-

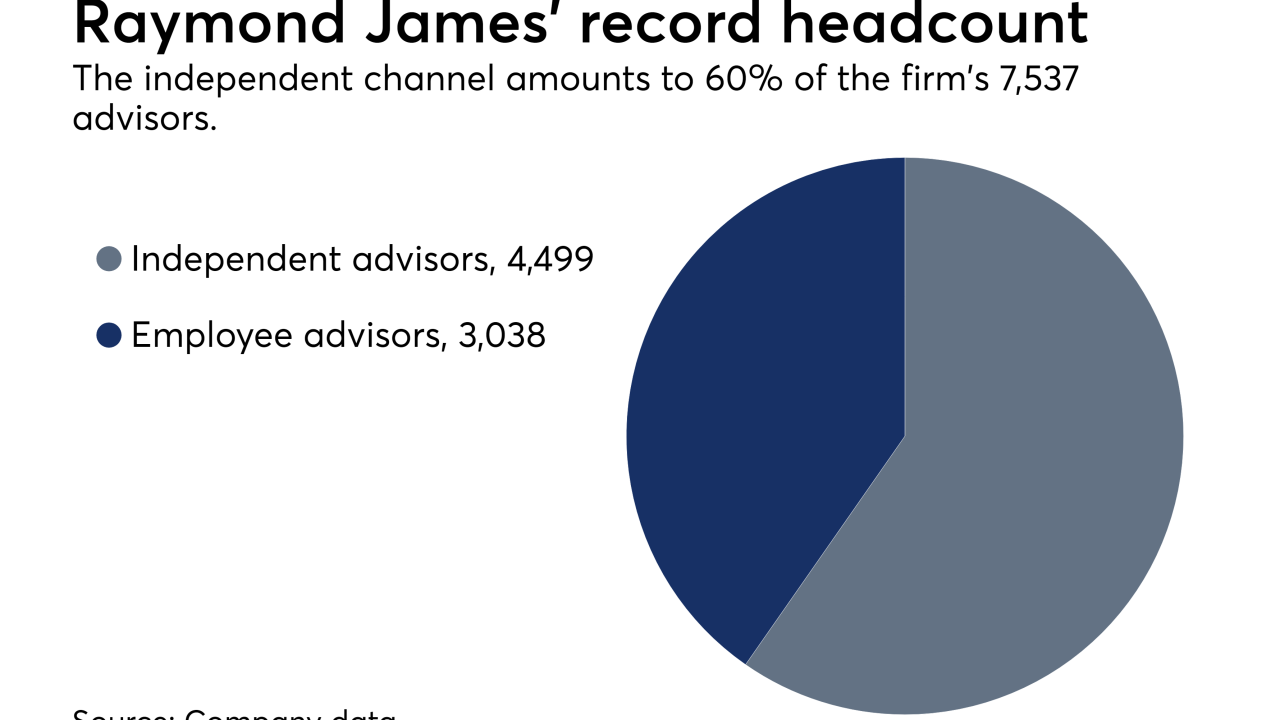

The $263 million practice’s new IBD reported record recruiting for 2017, helped in part by the movement of advisors following LPL’s massive acquisition.

April 9 -

When your client is a foreign national, it pays to find out if the same regulations apply.

April 9 -

Instead of thinking about fiduciary purely as an obligation or regulation, advisors should envision it as something much bigger: a way of life.

April 6 Financial Planning

Financial Planning -

The Justice Department disclosed a felony probe the day before the broker’s termination.

April 6 -

Many of the trades should have triggered market manipulation concerns because they involved companies that were barely operating but engaging heavily in promotional activity, the SEC says.

April 5 -

The new hires say they were drawn to the firm’s investment platform, product offerings and investment diversification.

April 4 -

The Advisor Group IBD added three new teams, but state regulators required enhanced oversight of one new recruit.

April 4 -

Dan Arnold received a 155% raise in his first year atop the nation’s largest independent broker-dealer.

April 2 -

Planners are seeking the independence and support that they say they aren’t getting at wirehouses.

April 2 -

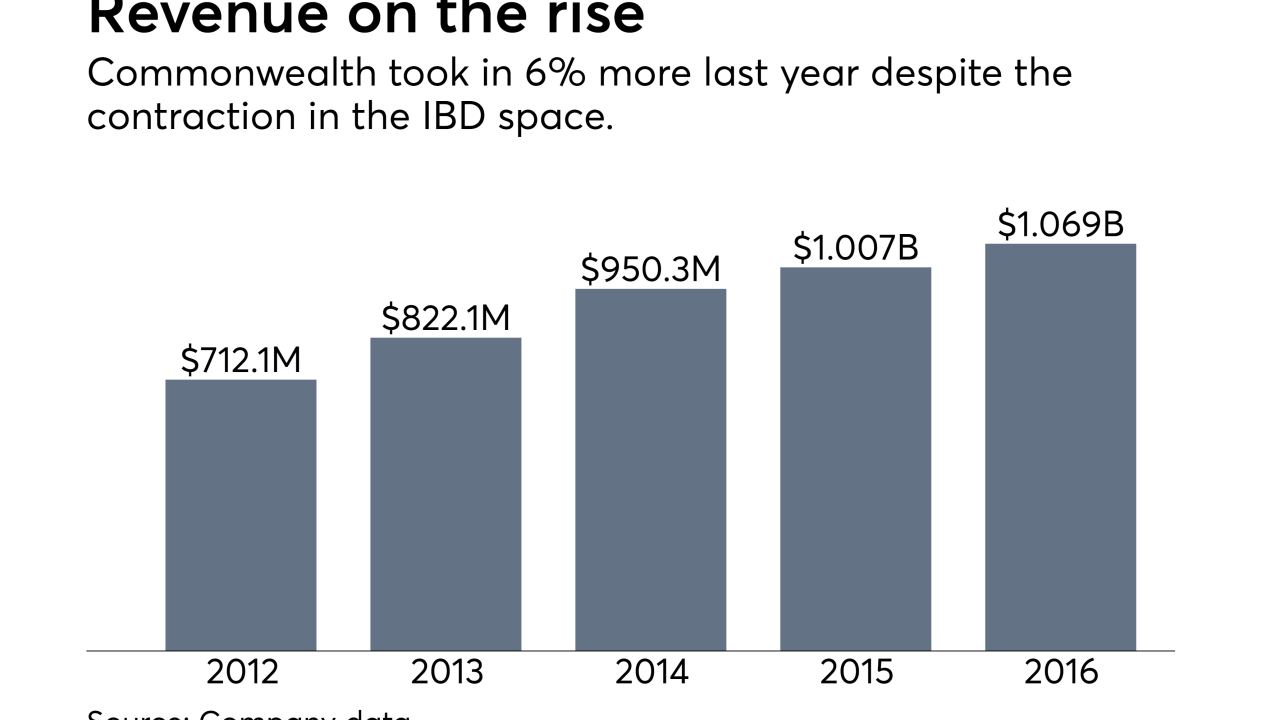

As the financial planning industry nears a fee-only, fiduciary world, independent broker-dealers will face some important choices about their future business models.

April 2 Financial Planning

Financial Planning -

IBDs and regional firms are making the biggest changes, but RIAs have room for growth as well.

April 2 -

National Financial Services accused the brokers' former IBD of breach of contract in a case displaying the complexities of such moves.

March 27 -

Frustrated by the limitations of working at a bank-owned brokerage, advisors Randy and Matthew Price opted to join the independent firm in Houston.

March 26 -

Cetera has provided financing and other services in more than 250 acquisitions across the IBD network since 2015.

March 23 -

IBDs are waging a tough recruiting fight for hybrid RIAs, and Bill Van Law played a pivotal role.

March 22 -

The securities-backed lending platform provides liquidity to borrowers and transparency to advisors, the investment banking giant says.

March 22 -

The 1,778-advisor firm constitutes the largest privately held IBD, underscoring the growing appeal of boutique-like models.

March 22 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

A directive on ETFs took the advisor by surprise after several years with the No. 29 IBD, he says.

March 21 -

The Chicago-based community bank is the second bank this year to move its business from Invest Financial.

March 21