In a black eye on the brokerage-affiliated RIA industry, 79 firms have voluntarily agreed to repay $125 million to clients they overcharged by putting them in high-priced mutual fund shares without adequate disclosure.

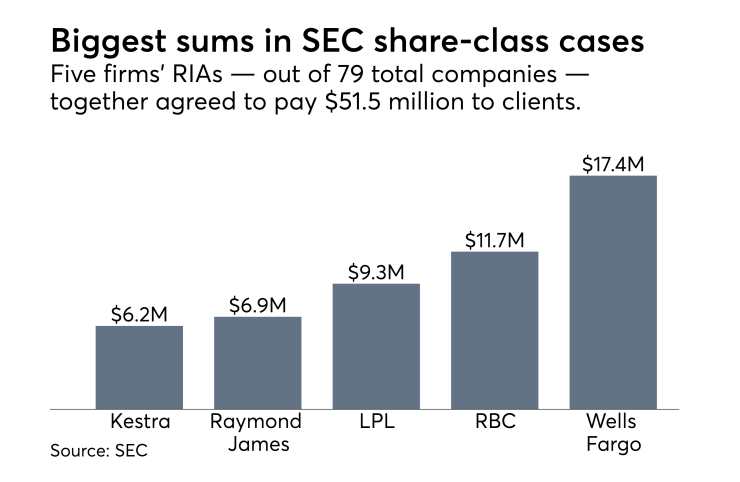

The investment advisory divisions of Wells Fargo, RBC, LPL Financial, Raymond James and Kestra Financial collectively will pay $51.5 million, or more than 40% of the total. Wells Fargo, which is scheduled to testify before Congress this week about a long list of admitted client abuses, leads the pack at $17.4 million, following by RBC Capital at $11.7 million.

The firms voluntarily came forth after the SEC offered them the opportunity last year to self-report when the firms had sold clients high-priced mutual fund shares when lower-cost alternatives were available. The cases focus on mutual fund 12-b1 fees, known as trails. The SEC’s program resembles tax amnesties offered by the IRS to tax scofflaws. By coming forward, the firms avoided fines from the commission.

Wells Fargo "violated … the Advisers Act, which makes it unlawful for any investment adviser, directly or indirectly, to 'engage in any transaction, practice or course of business which operates as a fraud or deceit upon any client or prospective client,'" the SEC wrote in its case against Wells. The language resembles that of the other firms' cases.

The firms settled without admitting or denying the commission's findings.

Risk alert: The agency expects advisors to follow these steps.

"We proactively enhanced our disclosures related to mutual fund transactions in 2014 before moving to a single share class on our Strategic Asset Management platform in 2016," LPL Financial said in a statement. "As a result of these efforts, the vast majority of the dollars we will return to investors covers an eight‐month period from five years ago. LPL continually looks for ways to enhance disclosures as the industry and regulatory environment changes.”

It added that, "The $8.1M of 12b-1 fees we will return to investors represents one tenth of 1% of advisory revenues over the five-year time period of the SEC’s program."

When contacted for comment, Wells Fargo, RBC and Cambridge Investment Research, which will pay $6.2 million, said they had voluntarily come forward and, since then, updated their disclosures.

Raymond James, Stifel and Kestra declined to comment.

In announcing its share class selection disclosure initiative last year, the SEC said it did so "to address ongoing concerns that, despite the fiduciary duty imposed by the Advisers Act [as well as numerous other programs], investment advisers were not adequately disclosing, or acting consistently with the disclosure regarding conflicts of interest related to their mutual fund share class selection practices. These disclosure failures caused harm to investors, particularly retail investors, including being deprived of the ability to make informed investment decisions when purchasing higher-cost share classes."