-

Once a top-performing fund with assets well over double today’s value, Templeton’s flagship bond fund has been diminished by the march of passive investments.

January 21 -

Similar products are stockpiling unprecedented levels of new cash as investors look to alternative assets for growth and income.

January 13 -

It was the biggest annual leap for strategies focused on corporate or government debt since 2014, boosting assets to more than $800 billion, data show.

January 8 -

Already, the fund has agreed to transactions involving German wind energy project developer PNE and Altice Europe’s Portuguese fiber assets.

December 20 -

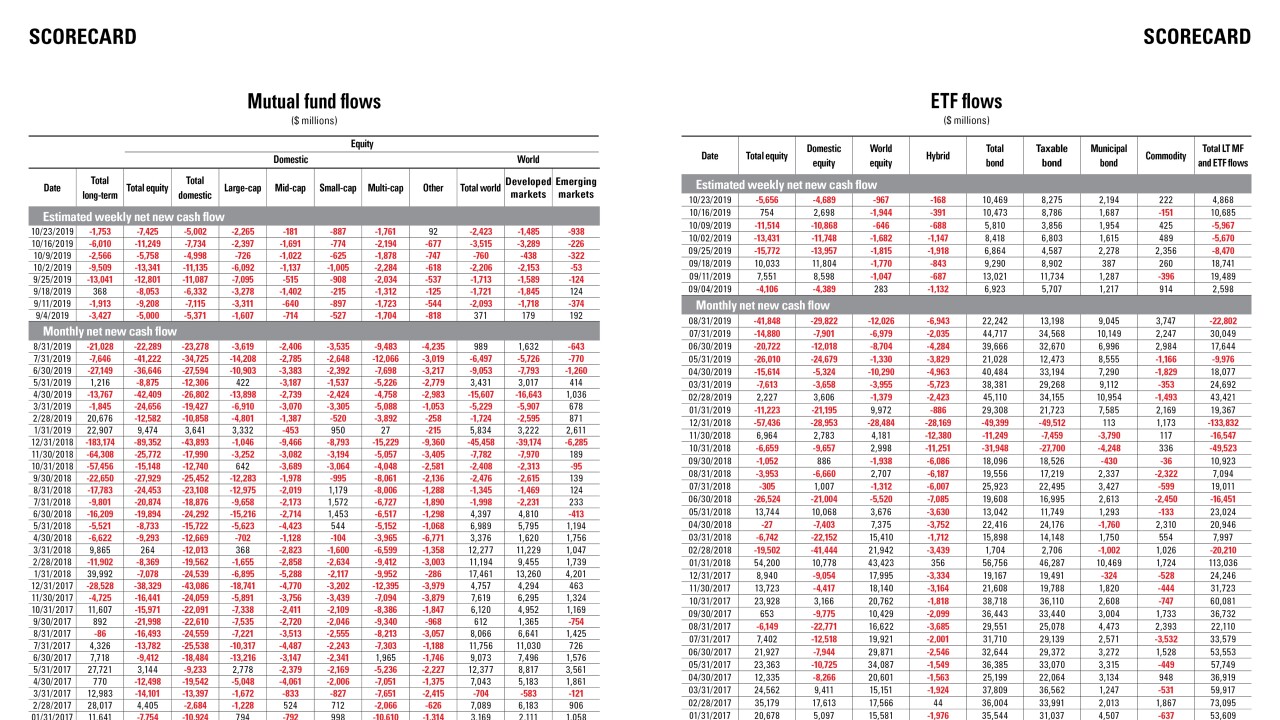

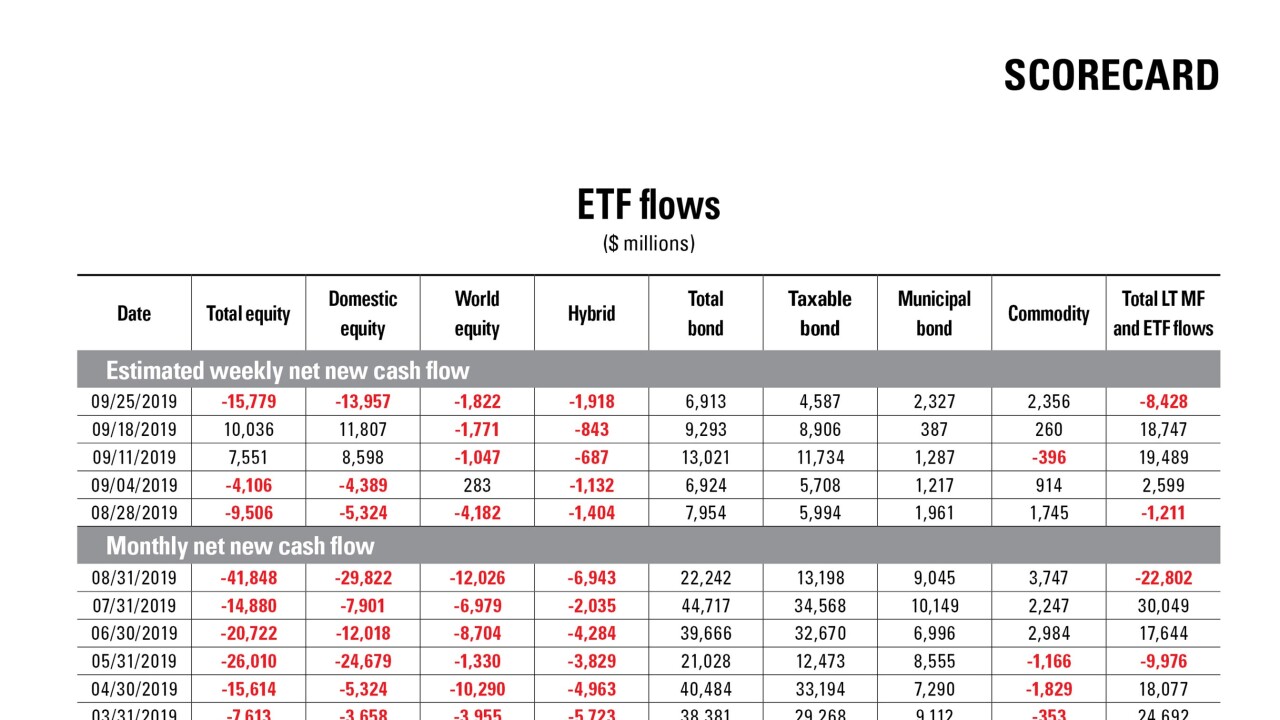

Data reported by the Investment Company Institute.

December 19 -

So much faith has been put on the partial trade deal with China that stocks have nearly recovered since President Trump’s first round of tariffs on imports.

December 17 -

Risky assets outside the U.S. are seeing fresh flows as a potential trade deal with China buoys expectations for global growth.

November 20 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Data reported by the Investment Company Institute.

November 7 -

The top 20 nearly doubled their gains over the last year, data show.

October 23 -

Data reported by the Investment Company Institute.

October 23 -

At more than twice the price of the average fund, many with the even biggest gains still underperformed the broader market over the last decade.

October 2 -

Someone with a long-term investing horizon is generally not helped by bailing out of a well-diversified, multi-asset portfolio. Here are some options for them, and some talking points for you.

October 1 -

Among funds impacted so far, the Invesco China Technology ETF fell 2.8%, while the KraneShares CSI China Internet Fund lost 3.8%.

September 30 -

After hitting the lowest level since January, the fund climbed on Tuesday as the Trump administration made efforts to de-escalate its dispute with China.

August 14 -

Of the 25 new ETFs, the majority come from JPMorgan and investment company Direxion.

August 9 -

If reached, the deal would precede a potential IPO of the $52 billion firm, which oversees asset allocations of domestic and offshore pension funds.

August 8 -

Data reported by the Investment Company Institute.

August 5 -

If approved, the actively managed product will hold anywhere from 60 to 100 equities across sectors and will have no position holding over 5%.

August 2 -

The firm is snapping up five- and 10-year notes as it predicts slowing inflation and trade tensions will push the Fed to lower its benchmark 75 basis points.

July 5