-

Seniors are advised to combine multiple tax-deferred accounts, such as traditional IRAs and 401(k)s.

August 13 -

It would raise enough new revenue to more than restore long-term balance of the program.

February 13 -

There are hundreds of claiming strategies — using the wrong one can have major repercussions.

October 16 -

Rich professionals have found a new way to bypass income limits created by Congress.

August 16 -

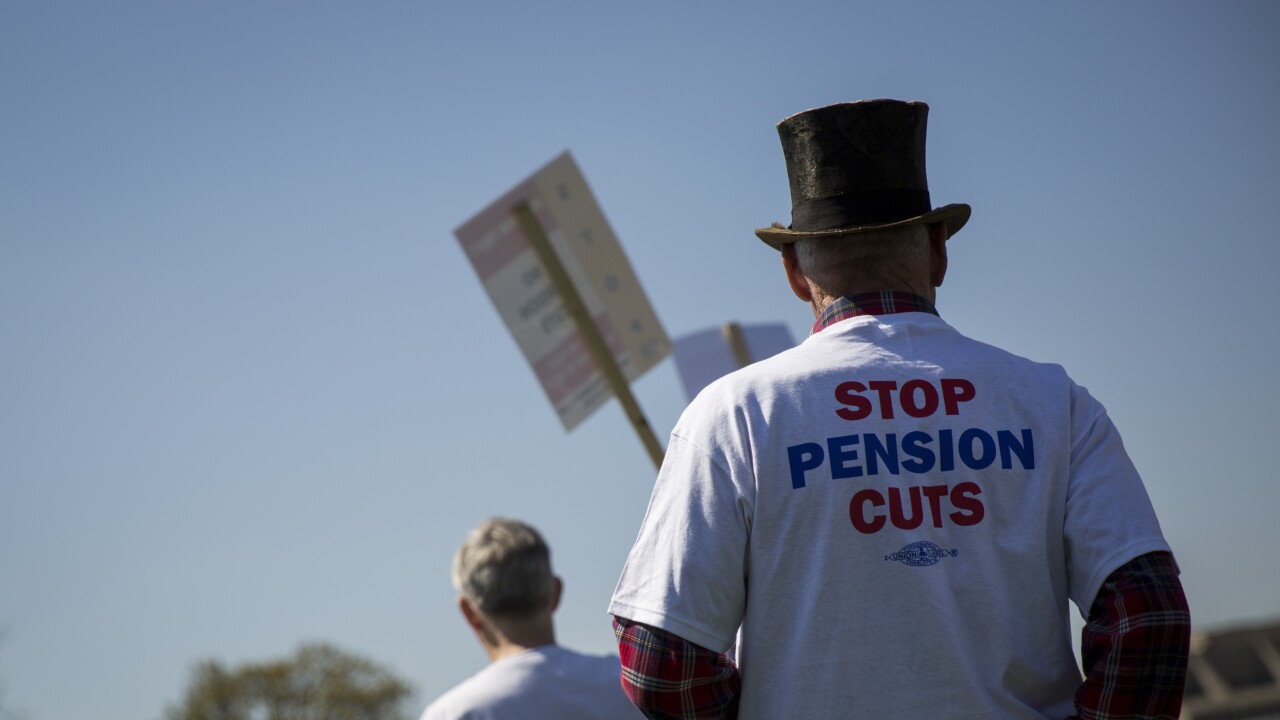

Some 1.4 million participants in private pension plans may be facing stiff pension cuts that could come as soon as 2028.

June 18 -

“Public pension plans continue to bury their heads in the sand living in a time warp of decades-old actuarial assumptions,” says a former Connecticut state treasurer.

June 15 -

Clients who want to make their retirement portfolio resilient to market volatility should veer away from core stock and bond holdings.

May 30 -

Medicare premiums will increase for high-income retirees because of the change in the income brackets that will serve as basis for determining these premiums for their Part B and Part D coverage.

May 3 -

In a bull market's later stages, some types of investments work better than others. Find out which ones they are.

March 13 -

Seniors who reach the age of 65 and are in good health have the option of opening a Medicare medical savings account.

February 21 -

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

With many private and public pensions in the red, clients are advised to look for options that will improve their prospects, such as Roth IRAs.

January 23 -

The funded ratio for defined benefit plans at Fortune 1,000 firms rose to 83% at the end of 2017, a new report says.

January 3 -

Investors are advised to do a Roth conversion before year-end to make the most of the federal tax deduction for state and local income taxes, which could disappear next year.

December 15 -

The strategy could provide lifelong cash flow by trimming longevity risk.

November 28 -

Many carriers offering long-term care coverage are experiencing financial woes and may no longer guarantee payments when clients need them.

June 15 -

Workers who withdraw from their 401(k) plan lose about 25% in compounded growth.

April 4 -

Proponents of defined-contribution plans envisioned them as supplements to defined benefit plans; they didn't anticipate that 401(k)s would largely replace pensions.

January 4 -

Some of the most significant financial planning changes advisers should consider when working with same-sex couples.

November 23 -

Some of the most significant financial planning changes advisers should consider when working with same-sex couples.

November 23