Regulation and compliance

Regulation and compliance

-

The nontraded REIT industry moved to introduce a new share class following tighter regulations.

June 8 -

The president makes good on his vow to kill legislation that would roll back the new regulations on retirement plans.

June 8 -

The regulator also says that the firm suffered from supervisory failures during a four-year period.

June 8 -

The question a Cetera advisor says he never wanted to get from a client: "How come this is $88,000 instead of $100,000?"

June 8 -

The new regulations are “arbitrary and capricious," a trade organization asserts.

June 7 -

Converging movements – fiduciary, technological and demographic – mean new realities for how a planner will act like a professional.

June 7 -

Richard W. Davis also took $1.5 million in fees while he was entitled to just $150,000, the commission alleges.

June 6 -

The adviser claimed she was unjustly fired from First Citizens Bank for allegedly making unauthorized bonus payments to her two sales assistants totaling $9,000.

June 6 -

The U.S. Chamber of Commerce, SIFMA, FSI and other groups are asking a Texas court to vacate the Labor Department's new regulations less than a year before the rule goes into effect.

June 2 -

The firm is facing a lawsuit on behalf of investors who lost money in a $350 million Ponzi scheme.

June 1 -

The firm's relatively modest-sized army of advisers is more productive than any of its competitors. In 2015, the average Raymond James adviser produced $387,733, beating Cetera, its closest rival, by more than $56,000.

June 1 -

If an advisor hasn't adopted new technology, the CEO asks, are they putting their own interests ahead of their clients?

June 1 -

The industrywide gain in fee income is a welcome development given the new fiduciary rule--see how firms are preparing for new regulations as well as new competition.

June 1 -

The fiduciary rule flips wealth management on its head, especially in the bank channel. Smaller books will be just one response at Cetera.

June 1 -

The adviser's job is about to get harder, and some old dogs are going to have to learn new tricks in order to survive.

June 1 -

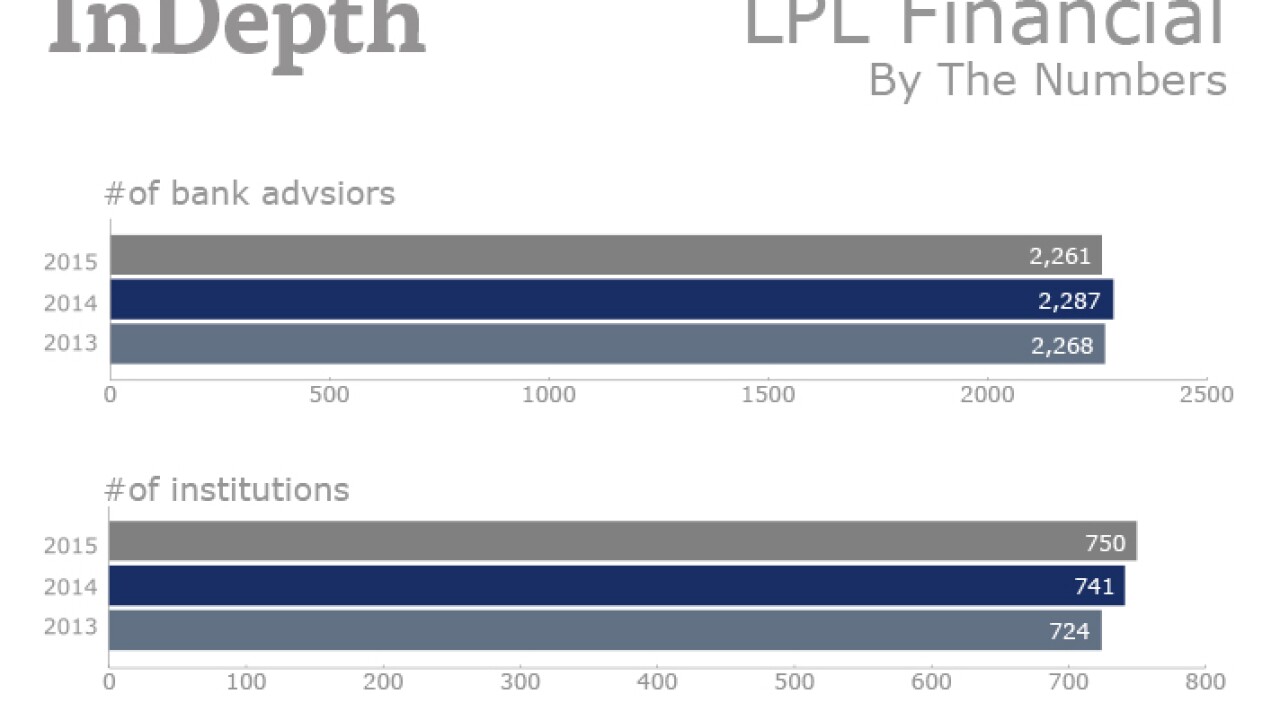

A longstanding obstacle is getting banks to recognize the opportunities in the wealth business, says Arthur Osman, executive vice president and institution service business consultant at LPL.

June 1 -

Quantum Advisors, which picks Indian stocks for Norways $860 billion wealth fund, says investors should stay away from index investing in Asias fourth-biggest market.

May 31 -

Some insiders at big brokerage firms encouraged the DoL to maintain progress. "That kept us going," Assistant Secretary of Labor Phyllis Borzi says.

May 25 -

Sales commissions may decrease, but new assets are expected to come on the platform.

May 25 -

If you're still thinking about a client who may be suffering from diminished capacity or displays other worrisome signs, then you need to say something, says Dr. Nancy Needell.

May 25