-

Executives say wealth management’s evolution means automation, lower salary expectations and niche practices.

September 13 -

Clients under 35 are the only age group with a negative savings rate. These tools can help them prepare.

September 11 -

These firms may actually be the worst positioned to capitalize on the robo trend, Michael Kitces writes.

September 6 -

An offering that can grow with a client, Ally Invest's president says, will stand out in the digital advice field.

September 6 -

Fifth Third Bank tweaks microinvesting premise with software that rounds up debit card purchases to help pay back educational loans.

September 5 -

Planners share how they are finding new revenue streams for their business.

August 29 -

The amount that can be transferred is equivalent to the HSA's annual contribution limit, which is $3,400 for singles and $6,750 for couples.

August 21 -

These two accounts are both funded with money that has already been taxed, but there are still important differences that clients need to know.

August 18 -

It may be time to update your salary strategy to encourage better performance and attract promising job candidates.

August 11Cruz Consulting Group -

Naming a young grandchild as beneficiary of a traditional IRA could be a wrong move, as the distributions will be subject to the "kiddie tax."

August 2 -

With fewer associate training programs, young bank advisers need to take the initiative to find a mentor and cultivate referrals.

August 2 -

The microinvesting site, which now has over 2 million accounts, allied itself with Clarity Money.

July 28 -

The most important consideration is that clients are able to complete the 35-year work period because benefits are based on the 35 highest-paid years from their careers.

July 27 -

Demand from millennials has helped the strategy become an $8 trillion category.

July 19 -

The app allows users, many of them first-time investors, to get started for as little as $5.

July 14 -

"Everything people thought was cool in 2014 is table stakes in 2017," said Kendra Thompson, head of Accenture’s global wealth management practice.

July 11 -

Although traditional IRAs offer upfront tax deductions, clients will have to pay taxes later in life when they likely will be in a higher tax bracket.

July 7 -

Popular microinvesting apps targeting novice investors are charging total fees well in excess of other options, says an industry observer.

July 5 -

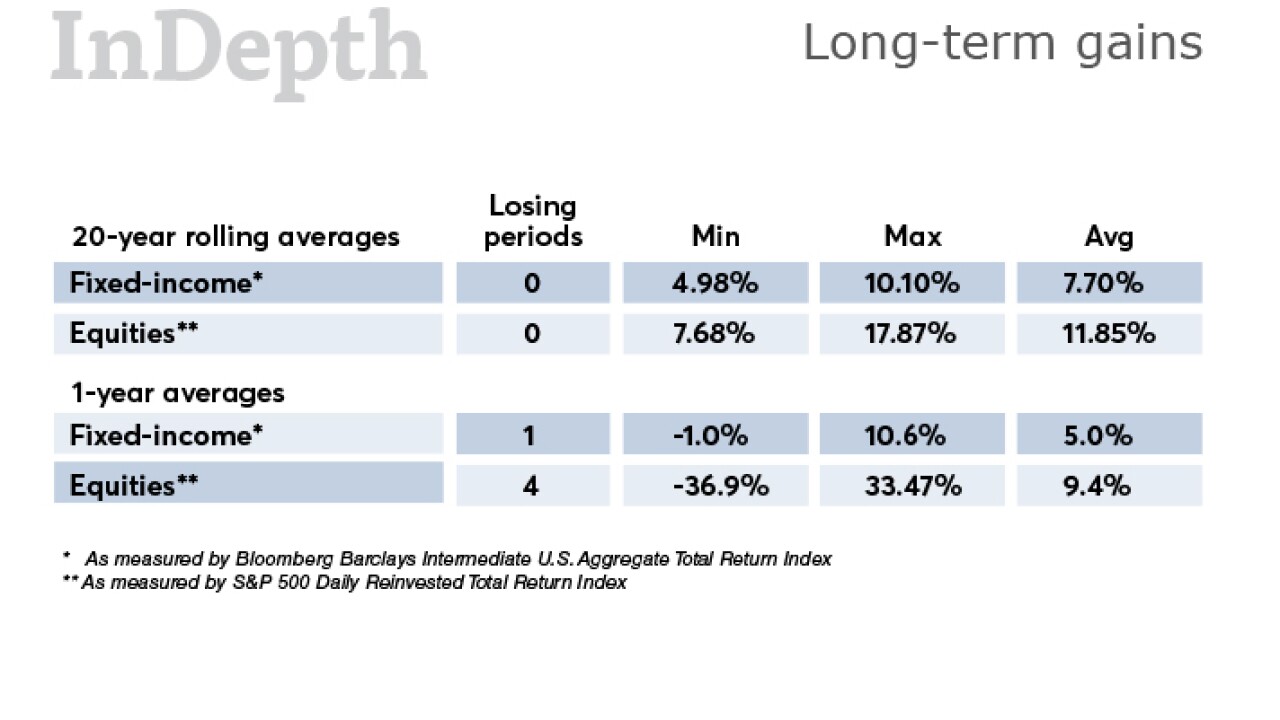

Taking a 20-year outlook is the best way to make gains, says Lipper number cruncher Tom Roseen.

July 5 -

Behavioral economics, essentially a combination of economics and psychology, is tailor-made to help straighten irrational decisions when it comes to portfolio construction.

July 5 Employee Benefit News and Employee Benefit Adviser

Employee Benefit News and Employee Benefit Adviser