Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

IBDs and regional firms are making the biggest changes, but RIAs have room for growth as well.

April 2 -

The research firm’s annual survey included new queries reflecting changes in the industry.

March 29 -

National Financial Services accused the brokers' former IBD of breach of contract in a case displaying the complexities of such moves.

March 27 -

Cetera has provided financing and other services in more than 250 acquisitions across the IBD network since 2015.

March 23 -

IBDs are waging a tough recruiting fight for hybrid RIAs, and Bill Van Law played a pivotal role.

March 22 -

The securities-backed lending platform provides liquidity to borrowers and transparency to advisors, the investment banking giant says.

March 22 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

A directive on ETFs took the advisor by surprise after several years with the No. 29 IBD, he says.

March 21 -

Ross Gerber says he left the firm to avoid its strict oversight of his press interviews and social media.

March 19 -

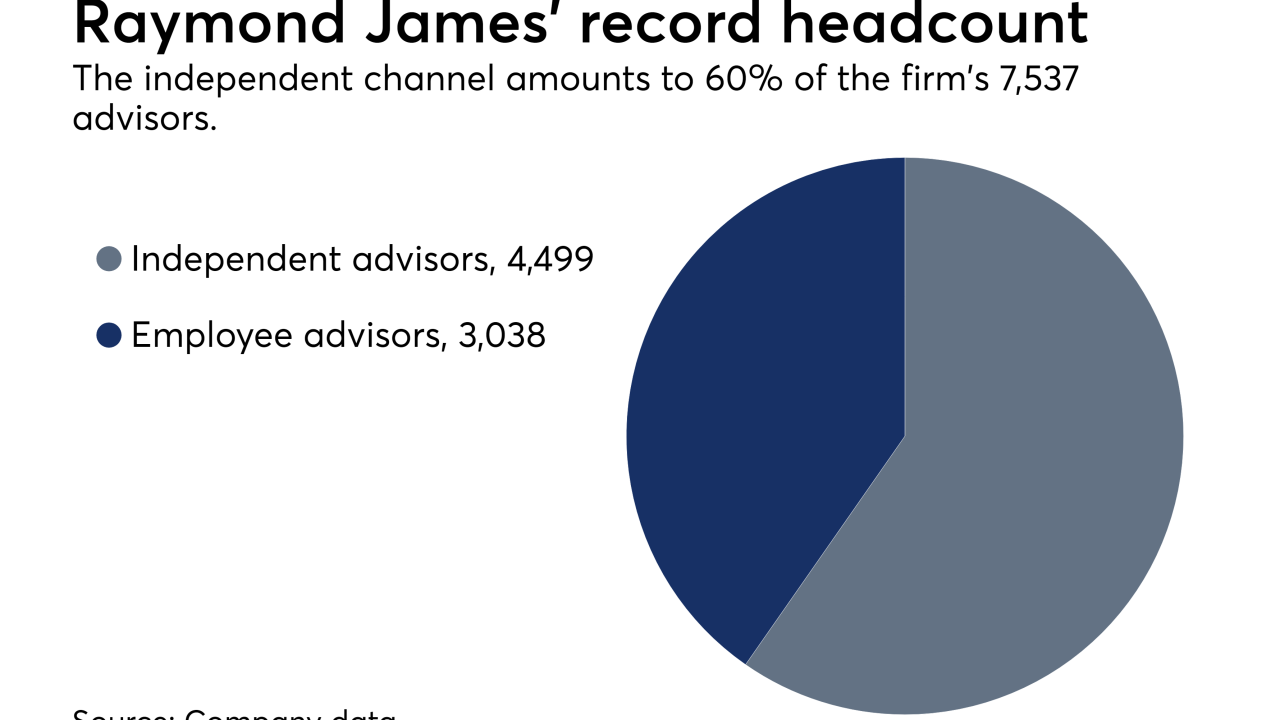

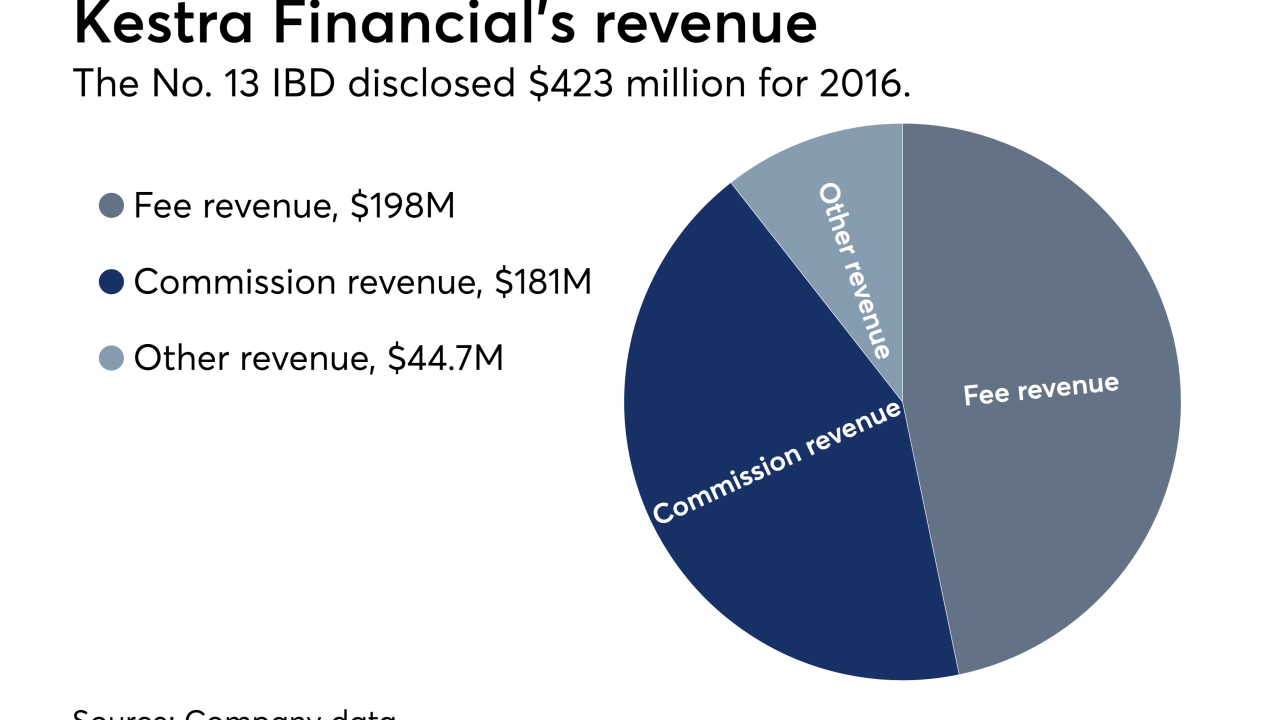

The No. 13 IBD has added 183 advisors through its recruiting efforts in the past two years.

March 19 -

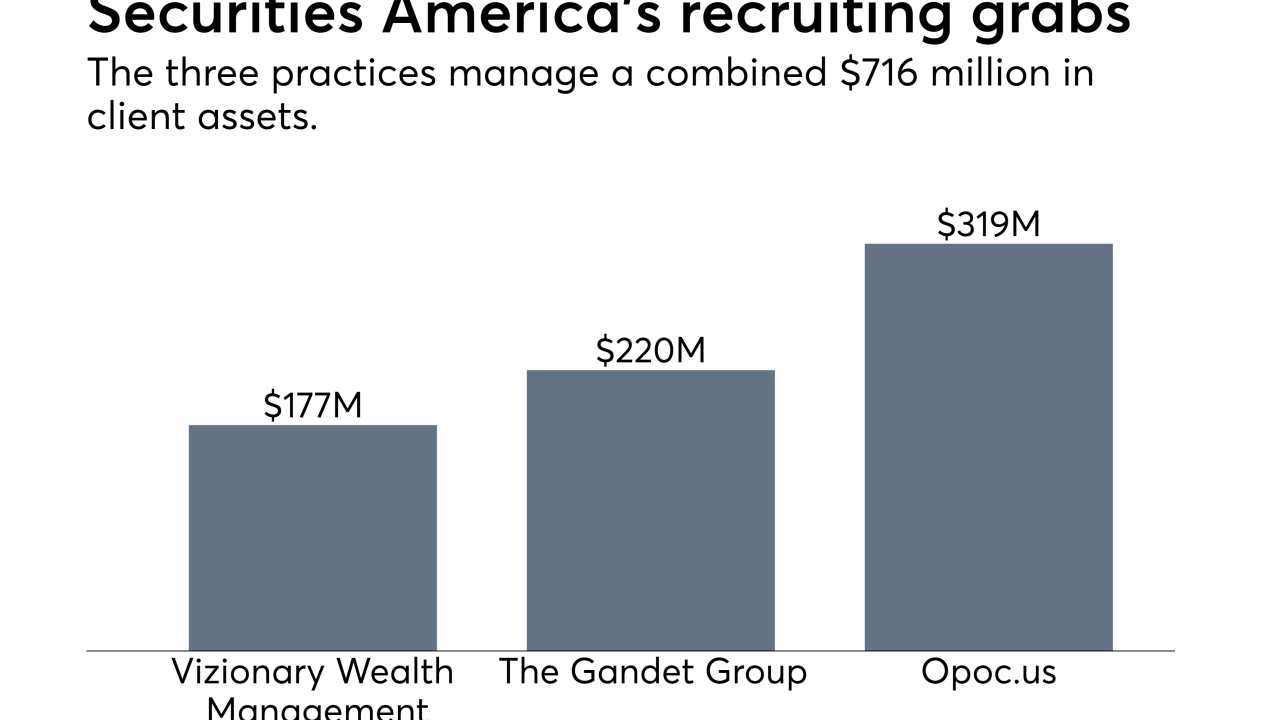

The newly merged practice became the seventh largest at the No. 18 IBD.

March 15 -

Pinnacle Investments tapped Ami Forte despite her ongoing legal struggles with her former firm and Home Shopping Network founder Roy Speer’s estate.

March 15 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

ACG Wealth’s affiliated IBD has also added teams from LPL and Merrill Lynch. Its CEO says the firm is just getting started.

March 12 -

Two Securities Service Network advisors have purchased 15 firms over a decade, and they plan to buy several more this year.

March 8 -

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2 -

CEO Bob Oros says the firm is focusing on recruiting more experienced advisors, among other changes at the No. 19 IBD.

March 1 -

Funds managed by Marco “Mick” Hellman sold most of their holdings, while CEO Dan Arnold received options worth $5 million.

February 28