-

The flood of new money may be evidence that investor angst is confined to the highest-flying tech segment and not the industry at large.

August 1 -

Some funds that were in the black still turned in a poor performance — it’s all relative.

July 24 -

A 20% gain sounds good, until you find out the category returned 30%.

July 18 -

Data reported by the Investment Company Institute.

July 13 -

Passive funds attracted new cash even if their returns were negative.

July 12 -

The asset manager's flows are down 42% year-over-year. The industry: 50%.

July 6 -

As equities in the sector extend a $3.8 trillion rout, the strategy has resulted in annualized returns of as much as 190%.

July 5 -

Volatility has returned in 2018, while easy stock gains have vanished.

June 27 -

The fund provides access to China-based companies committed to implementing the digital ledger technology. Plus; other launches.

June 22 -

Investors yanked $7.7 billion from emerging-market equity and investment-grade credit funds due to trade tensions and tightening monetary policies.

June 22 -

While some funds show low valuations, S&P and Dow both stand at post-crisis highs.

June 20 -

Even countries with solid prospects for growth and debt financing haven’t been immune to the selloff.

June 20 -

TPW Investment Management aims to provide alpha-generating ETF-based investment solutions.

June 15 -

Clients have the luxury of focusing on returns, but advisors need to add “risk adjusted” to their vocabulary.

June 13 -

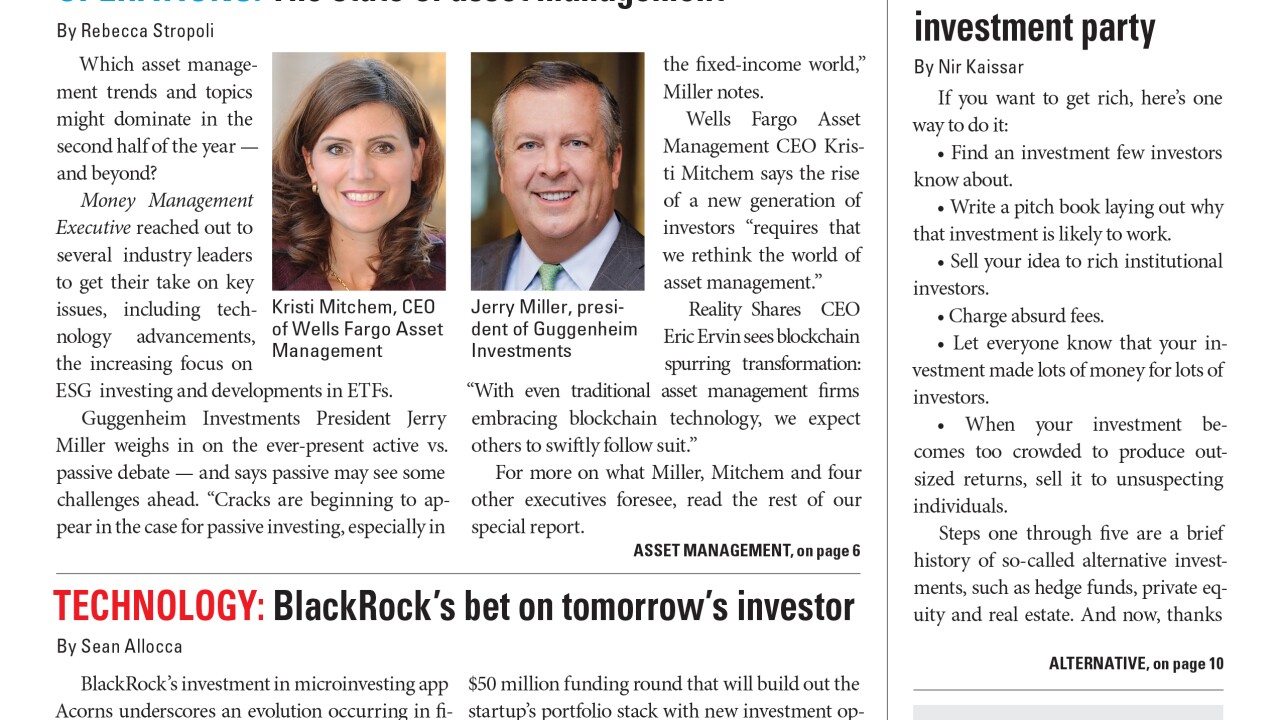

Industry leaders discuss advancements in technology, the increasing focus on ESG and developments in ETFs.

June 8 -

Data reported by the Investment Company Institute.

June 8 -

The $55 billion of new cash last week from global investors was the most since 2013.

June 8 -

Even profitable bond managers will have to up their game to remain relevant because in many cases investors have better options.

June 7 -

While passive funds track an index, active managers can still beat the averages and earn the much-discussed small-cap premium.

June 5 -

A fund weighted against brick-and-mortar businesses dropped 13% while the industry’s largest retail product tripled the return of the broader benchmark.

June 5