The rapid evolution of robo technology may be adding new pressures to traditional brokerage firms, but at least one executive of a leading digital firm sees a future for established players.

"If this is a $20 trillion industry, I'm pretty sure that in ten years when robos manage $10 trillion, then $9 trillion will still be in the hands of traditional financial services firms," Mike Sha, CEO of technology developer SigFig, said.

Sha was speaking at SourceMedia's In|Vest conference in New York, where he and other top executives discussed how digital advice was beginning to transform wealth management. Sha said that many traditional firms will have to adopt new ways to serve clients.

Over the past year, a number of firms have announced plans to develop robo advisers in-house or to acquire startups, showing the variety of ways that the industry is adjusting to the rapid evolution of new technologies. Last month, SigFig formed a partnership with UBS to deliver digital advice tools to the wirehouse's approximately 7,100 advisers.

Read more:

Mitchell Caplan, CEO of Jefferson National, said he basically agrees with Sha, noting how many firms successfully evolved when faced with disruptive innovations in their sectors.

"On the other hand there are plenty of large institutions that didn't change when they had to and they fell by the wayside," Caplan said.

The advisers most at risk from technological disruption are those that rely heavily on investment management and their proximity to clients, according to Joe Duran, CEO of United Capital.

"The biggest advantage that most advisers have is that they are in the neighborhood where their clients live. That is disappearing," Duran said.

Blockbuster industry deals and unforeseen shifts in client attitudes are altering future forecasts for digital advice.

It's the elimination of geography as an advantage he said, pointing to how digital firms such as Amazon have disrupted local business relationships. "If it's true for hard products like a TV or a mattress, then it's going to be true for financial advice," he said.

CLIENT MIGRATION

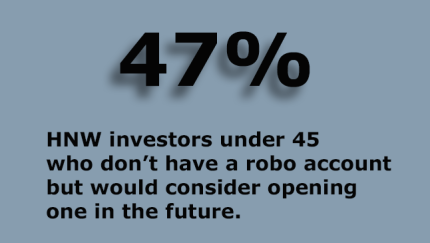

Duran said that the industry will know when it's reaching the tipping point when middle-aged investors – people between 35 and 50 years old – start migrating in large numbers to digital first or digital hybrid firms.

Duran said that most previous innovations in the financial services industry have been on the product side; now technology is transforming how advice can be delivered.

Jon Stein, CEO and founder of Betterment, said he's already seeing the migration of middle-aged and older clients. He says that 70% of Betterment's customers are not millennials. "At Betterment our business is already there," Stein said.

Sha said that he thinks a significant portion of the clients moving to digital advice firms do not currently have dedicated advisers, which is the case for about 90% of the money SigFig manages. The average account size at SigFig is currently $400,000, he said.

While the digital executives thought that robo firms had plenty of opportunities before them, they didn't expect that they would all necessary become as large as the wirehouses, which manage trillions in client assets.

"There will be a few companies that will breakthrough and become major national brands," said Stein.

Another thing all four executives agreed on: It's a period of tremendous transformation.

"The entire financial services industry is changing and I think it's changing more than any time since the 1970s," Stein said.