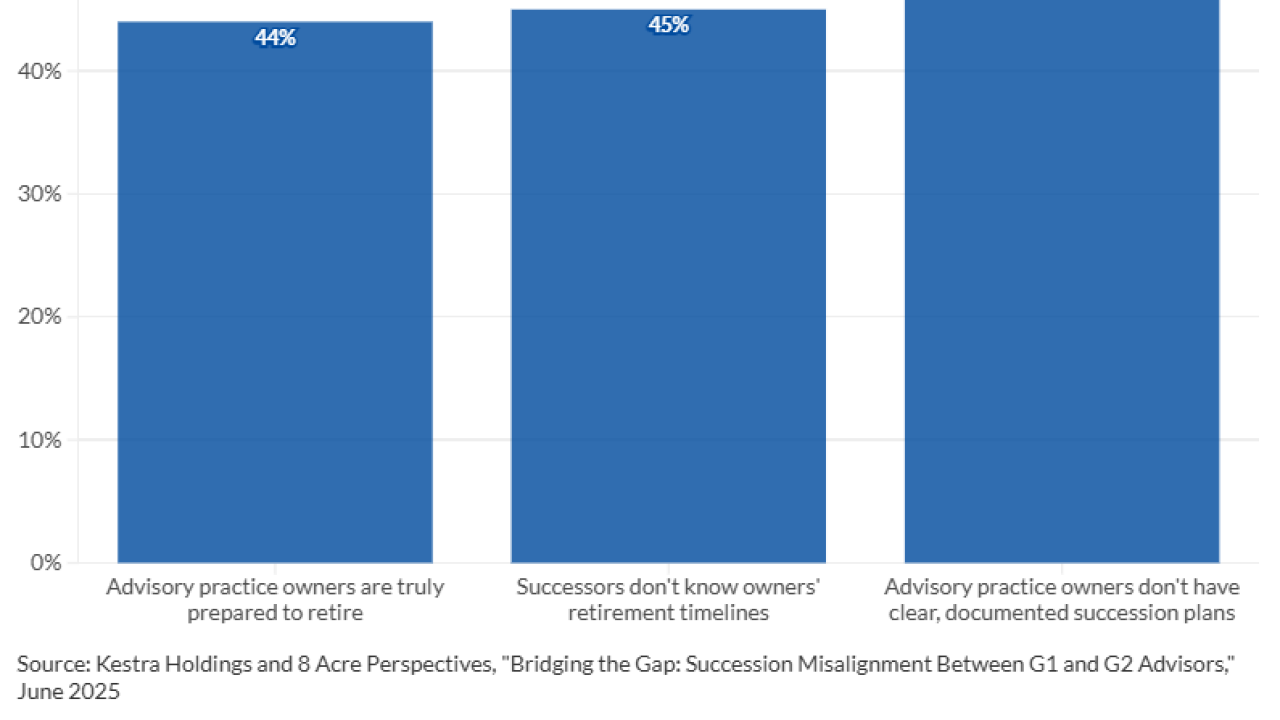

Separate from any transactions involved with succession, financial advisors who want to retire face challenges that make exiting the business difficult.

December 9 -

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

Henry Robert Gleckler IV's dispute with JPMorgan over his alleged solicitation of his former clients now heads for a resolution before a FINRA arbitration panel.

December 5 -

Also, Cresset extends its reach in Texas, Janney recruits from Wells Fargo and Ameriprise, Merrill draws from Wells Fargo and Mercer acquires a $1B firm.

December 4 -

RBC CEO David McKay discusses plans to provide more clients with banking relationships while the firm announces a reorganization of its U.S. wealth management division next year.

December 3 -

JPMorgan again shows it makes a sharp distinction between advisors who build their own books of business and those who amass clientele from bank referrals.

December 2 -

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

November 26