-

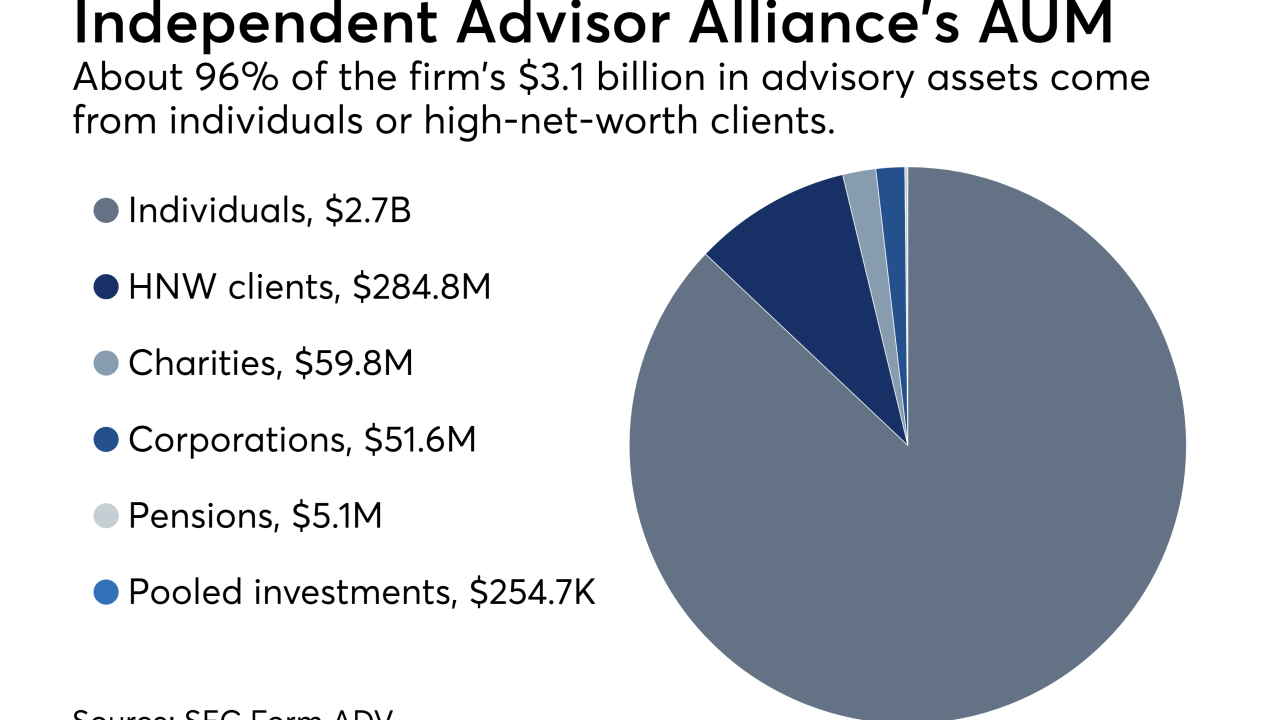

Robert Russo says the Independent Advisor Alliance has recruited nearly three dozen IFP reps, and other large enterprises have also made inroads.

August 28 -

The practice has grown rapidly, but it now faces a major decision about its IBD plans following the announcement of Advisor Group’s acquisition.

July 9 -

Experts cite a variety of reasons for the industry’s grim jobs forecast for advisors, but the data reveals much more complexity.

July 2 -

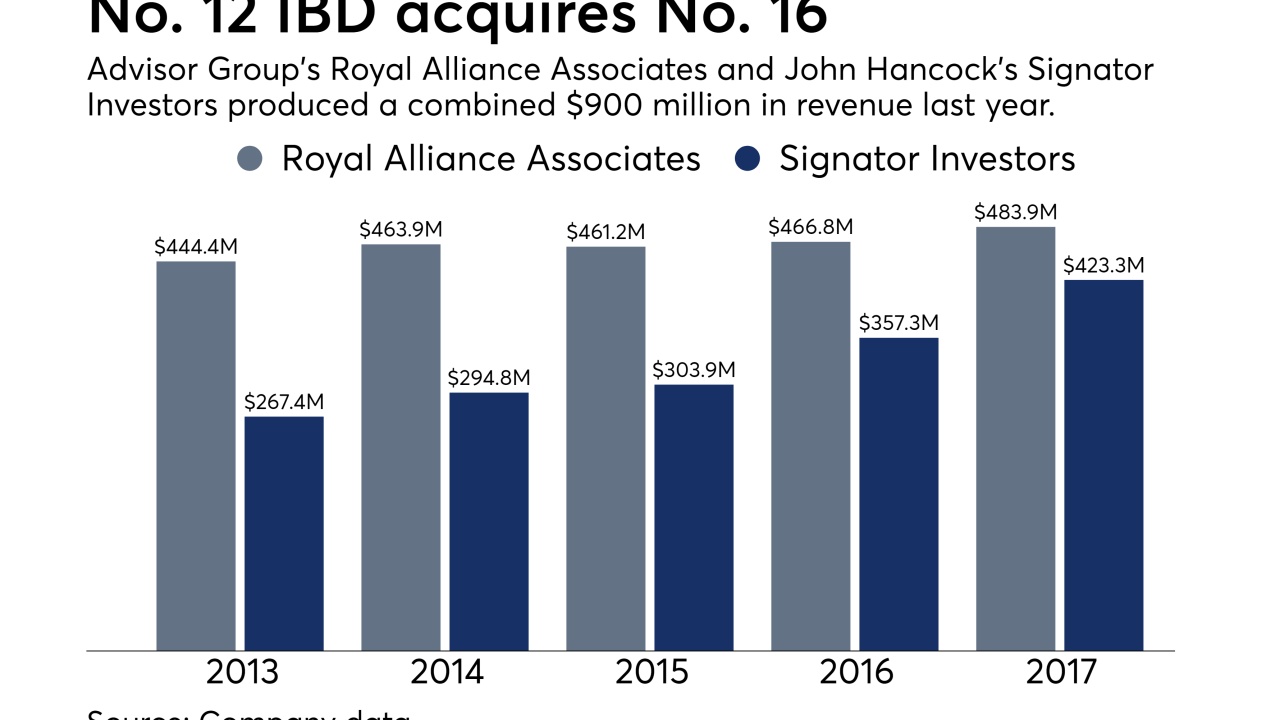

Royal Alliance Associates will absorb the firm following the deal, which would push the network’s headcount above 6,800 advisors.

June 21 -

The No. 7 IBD has unveiled five new internal classifications for practices in an effort, it says, to boost the customization of its services for advisors.

June 5 -

At least six RIAs have left since the No. 1 IBD announced a change in policies last November.

May 31 -

Independent Financial Partners’ CEO predicts the firm will retain about 80% of its business, despite a daunting series of challenges.

May 17 -

The firm broke off from its OSJ and followed four others of its type in leaving the No. 1 IBD after a change in its RIA rules.

May 15 -

In addition to being fired, advisors could also face suspension and fines — all from the carelessness of not carefully reading one simple question.

May 8 -

How often should CCOs pay a visit to branch offices?

April 23 -

Bill Hamm’s Independent Financial Partners has grown more than fivefold in 10 years with the No. 1 IBD.

April 10 -

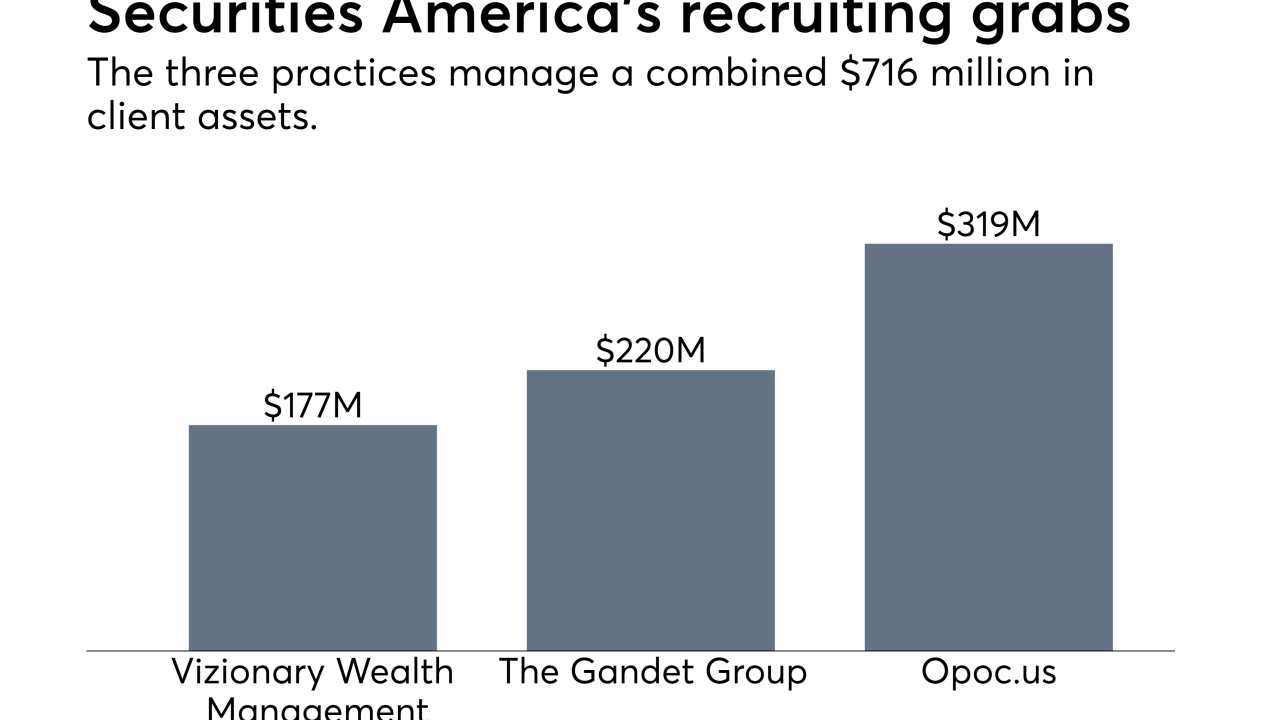

The Advisor Group IBD added three new teams, but state regulators required enhanced oversight of one new recruit.

April 4 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

An advisor who is a former ballplayer set ambitious goals for 2021 with an alternate take on the hybrid strategy.

February 22 -

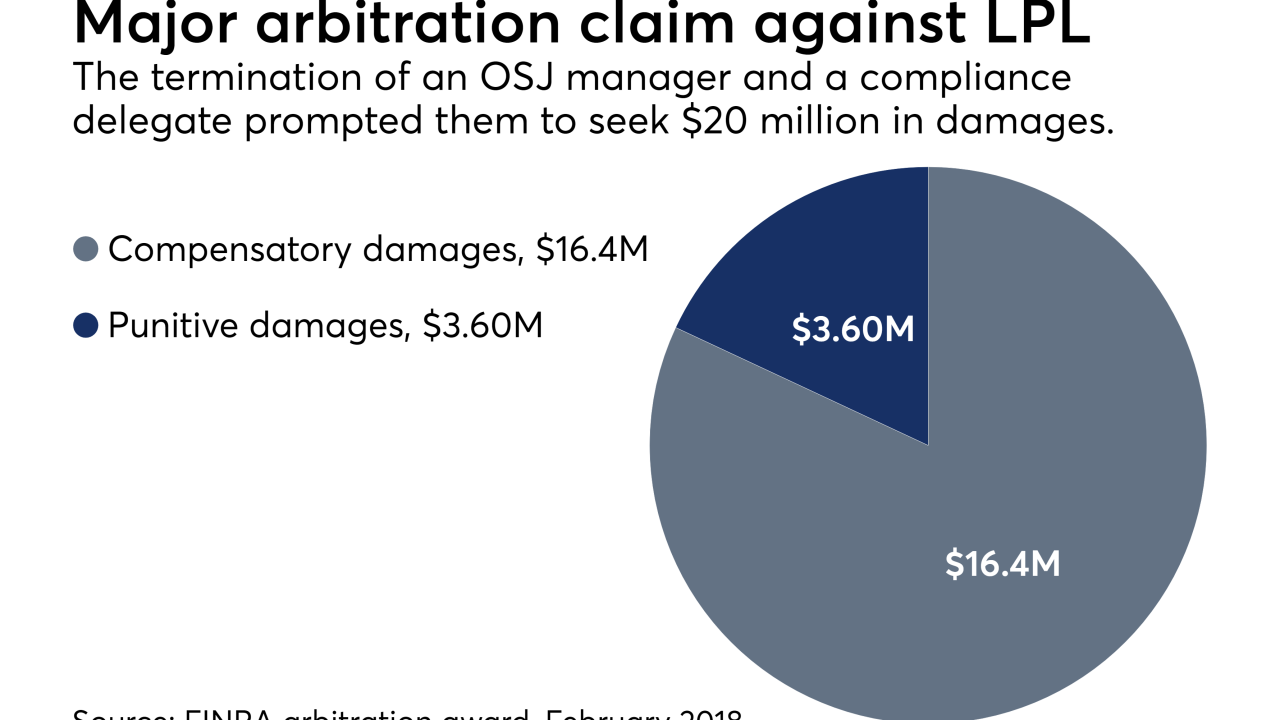

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

The practice’s managing director blamed the No. 1 IBD in part for its move to Securities America.

November 13 -

The fourth largest IBD added a super OSJ with $650 million in AUM.

November 7