-

Some advisers and their clients are running afoul of an IRS rule, and oversights can result in substantial penalties.

June 22 -

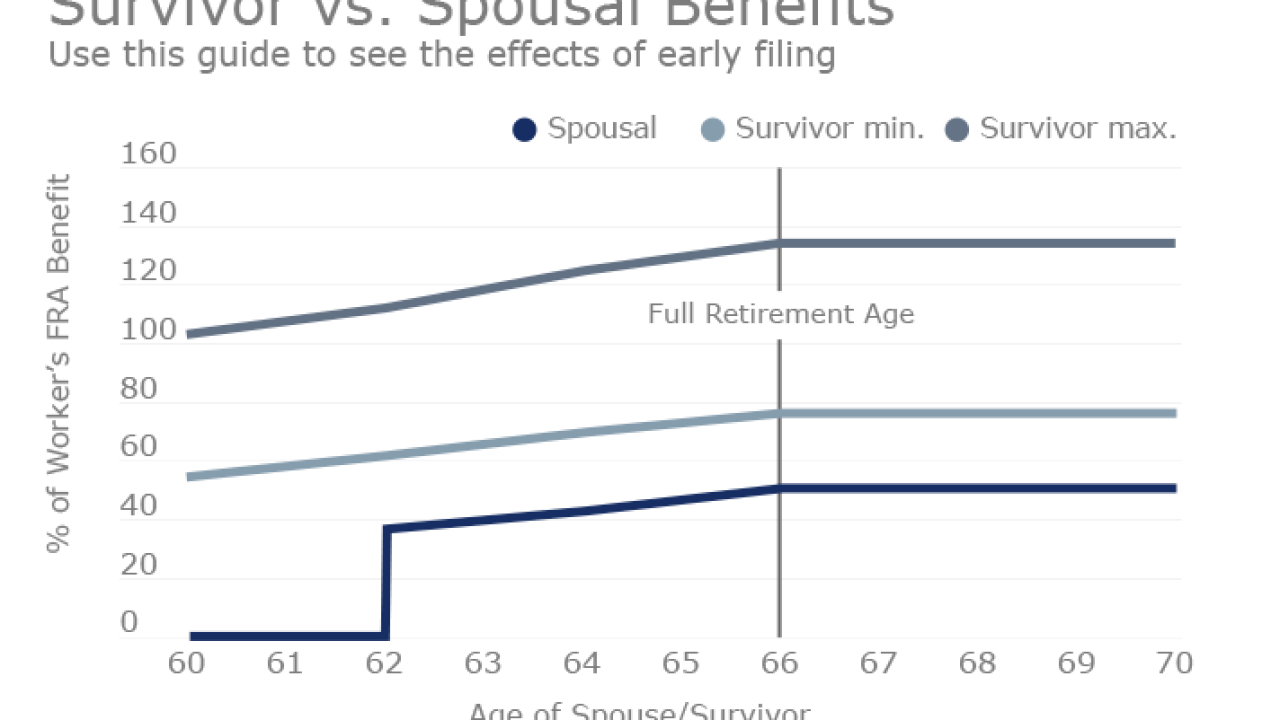

Spousal benefits and survivor benefits appear very similar, but scratch a little deeper you’ll find a tangle of regulations and features. Here’s how to unwind them.

June 22 -

The strategy raises tricky tax reporting and regulatory questions.

June 21 -

Whether clients are making 529 plan distributions, a direct tuition payment or an in-kind gift, for grandparents, timing is everything.

June 20 -

MLPs deliver returns and may help lower payments to the IRS. Plus, the costs of age-related milestones and ETFs.

June 16 -

One approach enables clients retiring with large positions of highly appreciated company stock in their 401(k) accounts to save thousands on taxes.

June 16 -

Advisers also noted a dip in their clients’ retirement savings activity after the tax filing deadline passed.

June 7 -

Advisers can use these strategies to help clients get through a marital split, says BNY Mellon wealth strategist Justin Miller.

June 6 -

A NING trust can provide significant savings and help clients avoid gift tax ramifications.

June 6 -

How a bundle of joy can reduce your client's IRS payment. Plus, the benefits of charitable remainder trusts and 20 common investing mistakes.

June 2