With almost $13 trillion of bonds in the global debt market yielding less than zero, fund managers are increasingly chasing returns in less liquid assets. The result could be a reduction in the transparency about what portfolios are really worth. Regulators are right to be paying heightened attention to any misadventures in illiquidity.

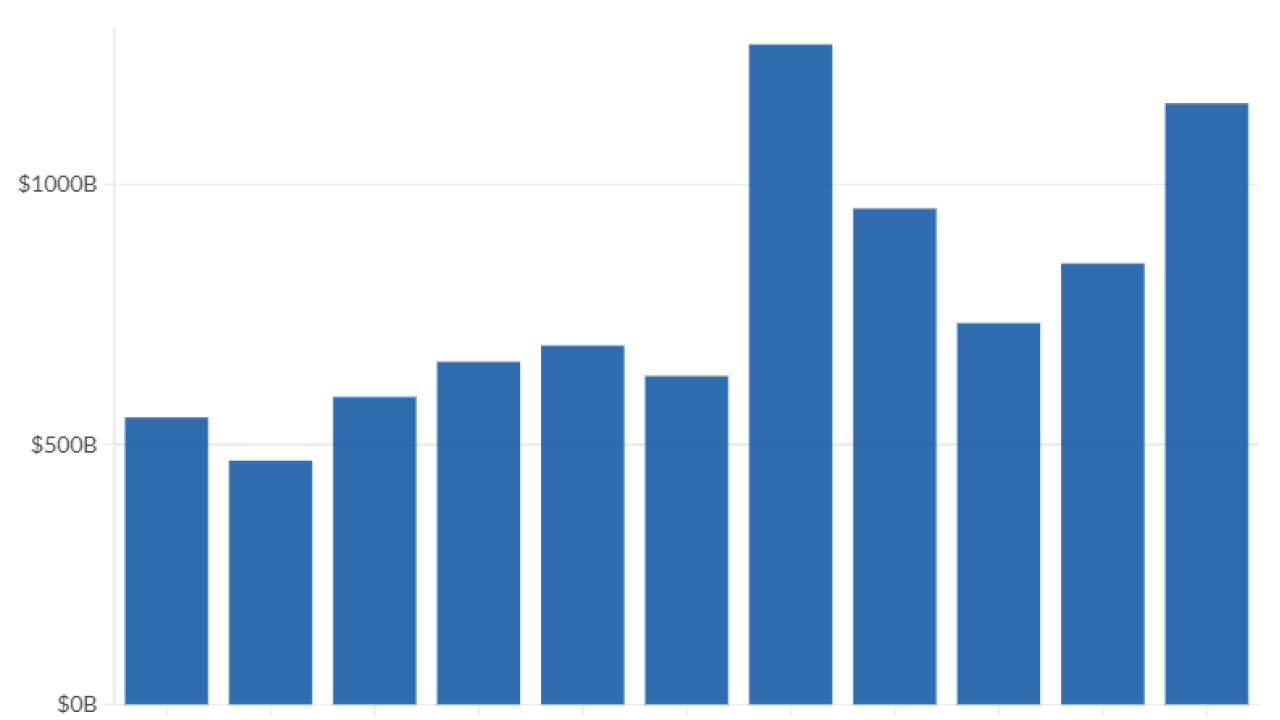

The decline in interest income available in the global bond market — even on securities that haven’t yet breached the zero bound — is truly staggering. The average yield on the world’s $54 trillion of investment grade debt is a paltry 1.5%, down from 9% at the start of 1990 and about half of its average since then.

The high-yield debt market looks increasingly misnamed. As much as $2.4 trillion of the low-rated bonds yield less than 6%, down from as much as 21% in 1990 and an average of almost 10% during the past two decades or so.

The world’s stock market, as measured by the MSCI World Index, is within touching distance of a record high — even as the prospect of a synchronized global economic slowdown is forcing central banks to turn on the monetary spigots once again. So investors are understandably a bit nervous about the prospect for further gains in public equities, and are turning increasingly to private markets, which supposedly offer higher rewards in return for less liquidity.

In Europe, private equity is poised to overtake hedge funds as the dominant asset class in the so-called alternatives space, according to

The total capital allocated to all flavors of private equity last year, including infrastructure, private debt and venture capital, climbed to a record $420 billion. And with $63 billion raised in Europe for private investments in the first quarter, 2019 is on track to set a fundraising record, the study said.

Sarah Donahue serves as Vice President of advocacy operations at Health Advocate. She brings over 25 years of experience in healthcare benefits, including 19 years with Health Advocate. In her current role, she oversees a team of more than 250 professionals across advocacy operations, claims and appeals, and care coordination. Sarah has extensive experience managing large-scale client implementations and driving operational excellence.

Snow Pine Private Wealth is the latest in a string of advisory groups to jump from UBS to Wells Fargo.

The lawsuit claims ShinyHunters, a prominent cybercrime group behind breaches at other wealth firms, exposed personal information after its ransom demands were refused.

That shift away from public markets shows no signs of stopping. A survey of more than 550 European investment firms

“Just like equities, last year was a volatile year and the fourth quarter of 2018 did a number on the returns of risk assets,” an expert says.

The danger here is that unlisted investments are effectively worth whatever the fund manager says they are — unless and until they have to find a buyer, either voluntarily or compulsorily. And that’s worrying.

“Illiquid assets are not marked to market,” the Greenwich report notes. “As a result, changes in valuation take longer to play out in institutional portfolios, muting quarter-to-quarter volatility in portfolio valuations and funding ratios.”

The pivot toward private markets is an understandable response to the worldwide drop in yields. But higher returns necessarily come by taking on increased risks. Clients and regulators alike should be wary of allowing asset managers too much leeway in the values they assign to unlisted assets. Regulators have every reason to look closely.