M&A

M&A

-

New firm registrations have soared by 75% over the past five years, according to Schwab.

November 2 -

Ziegler is the latest in a line of purchases by Stifel and other regional broker-dealers.

November 2 -

The Chicago-based RIA focuses on Midwest to expand its footprint.

October 27 -

CEO Dan Arnold said the acquisition of NPH’s assets will serve as a model for the future.

October 27 -

The practice opted for USA Financial after Jackson National sold National Planning's assets.

October 26 -

Advisory firms need private equity capital, but problematic strings may be attached.

October 26 -

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

Speculation about the RIA's future is quelled with a $100 million investment from Thomas H. Lee Partners.

October 25 -

The sale of an asset management firm gives Mariner a capital source to buy RIAs. Lots of them.

October 20 -

The team marks at least the second to opt for a smaller IBD over the nation’s largest.

October 19 -

IHT Wealth Management now has $2.4 billion in client assets.

October 19 -

The move marks the latest in a frenzied period one recruiter describes as “a feast.”

October 19 -

Independent firms need capital, but some top executives question private equity's benefits.

October 18 -

The number of transactions is expected to increase over 20% from 2016.

October 17 -

A recent launch from Flat Rock is designed to provide access to middle-market debt in a new way, according to the firm’s CEO, Robert Grunewald.

October 16 -

Wealth Partners Capital Group's strategy uses a triumvirate, multi-regional method to buying firms.

October 12 -

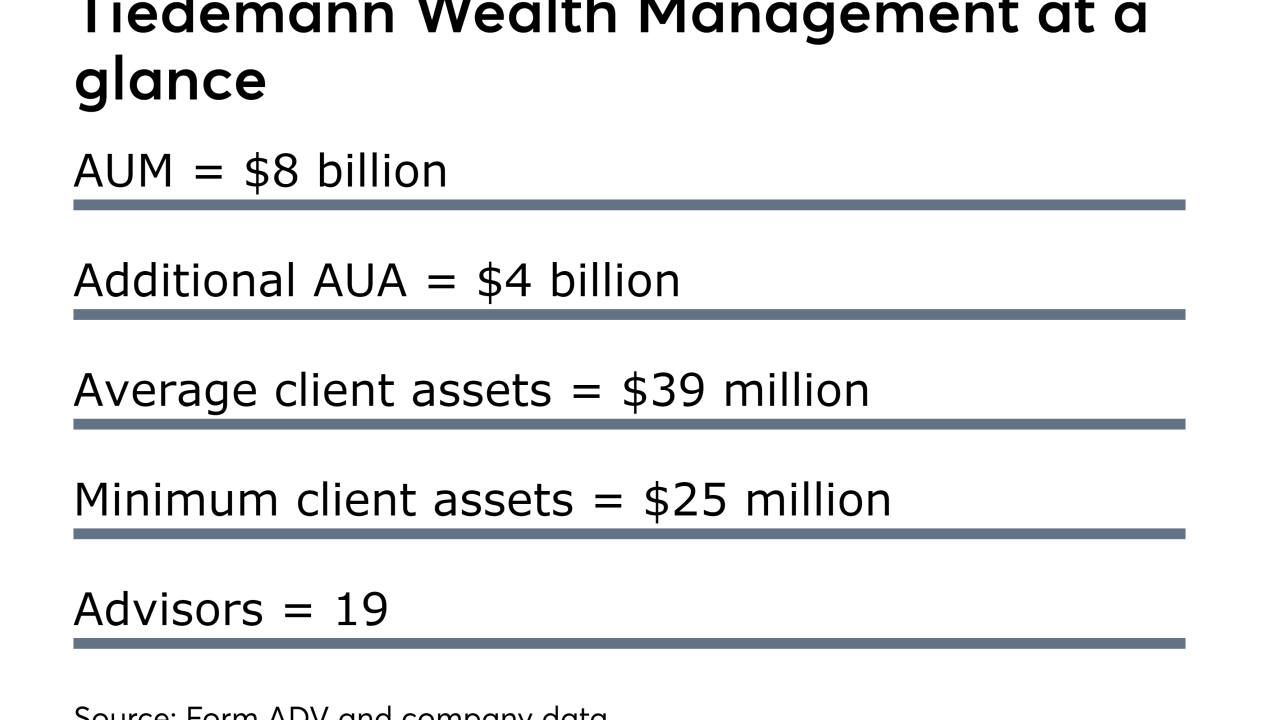

The acquisition gives Tiedemann $11 billion in AUM, impact investing expertise and a presence in the Northwest.

October 12 -

Chief executive Jay Shah says a public offering will happen, "when the time is right."

October 11 -

An acquisition may pivot on making sure the RIA's nearly 200 advisors stick around after a deal closes.

October 10 -

As RIAs and regulations reshape the industry, the concern is real, a new Cerulli report says.

October 10