- Charity, free advisor services and more: How the industry is stepping up in the coronavirus outbreak

Organizations and firms are donating N95 masks, providing resources at no cost and taking steps to protect employees and practices nationwide from the spreading pandemic.

April 7 -

FSI aims for a pragmatic approach when advocating on behalf of more than 90 independent broker-dealers and 30,000 financial advisors, Deputy General Counsel Robin Traxler says in an episode of the Financial Planning podcast.

April 7 -

Rivals and rating agencies aren’t taking any breaks in the pandemic, and CEO Jamie Price says the new giant IBD network remains on track as well.

April 3 -

It's the largest IBD recruiting move announced so far this year, and it may not be surpassed any time soon due to the pandemic.

April 1 -

Ratings agencies predict major losses for all of the largest BDs, prompting firms to reassess strategies in uncertain times.

March 30 -

The perennial contender won the top spot in J.D. Power’s annual survey as the coronavirus makes brand and advisor trust even more important to the industry.

March 26 -

Ameriprise’s chief took a 5% cut in his compensation, even as the firm cited notable positive results that buoyed the industry last year.

March 25 -

The amount of financial advisors changing firms doesn’t capture the breadth of the challenge broker-dealers face to retain them, recruiter Jodie Papike says in an episode of Financial Planning’s podcast.

March 24 -

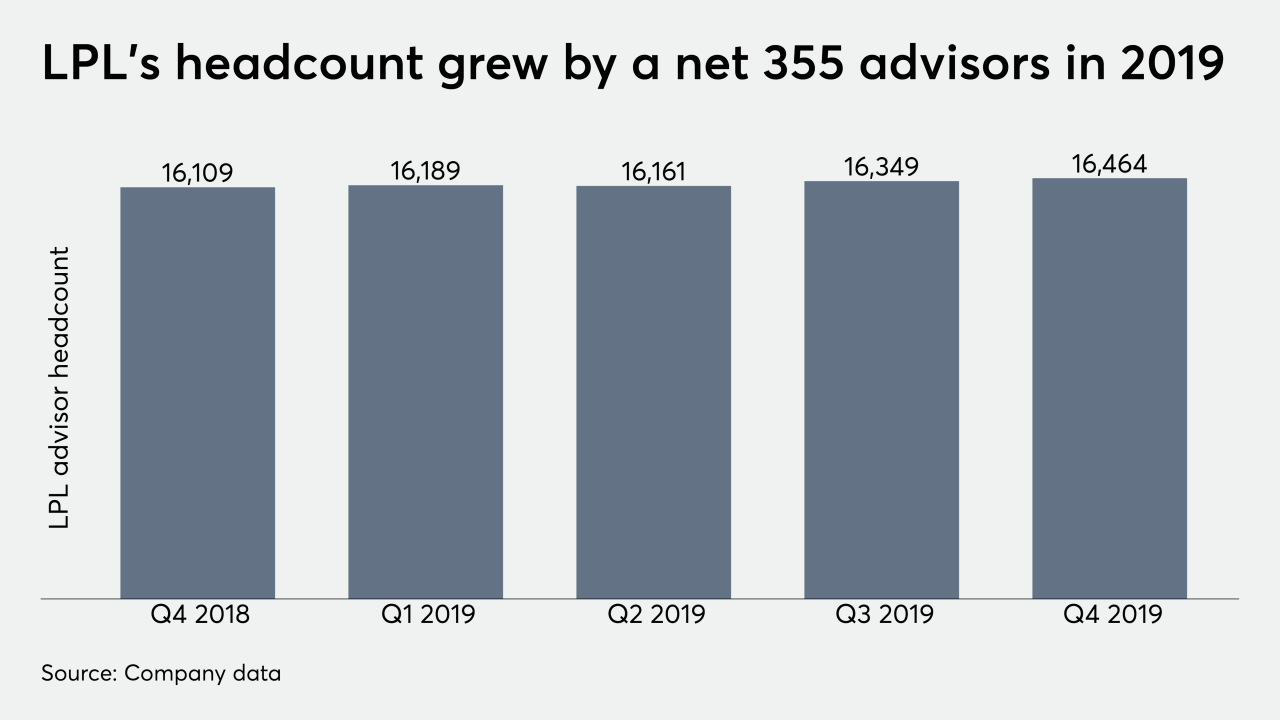

Senior leaders at the No. 1 IBD meet daily about the pandemic as large enterprises set their own continuity plans into motion with an eye toward ensuring operations.

March 20 -

Moody’s lowered the giant IBD network’s credit rating with sobering words that could resonate across wealth management.

March 20