-

The great value in simplicity is that the client can personally identify with the investment approach.

November 17 Samara Capital

Samara Capital -

Equine exposure should be done outside the core portfolio, using discretionary funds.

November 16 -

-

High-risk, highly concentrated funds may not be for everyone, but they can fill a niche.

November 14 -

Many advisors want nothing to do with cryptocurrency.

November 13 -

Often derided, a small amount of the precious metal can help clients diversify.

November 10 -

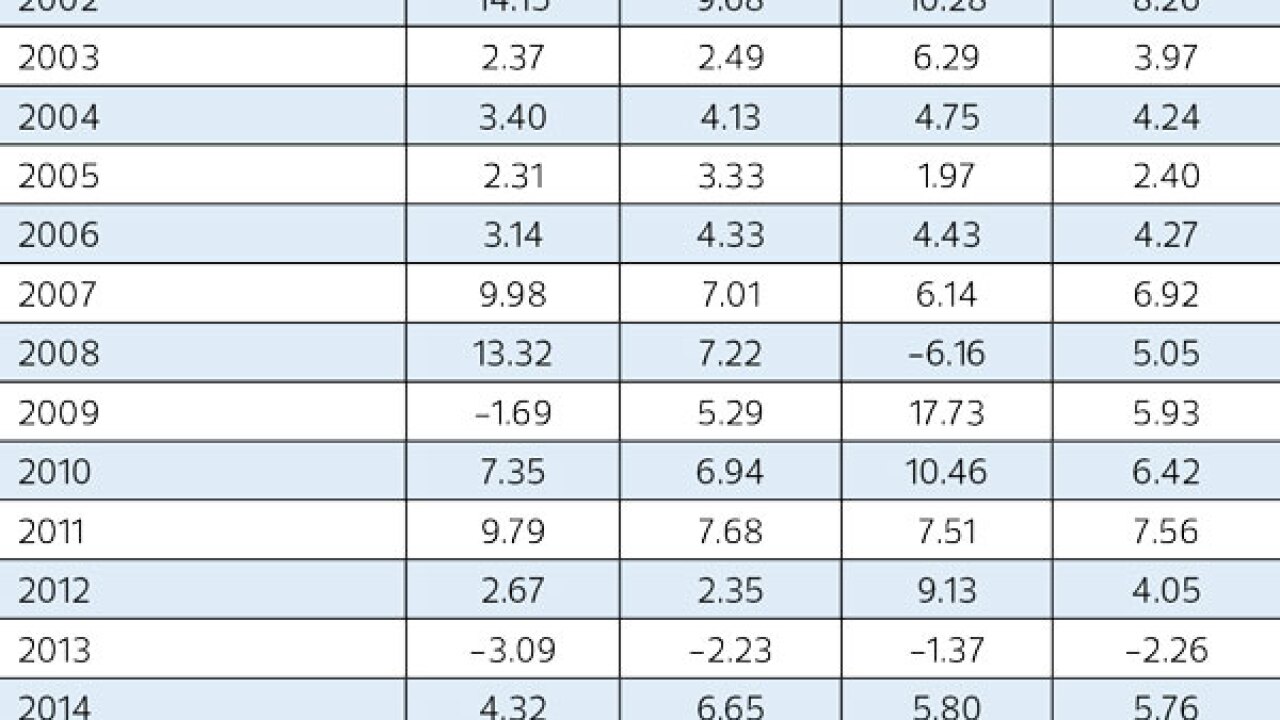

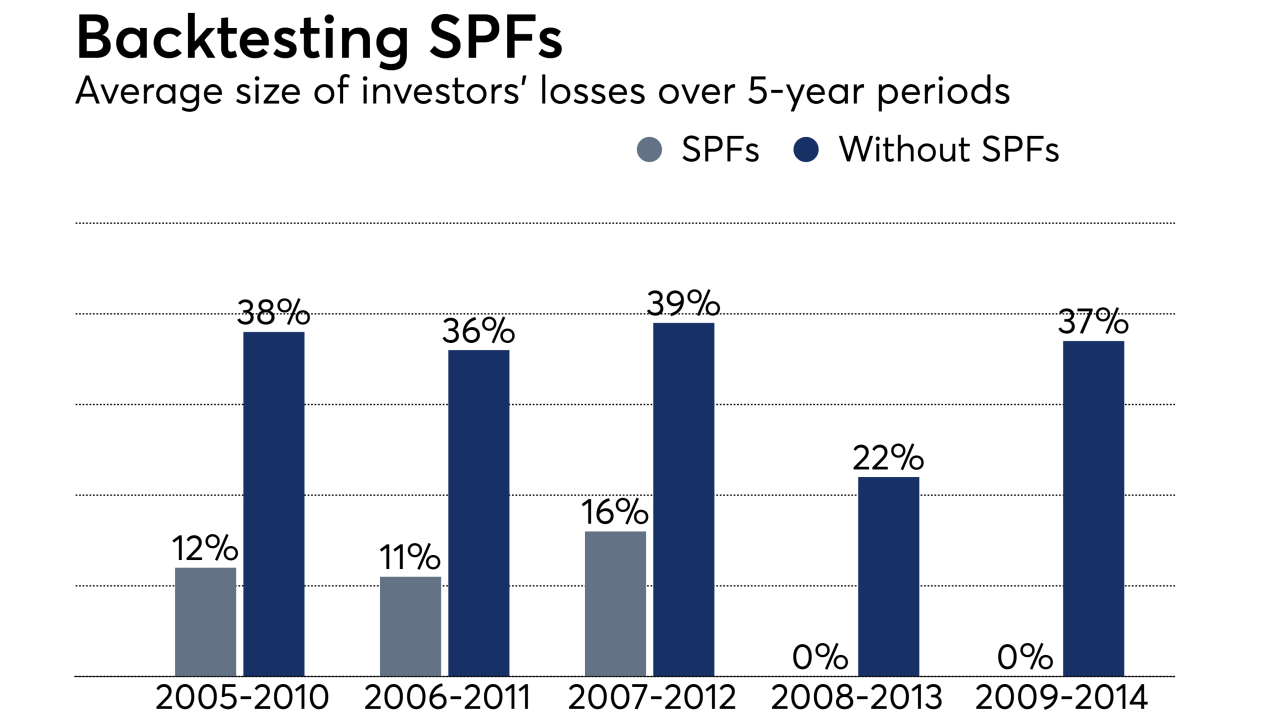

Some clients may demand more evidence of actual outcomes.

November 10 -

Smaller and midsized firms typically have fewer resources, limiting the time available to complete annual examinations of their policies and procedures.

November 10 Alaric Compliance Services

Alaric Compliance Services -

-

If one day’s immersion in world news teaches us anything, it is that risk is not just a game.

November 8 -

A proliferation of ETFs raises the stakes of distinguishing between passive and active. It's smart to be a little skeptical.

November 7 -

Positioning clients to weather market volatility and potential correction has become a top concern.

November 7 -

With so many choices available, it can be tough to cut through the noise. Here's how.

November 3 -

Some experts say the advantages are oversold.

November 3 -

Bond funds go mano a mano in the last installment of this 3-part series on maximizing total-market index funds.

October 12 -

"If you think you are going to get paid for what technology can do, think again."

October 6 -

Stock Protection Funds could mitigate single-stock risk, but are they worth the fees?

October 5 -

The American Opportunity Tax Credit can save clients $2,500, while they can claim up to $2,000 with the Lifetime Learning Credit.

September 29 -

Non-traditional asset classes include structured credit, reinsurance and alternative lending.

September 29 -

Smart beta and other factor investing often leads to more complexity than necessary.

September 22