-

Merrill Lynch’s head count isn’t suffering, but some regional BDs have grown by thousands in the past five years.

August 21 -

The Advisor Group IBD acquired Capital One’s in-branch brokerage unit last month, but it hasn’t stepped away from traditional recruiting either.

August 20 -

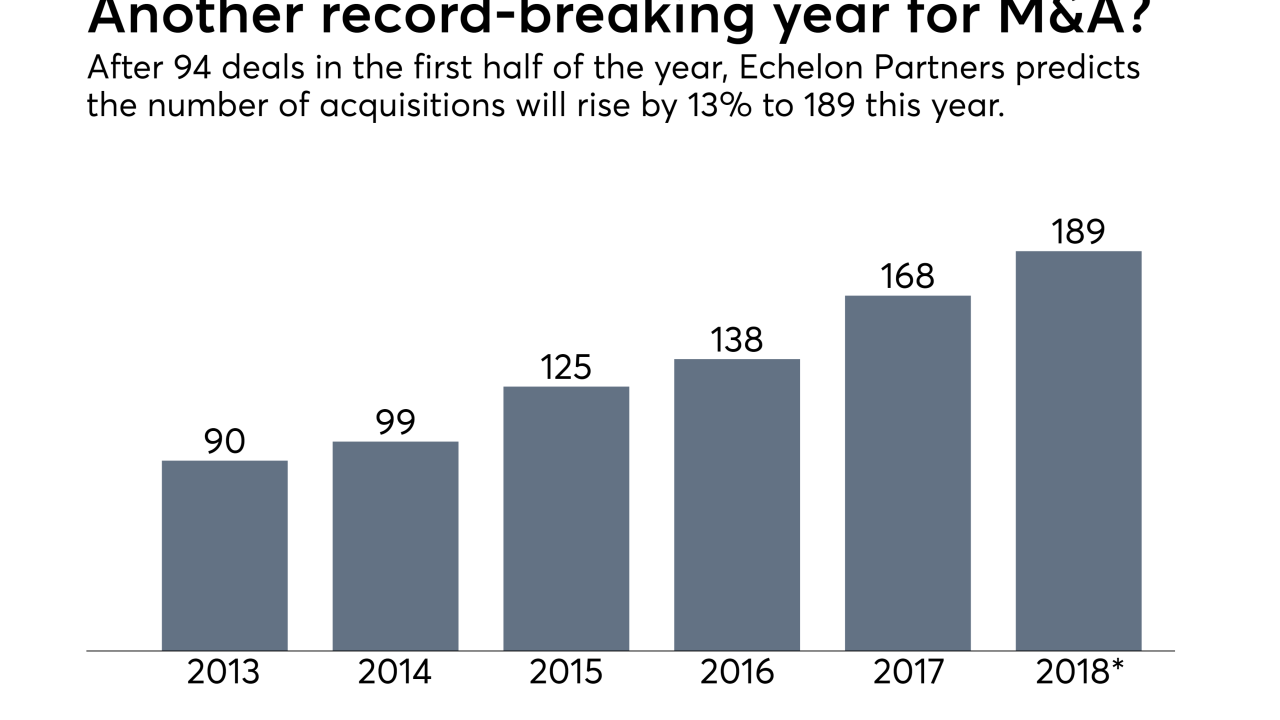

The ongoing shift away from commissionable products is driving major changes in the space.

August 17 -

The IBD network is following its rivals in launching a centralized program on succession planning and acquisitions.

August 16 -

Five fired and barred former registered reps stole more than $1 million from clients over a four-year period, according to the regulator.

August 15 -

Violating this FINRA rule has extremely serious consequences including termination and disciplinary action.

August 14 -

The firms may or may not be vying against one another, but their advisor forces are moving in different directions.

August 8 -

The IBD network disclosed the renewal of its clearing agreement, along with three firms’ intention to self-report possible mutual fund violations to the SEC.

August 8 -

The largest firms’ combined VA and FA revenues hit a three-year low in 2017, but the products still make up a significant portion of their businesses.

August 3 -

Blucora CEO John Clendening says the cuts to head count should taper off by next year, when the firm will have dropped as many as 1,000 reps in 16 months.

August 1 -

The barred onetime Questar Capital and Woodbury Financial rep had pleaded guilty to the scam, which he says stemmed from a gambling addiction.

August 1 -

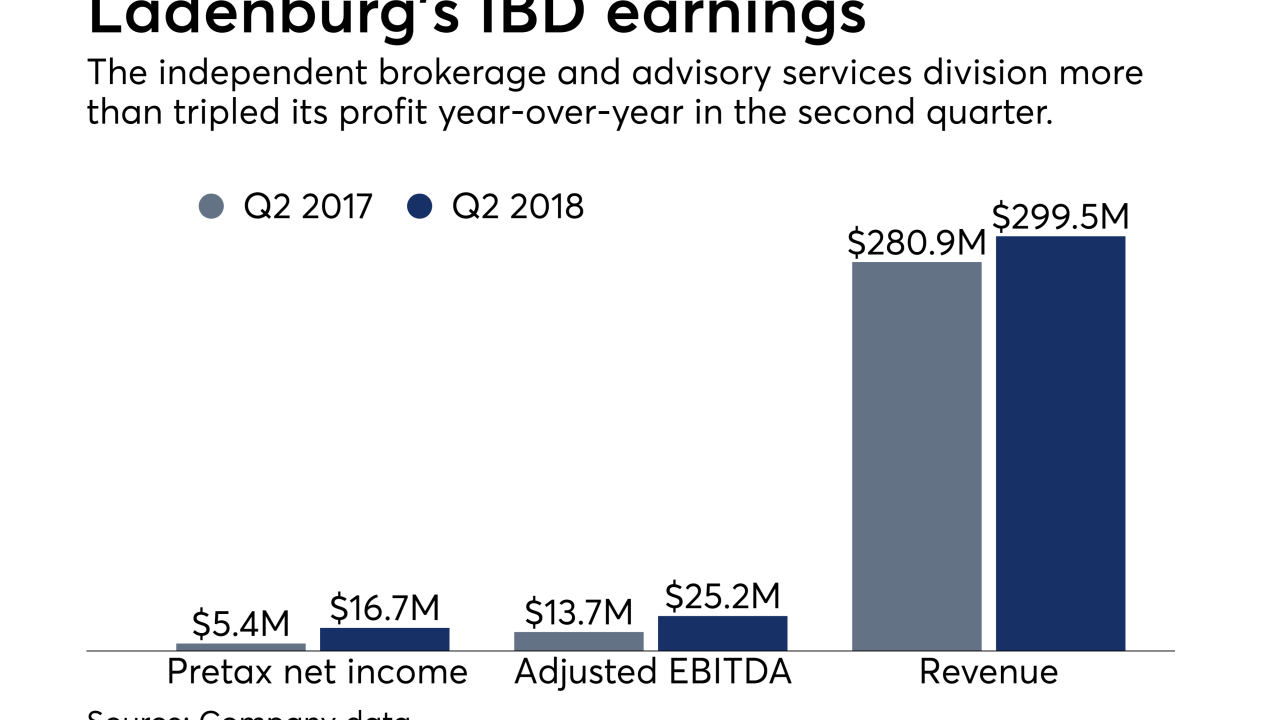

The firm remains in transformational flux, but the results of its "Project E" evolution are beginning to show.

August 1 -

The No. 1 IBD adapted Riskalyze to its still-evolving ClientWorks portal and added Black Diamond to its discounted vendor program.

July 30 -

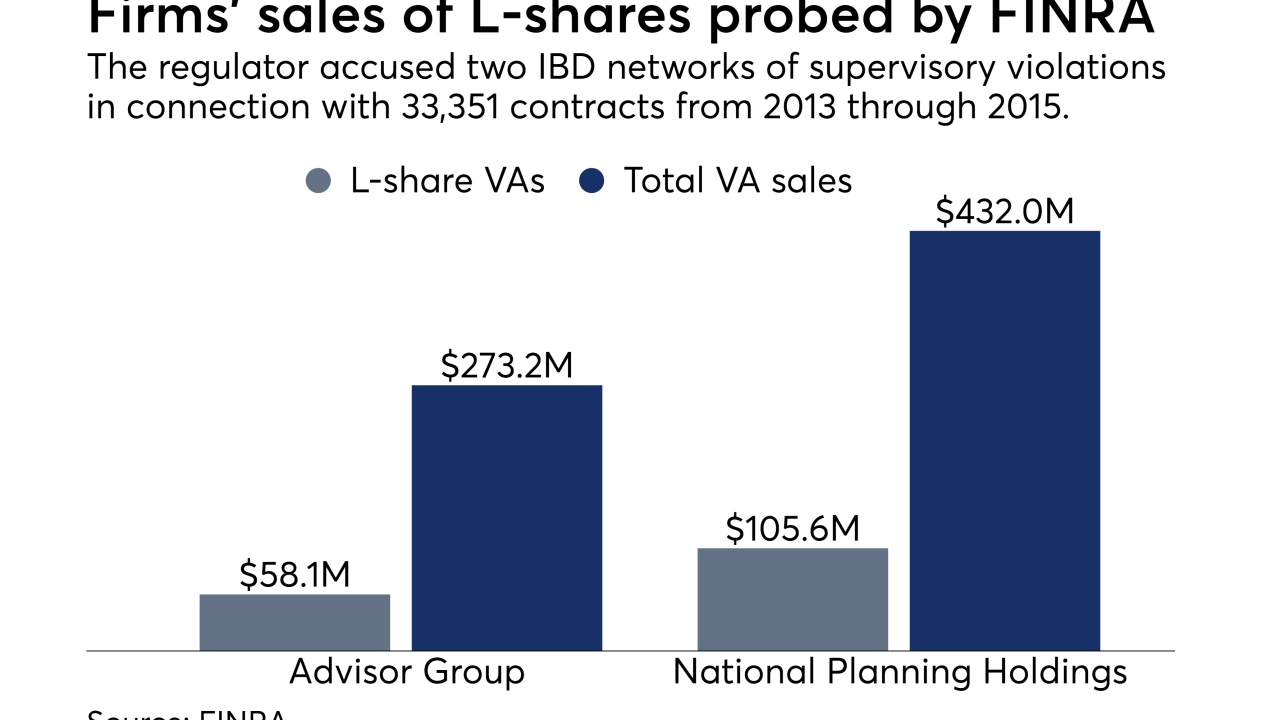

The regulator accused the four firms and the Advisor Group network of supervisory failures in sales of L-share VAs in separate but near-identical cases.

July 30 -

Dan Arnold says the firm remains interested if deals are a match for the No. 1 IBD.

July 27 -

At least 17 individuals invested $13 million in the scheme, and many lost 'substantial portions' of their life savings, prosecutors say.

July 26 -

The firm achieved a record 7,719 independent and employee advisors in the second quarter.

July 26 -

Wealth Enhancement Group would grow to nearly 70 advisors nationwide under its second major purchase of the year.

July 25 -

The funds allegedly paid for summer camp fees and a 1976 Corvette.

July 25 -

The firm will move over to Salesforce’s CRM tool starting next year as part of an effort to boost efficiency with new technology.

July 25