-

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

A barred broker told clients the lifestyle media company was about to be acquired, so “they needed to act quickly,” according to the regulator.

July 9 -

Clients seeking to recoup some $14 million in damages have received only 12% of their total claims, according to an SEC-appointed receiver.

July 3 -

With transparency about conflicts on the rise even as it varies by firm, critics question whether clients really understand complicated technical documents.

May 30 -

The SEC is giving serious side-eye to firms with part-time or underqualified compliance officers.

April 30 Cipperman Compliance Services

Cipperman Compliance Services -

The allegation was laid out in an SEC order, which hit a U.S. unit of the firm with a $500,000 penalty.

April 26 -

Audit volume is up but compliance issues are down — with cybersecurity as the wild card.

April 9 RIA in a Box

RIA in a Box -

The justices said bankers can be held liable for sending clients deceptive information written by others.

March 28 -

The firm’s founder “knowingly engaged in a multi-year scheme to mask the poor performance of one of the funds’ largest investments,” the SEC alleged.

March 26 -

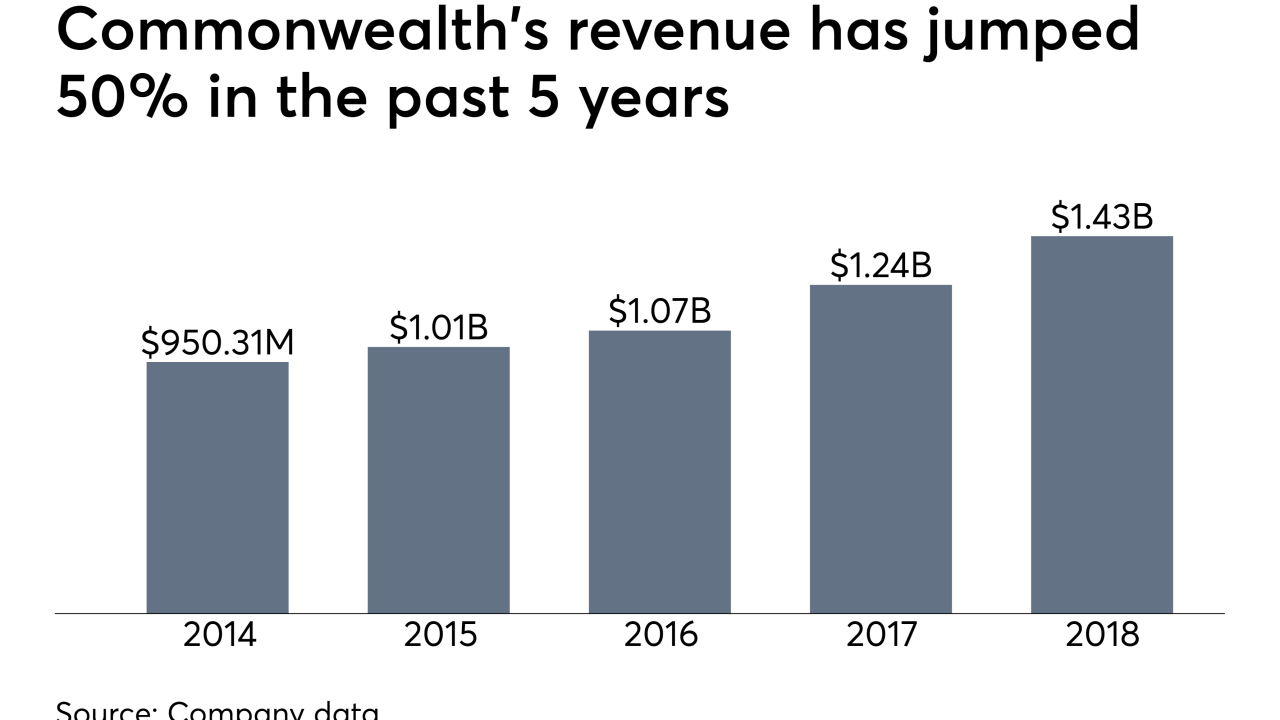

The independent broker-dealer accidentally published a list of credits of its most lucrative advisors.

March 22 -

The RIA divisions of Raymond James and RBC are also among the companies that self-reported.

March 11 -

Non-public corporate earnings reports were among the stolen information, the regulator claims.

January 16 -

The SEC is running on a skeleton crew that effectively halts routine oversight.

January 3 -

Investigators say the onetime FiNet branch manager preyed on “particularly vulnerable” clients, including several with dementia.

January 2 -

The IBD network’s parent repurchased the majority of Dr. Phillip Frost’s shares just before the SEC filed proposed settlements of its pump-and-dump case.

December 31 -

Wall Street’s main regulator has made ADR sales a focus of its enforcement efforts.

December 27 -

Former Securities America rep Hector May carried out a 20-year scam through his outside RIA, according to prosecutors

December 17 -

Investigators say the barred rep diverted more than $1.8 million of her clients’ money for personal use, including on vacations and houses.

November 6 -

Edward Lee Moody used the stolen proceeds to buy a home and travel to Las Vegas among other destinations.

October 17 -

Dick Lampen says the SEC charges against Dr. Phillip Frost, the firm’s primary shareholder, won’t affect its “significant” other resources.

October 1