-

Good Life Companies fosters competition among wealth managers for its own health and runs food stores and a gym.

June 17 -

The hybrid firm’s giant parent tapped a new leader as it builds out a growing team with a mission.

June 16 -

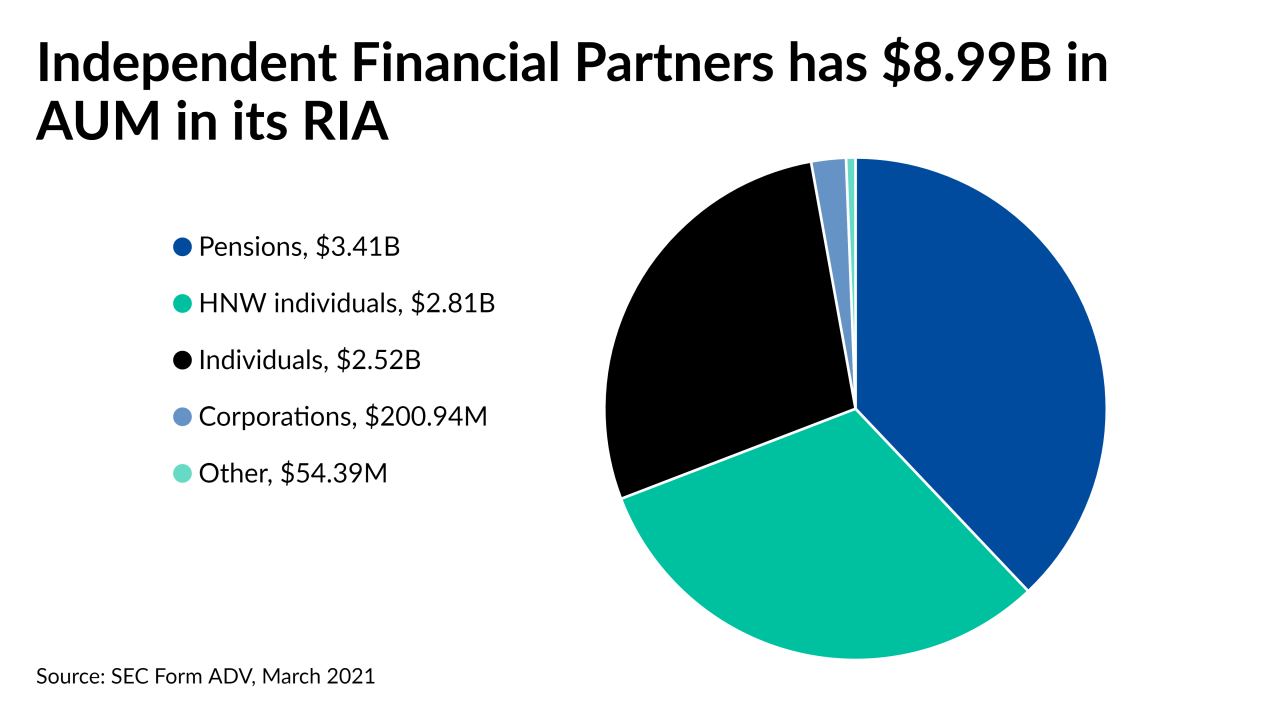

Bill and Chris Hamm admit it’s been something of a rocky start, but they say IFP is saving advisors and clients money compared to a typical wealth manager.

June 15 -

CUNA Mutual Group’s wealth manager of 550 financial advisors will almost certainly represent the largest recruiting move in the sector next year.

June 14 -

For advisors, this structure can deepen relationships and help bring interaction with new populations and prospects, writes Marianne Caswell.

June 13 Park Avenue Securities

Park Avenue Securities -

The Dallas-based hybrid RIA has more than 100 reps, and, if they follow the chief’s exit, it would be the the No. 1 IBD’s largest loss since 2019.

June 11 -

The case against Centaurus Financial comes after the industry and consumer advocates decried the previous administration’s approach for different reasons.

June 10 -

According to the latest Federal Deposit Insurance Corporation (FDIC)’s “How America Banks” report, there is an estimated 7.1 million unbanked households in 2019. Given the record levels of unemployment, the pandemic has brought on the FDIC expects this number to rise. Join Joe Adler, American Banker’s Washington Bureau Chief and Leonard Chanin, Deputy to the Chairman of the FDIC as they discuss the FDIC’s stance on financial inclusion and how banks can get millions of unbanked Americans into the traditional banking system.

-

The PE-backed hybrid RIA is acquiring a practice with nine financial advisors managing $1.46 billion in client assets.

June 9 -

The technology debuted at the annual INSITE conference reveals how the firm is looking to expand market share among advisors and fintechs.

June 9 -

The firm’s head of advisors says implementation required significant additions and enhancements.

June 9 -

The four largest U.S. banks face investor pressure to deliver the returns of smaller rivals, but they complain that the federal deposit cap and capital rules make that difficult. So they're pouring money into wealth management, payments and digital banking to seize more market share in existing businesses and fend off nonbank challengers.

June 9 -

Some lawmakers have slammed legislatures for kicking their own residents while they’re down.

June 8 -

Even with a 15-year window to pay taxes, a near-doubling of the capital gains rate and the elimination of the step-up in basis loophole will make a sale expensive.

June 8 -

It’s unclear whether the independent firm will retain any broker-dealer or RIA affiliation with Raymond James.

June 7 -

The trio of advisors leaving Commonwealth for the regional firm are its largest “reverse breakaways” ever.

June 7 -

The agency is headed back to the drawing board with its proposed revision of how brokers get complaints removed from their record.

June 7 -

Bob Doll, LPL, Advisor Group, Cetera, Northwestern Mutual, Thrivent, Commonwealth Financial, RIA in a Box and other news from around the industry.

June 4 -

Concurrent is catering to breakaway teams assessing their options after back-office frustrations during the coronavirus, co-founder Mike Hlavek says.

June 3 -

The private equity-backed wealth and 401(k) manager drew away an ex-Hightower team as part of its surging growth in the past year.

June 3