Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

Teams managing $7.5 billion in client assets flocked to Financial Advocates through referrals from other reps who had previously moved to the firm.

October 13 -

FP’s annual list recognizes the accomplishments of an elite cohort of young wirehouse and regional advisors.

October 12 -

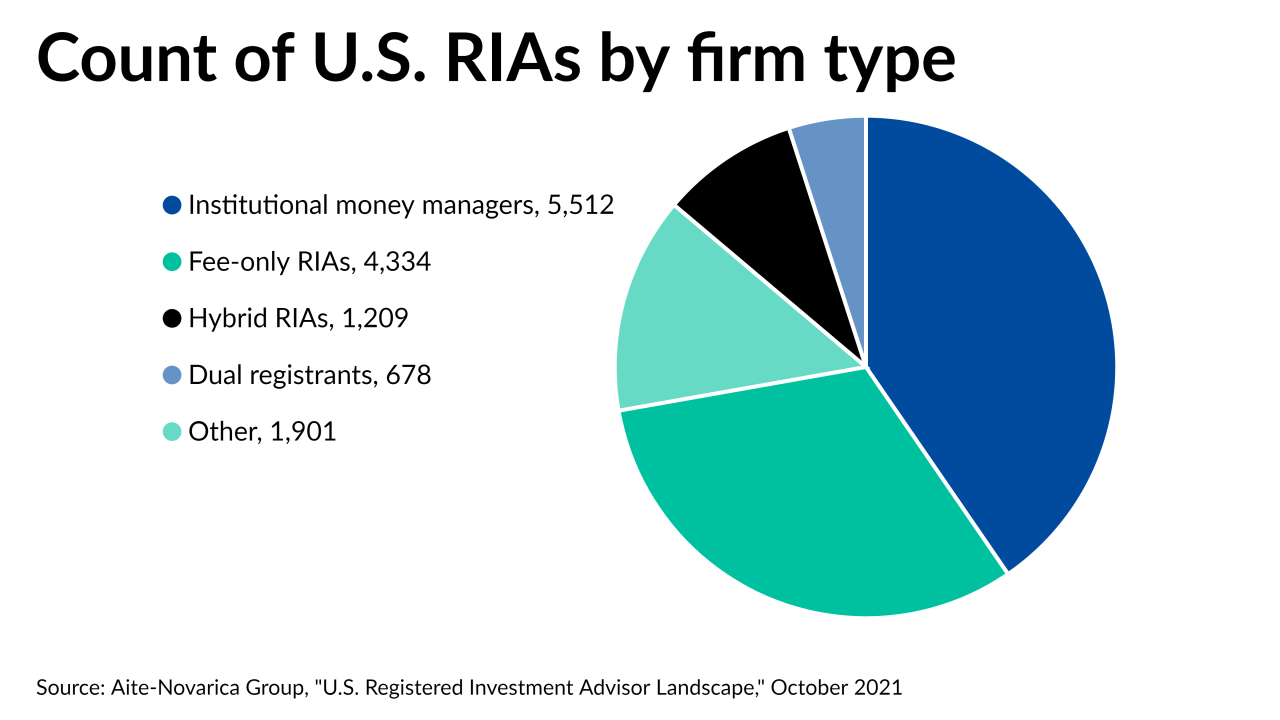

New research compiled by consulting firm Aite-Novarica Group reveals how dually-registered and fee-only firms diverge in business model and clientele.

October 7 -

The former 13-year veteran of Wells Fargo’s IBD has ambitious plans for the firm’s expansion beyond its traditional market

October 6 -

The PE-backed consolidators picked up firms with a combined $6.7 billion in client assets as high valuations and expansion plans bring sellers to the table.

October 5 -

An ex-executive with a firm acquired by the network three years earlier will lead FSC Securities as it seeks to grow in a competitive industry.

October 5 -

Here’s what one advisory firm found were the most common financial planning questions among a historically underserved group.

October 4 -

Sean Kaligh dropped Wells Fargo for LPL, as more planners leave wirehouses during the pandemic.

October 4 -

A firm with no website and a generic name has served internet pioneers Pierre Omidyar and Jerry Yang for decades.

September 29 -

Berman Capital is the latest big seller to find a larger partner as equity values, tax fears and other factors push deal volume and size even higher in 2021.

September 28 -

Higher internal expenses in mutual fund share classes came with much lower overall advisory fees in wrap accounts, the firm argues.

September 28 -

The RIA consolidator poached the founding advisor’s practice only about a year after the enterprise closed its BD in its prior move.

September 27 -

A lack of uniform classifications and an identity crisis at the heart of the fragmented industry makes it a thorny task.

September 27 -

Some of the industry's largest firms and toughest critics weighed in on the vexing fragmentation that’s growing alongside the trillions in AUM.

September 27 -

The Catholic charitable society’s new proprietary models join Quaker and Lutheran-rooted investing products and services at the industry’s intersection with religion.

September 25 -

After topping $1 billion in client assets, Crewe Advisors completed the first step in its growth strategy.

September 24 -

The distinction between the two concepts lies in advocacy and leadership, said executives from Morgan Stanley, J.P. Morgan, Citi and Stifel.

September 23 -

The practice led by two brothers is the 10th to join Dynasty’s platform in 2021, as more wirehouse teams go independent.

September 23 - A pair of financial advisors whose practice merged with Mercer Advisors reflect on how it’s changed their day-to-day and share advice for other planners.Sponsored by Fidelity Investments

-

Morgan Stanley, Raymond James, Charles Schwab and Truist aim to fuel long-term shifts in advisor recruitment and retention through a series of new programs.

September 22