Regulation and compliance

Regulation and compliance

-

‘Hey, you, get off of my cloud.’ What wealth managers should know about the risk-reward of cybersecurity.

January 31 -

Gold futures may see their first monthly gain since September as worries over President Donald Trump's trade policy outweighs the threat of rate hikes.

January 31 -

Morgan Stanley and Advisor Group are moving ahead with changes despite the possibility that the Department of Labor's regulation could be reversed.

January 30 -

The regulator was operating with three of five commissioners before Chairwoman Mary Jo White left.

January 30 -

The wirehouse will make “many” of the pricing and product design changes it planned last year, include lowering commissions for trades involving stocks and ETFs “to the benefit of our clients,” according to an internal memo.

January 27 -

The long-running feud between banks and fintech companies over screen scraping is morphing into a more nuanced and important conversation about how to exchange consumers' financial data securely and fairly.

January 27 -

By putting clients’ interests first and documenting conscientiously, advisors will comply with the rule, while also building trust.

January 27 -

The fiduciary rule is just one of the pressures affecting the fund industry, which is why disruption is the theme of the organization's annual Strategic Leadership Forum.

January 27 -

Michael J. Breton admitted to using master accounts from Fidelity and Schwab to take winning investments for himself, while giving clients the losers, the Department of Justice says.

January 26 -

The settlement comes two weeks after Citigroup resolved similar charges with the New York Attorney General's office.

January 26 -

For the first time since 2008, a commission will propose long-awaited changes to the Standards of Professional Conduct. Areas under review include code of ethics and planning practice standards.

January 26 -

FINRA barred the former J.P. Morgan rep for allegedly using customer debit cards to steal $1,002.

January 26 -

Executives also estimate how much of their advisory force will quit in the wake of the DoL rule.

January 26 -

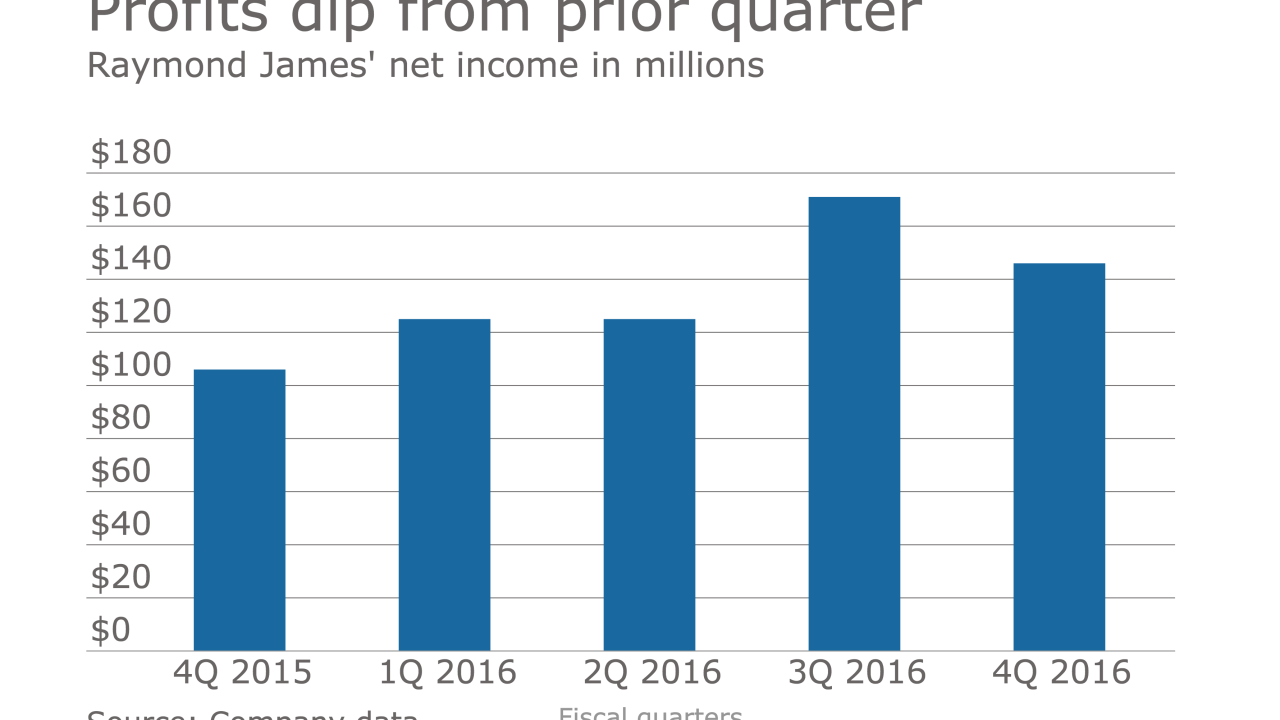

The firm is preparing for the fiduciary rule and contesting a lawsuit alleging that Raymond James allowed a $350 million fraud to be perpetuated.

January 26 -

The bank has made no secret that it planned to put more pressure on vendors.

January 26 -

A revenue boost for the firm's asset-management unit is key and could play a role in raising capital that's been eroded by misconduct charges.

January 25 -

Too much growth has led to a slowdown in business efficiencies. Smart firms need to fix their operating models.

January 25 -

The industry will experience an acceleration of the technology as firms meet data challenges, says Todd Moyer, an executive vice president at Confluence.

January 24 -

The regulator reprimanded Citizens’ retail brokerage for not amending reps' Forms U4 and U5 within 30 days of learning of complaints.

January 24 -

There's a better way to craft a standard that would protect investors and preserve client choice.

January 24