-

The pandemic has ushered in an ultra-remote environment, complete with more video calls, more e-signing and, inevitably, more stress.

April 20 -

Lisa Quadrini had worked with the practice during her earlier tenure with Merrill Lynch, and she’s now launching its new office.

April 13 -

The quartet of advisors picked the nation’s largest IBD out of the increasing number of suitors available to ex-employee practices.

April 12 -

“When I left, I told Morgan Stanley [Ron] was the best person I've ever worked for in my career,” says advisor Jason Fertitta, who is hiring his old boss.

March 23 -

With a new brand and new leadership, the firm hopes to tap into a burgeoning wealth management sector.

March 16 -

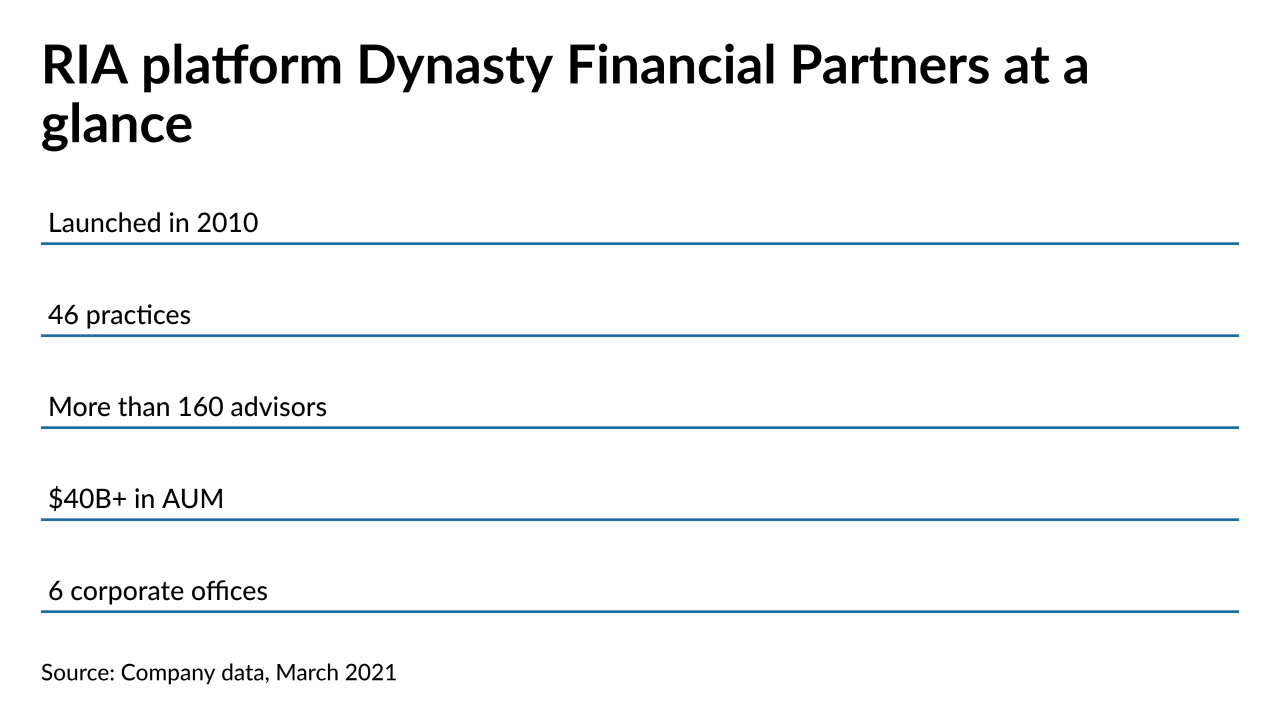

The quartet of financial advisors range in age from their 20s to their 90s, and are the second group to sign with Dynasty this week.

March 3 -

The growing practice’s founder dropped his FINRA registration after 14 years with KMS Financial Services.

February 25 -

Documents shed light on how two brokers overseeing trainees allegedly called hundreds of phone numbers on Merrill’s Do Not Call list.

February 9 -

One of the largest wealth managers aims to attract more teams out of the crop of nearly 7,000 advisors leaving employee-channel firms each year.

January 26 -

The CEO of three-generation family firm says they wanted to remove conflicts of interest and offer banking and trust services to clients.

January 22 -

The group leader, advisor Lars Olson, had been with the wirehouse since 1994.

January 13 -

Advisors may sometimes overlook clients with special needs, despite the size of the community and available tools like ABLE Accounts.

January 12 -

The IBD completed a stellar recruiting year by adding a team led by a 30-year veteran advisor.

January 6 -

LPL Financial and indie rivals like Raymond James, Wells Fargo FiNet and Kestra Financial completed at least 17 recruiting grabs of $800 million or more this year.

December 18 -

It’s one of the largest teams to quit a wirehouse this year.

December 14 -

The OSJ scooped up teams from Edward Jones, Wells Fargo Advisors and Wedbush Securities.

December 11 -

The Buffalo, New York location is the independent firm’s 12th nationwide.

December 8 -

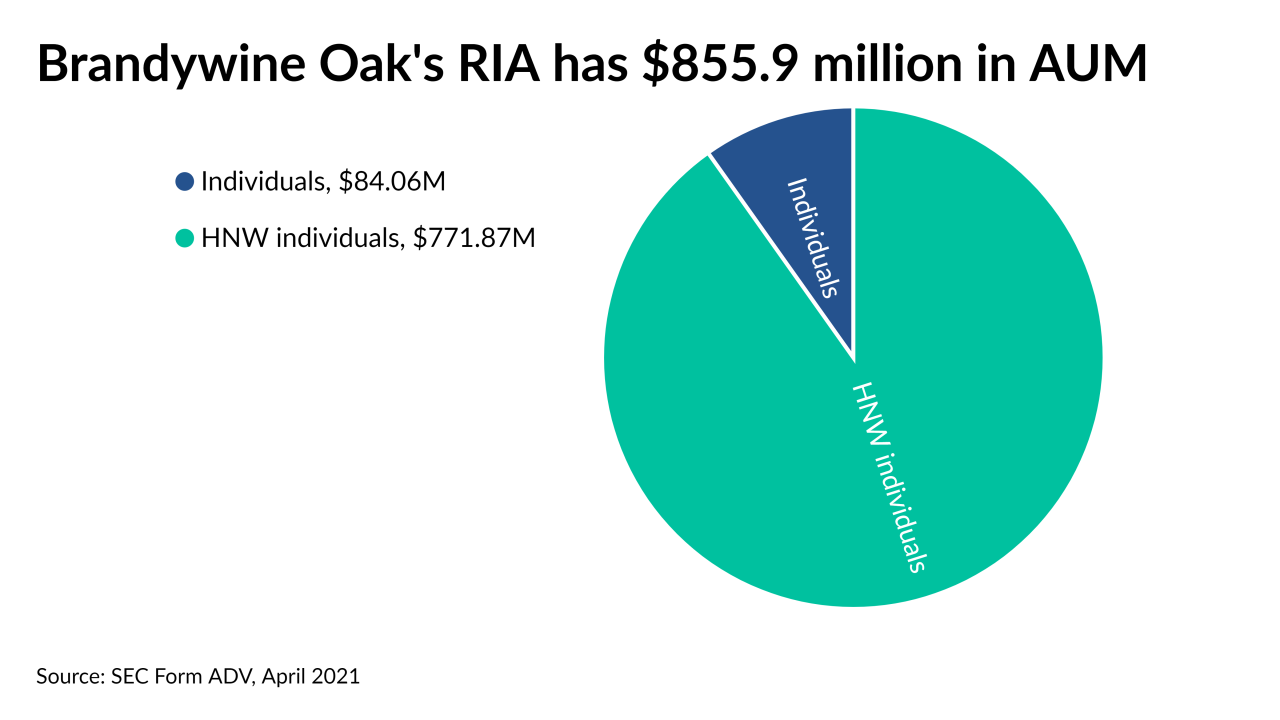

The Boston-based boutique oversees the assets of roughly 140 full- service clients and 800 individual households.

December 3 -

It’s one of the largest recruiting moves of the year in the independent broker-dealer sector.

November 16 -

The private equity-backed firm’s bottom line has been less affected by coronavirus-related low interest rates than its rivals, Moody’s says.

November 4