-

They’re grinding forward with changes, even as complicating factors emerge ahead of when the rule takes effect next year.

September 10 -

Even though many of its members weren’t satisfied by the SEC’s rule, NASAA praises the inclusion of a requirement to consider costs in a recommendation.

September 9 -

The IBD trade group launched a public campaign after more than 80 cases this year alleging inadequate disclosure of mutual fund fees and compensation.

September 5 -

The SEC published more than 1,300 pages of regulatory information. Here's what advisors need to know.

September 3 -

The IBD failed to adequately disclose conflicts of interest to clients related to receiving $10.8 million from mutual funds and its clearing broker, the SEC says.

August 30 -

Due to a 2010 FINRA rule change the answer is — with difficulty.

August 30 -

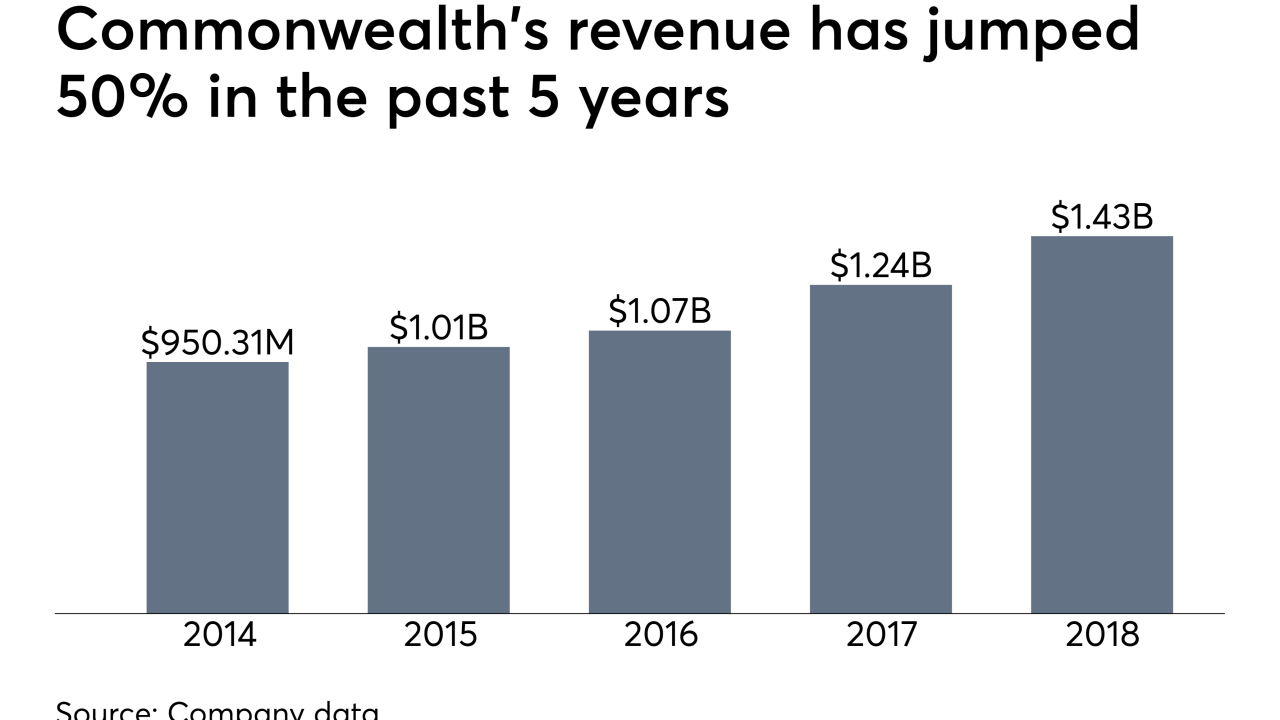

Critics reject the notion that disclosure alone is sufficient for reigning in conflicts — but the charges against Commonwealth have put BDs on notice.

August 12 -

A barred and terminated former Securities America advisor’s conduct was “appalling, reprehensible and evil,” according to a federal judge.

August 8 -

An RIA owner accused the custodian of aiding his chief compliance in setting up a competing firm.

August 7 -

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1