A hybrid RIA that has grown rapidly over the last year and a half now faces a major decision: How to proceed after its independent broker-dealer of two decades has been acquired by another firm.

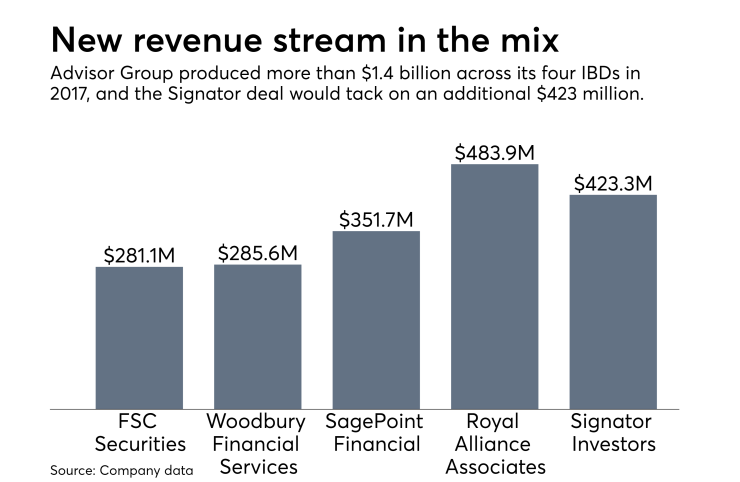

Brian Holmes’ Signature Estate & Investment Advisors, which is affiliated with Signator Investors, has expanded its assets under management by nearly 40% to more than $8 billion since the beginning of 2017, according to the practice’s director of operations.

SEIA also recently opened two new offices to grow to seven and moved one of its existing locations into a space twice as large, the firm

The team has yet to decide, however, whether it will

SEIA Director of Operations Joe Fusaro expressed a positive initial response to the deal “from a 30,000-foot view” but said the team will be considering the best possible option for its advisors and clients. The firm has bulked up in recent years by recruiting from wirehouses, RIAs and IBDs alike, Fusaro says.

“It’s been a little bit of everything,” he says. “Advisors really get attracted to the fact that they can come here and own their own book of business, truly own it, and have a say of what goes on in their firm.”

-

Royal Alliance Associates will absorb the firm following the deal, which would push the network’s headcount above 6,800 advisors.

June 21 -

The move to acquire the No. 16 firm from John Hancock reflects the acceleration of industry trends and a potential giant in the making.

June 25 -

The bank’s latest retreat from wealth management will move 51 advisors to the independent space under Woodbury Financial.

April 19

While Raymond James and Stifel are on hiring sprees, Wells Fargo is still losing talent.

The RIA has aligned with Signator since it opened, and Holmes has worked for Signator for his entire 34-year career in the industry, according to FINRA BrokerCheck. Fellow Signator advisor Jesse Brown officially joined SEIA on June 28, opening the firm’s new office in Houston.

In the spring, the firm launched a new location in San Mateo, California, in an effort to better serve its clients in the San Francisco and Silicon Valley areas. Previously, the firm’s advisors needed to travel nearly 400 miles north to visit their clients.

In mid-February, SEIA also relocated its office in Redondo Beach in the Los Angeles area to accommodate three advisors’ continuing growth, Fusaro says. The firm, which has five offices in California, another one in Tysons Corner, Virginia and its new Texas location, is actively recruiting.

Experts have pointed to the many such large offices of supervisory jurisdiction and other big practices at both Signator and Royal Alliance

“Those are some of our most successful large OSJ managers and they run very successful practices that are unique,” Royal Alliance CEO Dmitry Goldin said after the deal was announced. “We have a very close, personalized relationship with them, which I think works with Signator’s large OSJ model as well.”

Both Goldin and Advisor Group CEO Jamie Price have said they hope to retain as many of Signator’s roughly 1,800 advisors as possible when the deal closes later this year. The advisors and roughly $50 billion in client assets would fold into Royal Alliance upon closure of the deal as well.

The effort to retain Signator’s advisors remains in the beginning stages, Fusaro notes. The team looks forward to meeting with Royal Alliance as it decides its next move, he says.

“It’s very early in the sense that we need to speak with them and find out what their vision and plans are,” Fusaro says. “The communication is important.”