Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

The growing number of commission-free planners at IBDs doesn't necessarily fit the industry’s accepted definition, or its traditional categories.

January 11 -

Private Advisor Group is “cautiously optimistic” it could recruit a dozen teams with about $500 million in AUM each this year, an executive says.

January 10 -

The LearnVest founder left the insurance giant and No. 6 IBD, in her latest surprise move after the firm shut down the startup’s online planning services.

January 9 -

The deal for Next Financial would grow the firm's portfolio in the sector to nearly 2,000 reps.

January 8 -

The No. 1 IBD is marshaling transition assistance, technology and other resources toward recruiting success across the firm and its bank channel.

January 4 -

Investigators say the onetime FiNet branch manager preyed on “particularly vulnerable” clients, including several with dementia.

January 2 -

The IBD network’s parent repurchased the majority of Dr. Phillip Frost’s shares just before the SEC filed proposed settlements of its pump-and-dump case.

December 31 -

In an internal memo, CEO James Poer pledges that any change to the firm’s capital structure "would be made with your business in mind first."

December 21 -

“I don’t want to call a helpline, I want a partnership,” the advisor says of her move to the firm, which expects to hit record gross recruited production.

December 21 -

The organization of CFP volunteers and other nonprofits are ramping up services and recognition for advisors who do good deeds.

December 20 -

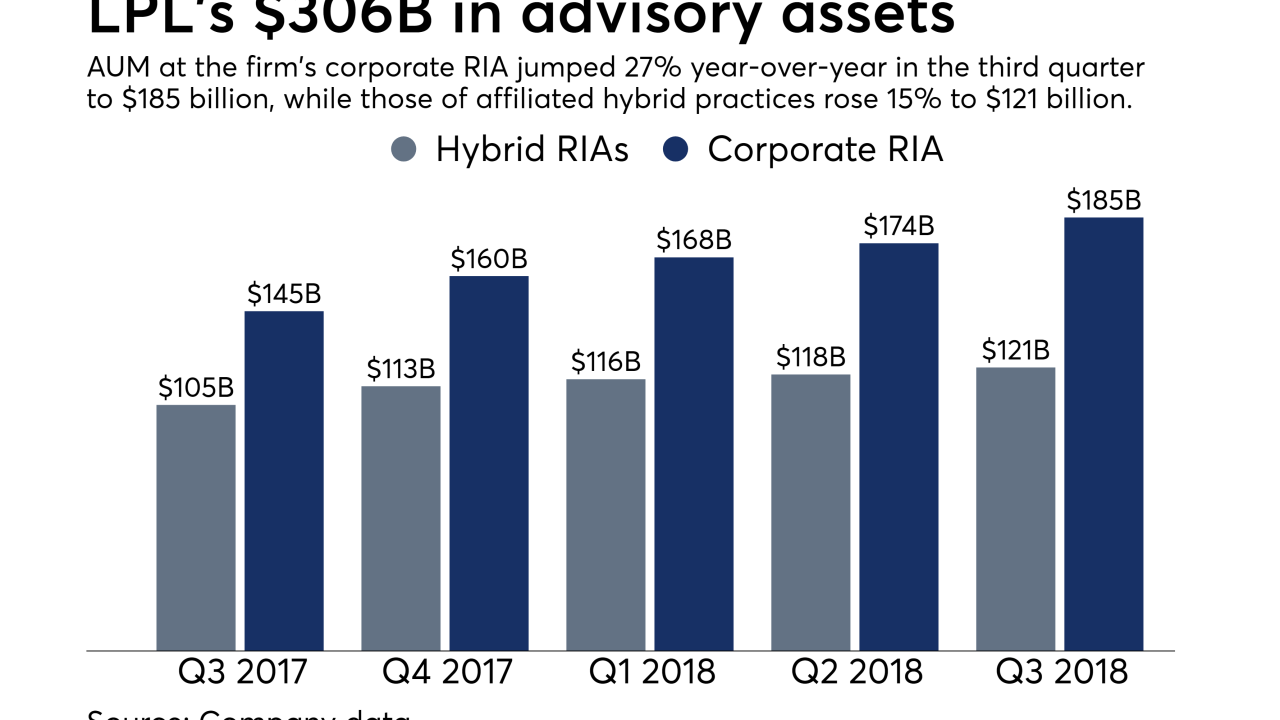

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

Former Securities America rep Hector May carried out a 20-year scam through his outside RIA, according to prosecutors

December 17 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

The IBD and its subsidiaries’ 2,300 advisors appear to be facing a sale by its parent, with bidding reported to be starting as soon as next week.

December 14 -

Independent Advisor Alliance and Private Advisor Group — two of the firm’s largest hybrid RIAs — say they’ve added billions in clients assets from IFP.

December 13 -

Macroeconomic trends and matters of convenience will move advisors, assets and markets next year in the ever-changing wealth management space.

December 11 -

Wealth management transaction activity will reach a record level for the sixth straight year in 2018, according to one forecast.

December 7 -

The rarely dinged firm joined peers grappling with two issues: mutual fund fees and supervision of advisors who've been sanctioned multiple times.

December 6 -

The representative had already been permitted to resign and suspended by state regulators, but the firm lost its case for additional damages.

December 4 -

AdvisoryWorld will operate as an independent subsidiary under the No. 1 IBD while adding new offerings for its 30,000 advisor and institutional clients.

December 3