Compensation

Compensation

-

Many deductions are likely to disappear if Congress passes the reform bill into law.

December 8 -

If clients set aside a portion of earnings in a 401(k) or IRA, taxes weren't forgiven, just deferred. They'll still owe money to the IRS at some point.

December 8 -

While clients cannot determine their health care expenses and taxes in retirement, they can improve their prospects by minimizing investment fees and diversifying their portfolios.

December 7 -

Some of the new recruits joined from Morgan Stanley just prior to the firm's Broker Protocol exit.

December 7 -

He is the latest in a string of high-profile men to lose their jobs after accusations of mistreating women.

December 7 -

A recent report provides insights into the regulator's concerns, that include cybersecurity, anti-money laundering and alternative investments.

December 7 -

Small firms are allowed to set up multiple-employer plans, but the government needs to "simplify and rationalize the rules" for these types of plans, says an expert.

December 7 -

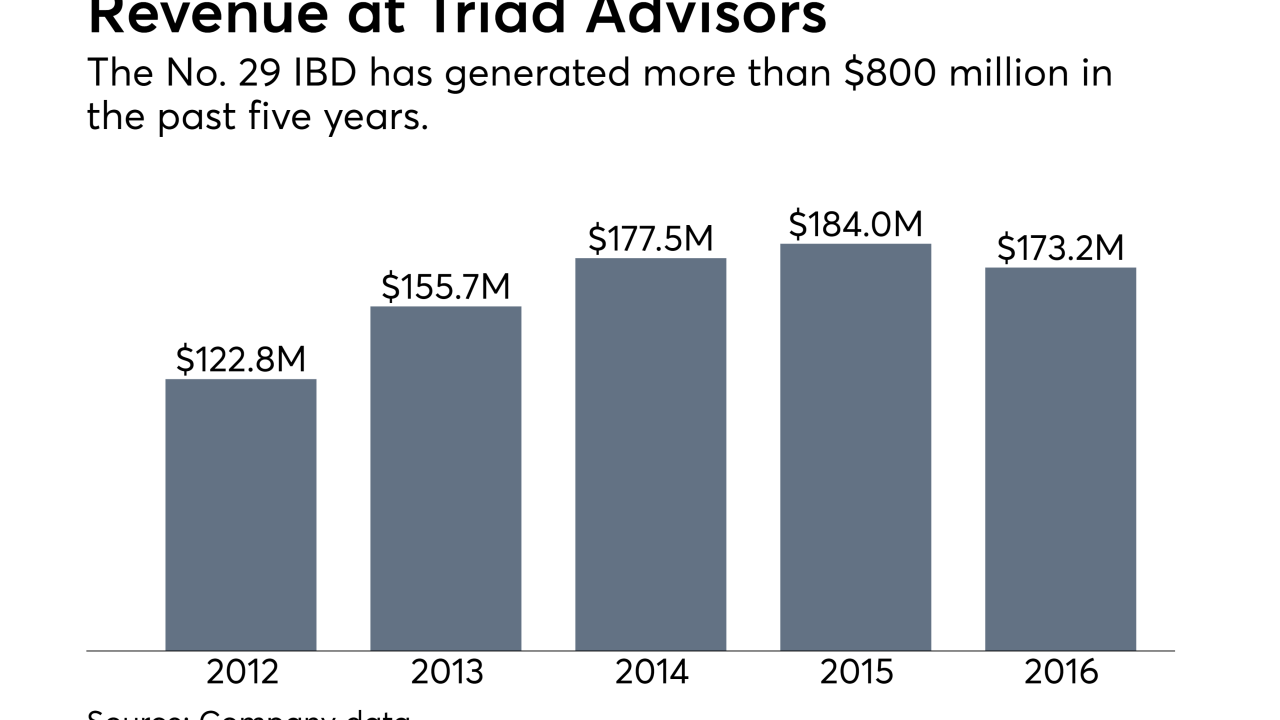

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

Despite Merrill Lynch’s recent decision to stay in the Broker Protocol, Greg Fleming sees a long struggle ahead.

December 6 -

Morgan Stanley and UBS's exit from the accord spurred a number of advisors to move up their planned career changes.

December 6 -

While there’s no fail-safe method for modeling the costs, a popular calculation may significantly under- or overstate the burden of tuition, room and board, Kitces.com research associate Derek Tharp writes.

December 6 -

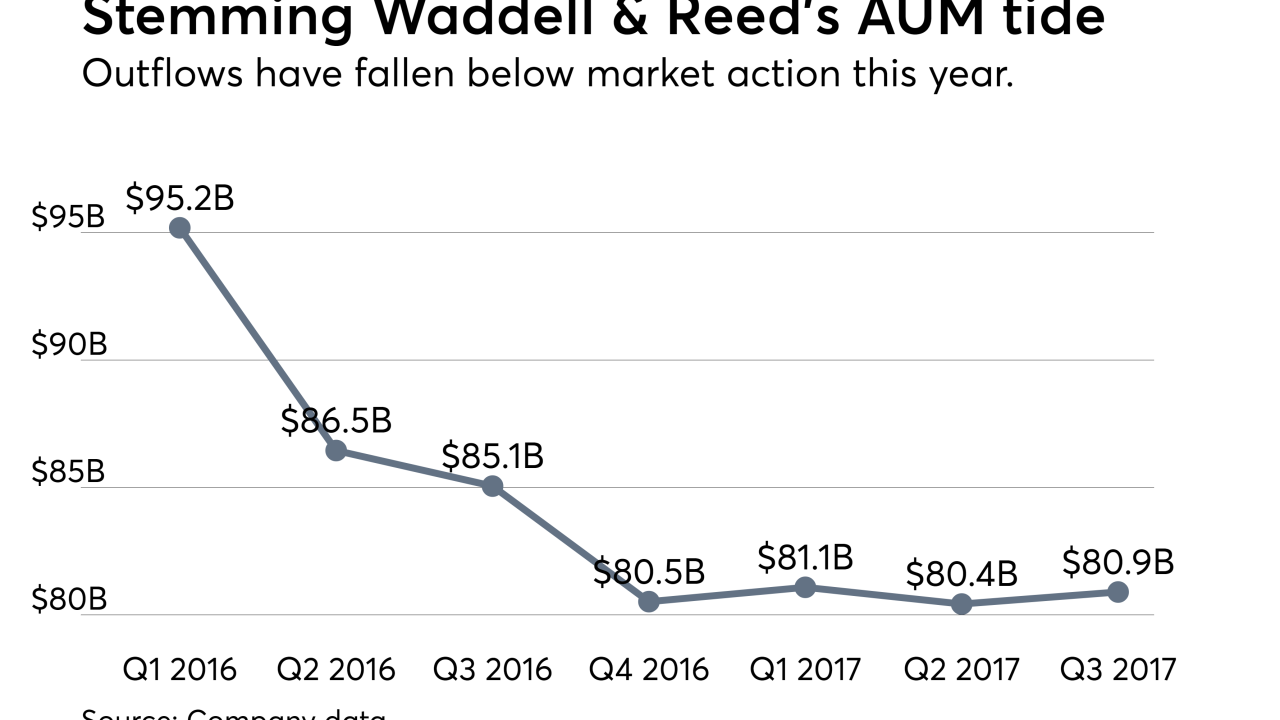

Rising technology costs and increased fee pressure are working against the industry, research shows.

December 6 -

-

Medicare Part B premiums will stay flat next year, but most retirees will still pay more.

December 5 -

Find out where this year's 95 CFP Board-registered financial planning degree programs at colleges and universities fall on the map.

December 5 -

Brokers who shed small accounts and focus on larger clients could earn a higher payout.

December 5 -

The IBD has boosted payouts for advisors as it trims lower producers from its ranks.

December 5 -

Clients should consider tax breaks such as education expenses, mortgage interest payment and small business costs.

December 5 -

Both advisors are attracted by Ameriprise’s technology and investment options.

December 4 -

Advisors should contact every client who did a Roth conversion in 2017 to discuss a key change in tax regulations, Ed Slott says.

December 4