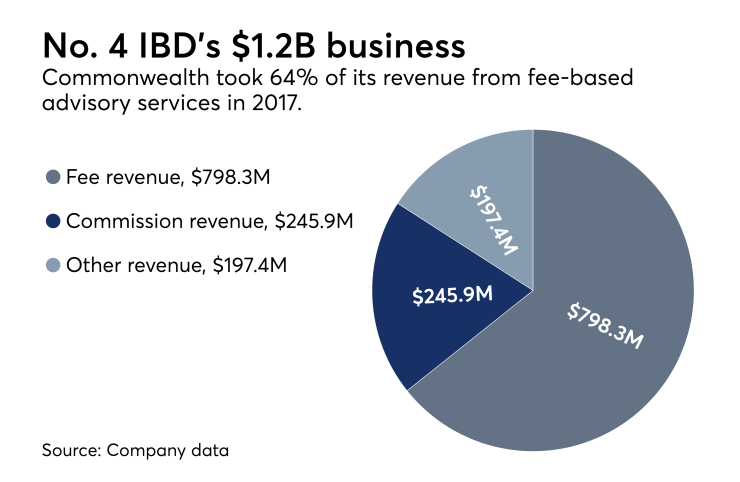

Commonwealth Financial Network lost two client arbitration cases and agreed to pay $888,000 restitution while accepting a censure from FINRA — in a three-week span. The firm had previously gone

Commonwealth disgorged the payment to 688 retirement plan and charitable organization accounts it “disadvantaged” over eight years by selling them mutual fund share classes without sales-charge waivers, the regulator said last month. FINRA has hit three dozen firms with similar cases ending in settlements.

The case and the arbitration decisions show how the firm has — like its more frequently dinged peers — been grappling in recent years with issues relating to mutual fund fees and supervision of advisors with multiple disclosures. Private arbitrations make the nature of the cases difficult to discern, though.

Commonwealth advisor James A. King III of Austin Financial Management lists three judgments and one settlement for a combined $841,000

The clients won the decisions from Charlotte, North Carolina-based panels after accusing King and the firm of fraud, unsuitability, negligence, failure to supervise and other claims in filings on the same day in May 2017. The cases focus on IRA rollovers of the clients’ stock holdings in the retailer Lowe’s.

Commonwealth rather than the advisor paid an earlier $580,000 award to a different client represented by the same attorney and argued he “did not act improperly,” King commented on BrokerCheck. The firm has also said it doesn’t recruit or retain any advisors who need heightened supervision and therefore doesn’t use it.

However, King’s six client-claim disclosures and one dismissed case place him “in a very small percentage of brokers” who have that many, points out Christine Lazaro, president of the Public Investors Arbitration Bar Association.

Share class selection “shouldn’t be that difficult for a firm to supervise,” but the number of firms involved in such cases shows “why higher standards really are necessary,” she says. FINRA cited no relevant disciplinary history for Commonwealth in the settlement, despite its size and time in business.

“Firms aren’t going to be perfect, and I think the important thing is that, if something does go wrong, that they make it right for investors,” Lazaro says. “Investors really do trust their investment professional, so it’s important that the firms earn that trust.”

-

The regulator is living up to its promise to overhaul exams and engage more — and one potential rule in the works would be “monumental," according to the IBD.

November 8 -

Commission officials put the industry on notice about self-reporting: financial advisors must comply or face harsh punishments.

February 28 -

The commission's frequently asked questions come six weeks ahead of the deadline to self-report placing clients in high-fee share classes.

May 2

Factors including low interest rates may have contributed to success.

King didn’t respond to requests for comment at his Greensboro-based practice. Representatives for Commonwealth declined to discuss King’s status or the arbitration cases. The firm did say it was pleased to have the FINRA mutual-fund case resolved.

“Upon discovering the issue, we took immediate corrective action, initiating our own investigation and paying restitution to clients prior to FINRA’s intervention,” Chief Compliance Officer Paul Tolley said in a statement.

Representatives for FINRA also declined to discuss King’s record as shown by the arbitration disclosures, instead referring questions about his individual case to a

“Firms must do their part by, among other steps, reviewing their hiring practices, monitoring their brokers, improving supervisory systems, and investigating red flags suggestive of misconduct,” Cook said.

Jonathan E. Neuman, the attorney who has represented clients in all of the completed arbitration cases involving King and Commonwealth, declined to discuss the most recent decisions. A former business partner of King’s, fellow Commonwealth advisor Suzanne Banzet, didn’t reply to requests for comment.

FINRA guidelines required her to list arbitration cases involving King on her BrokerCheck record, she wrote in a comment, even though the filings didn’t name her as a respondent. Neither King nor Banzet has any enforcement disclosures, and neither has any disciplinary history with the CFP Board.

Clients of King’s pressed the first case in 2013 against Commonwealth, winning the highest payout of $580,000 in

The second case ended in a $4,000 settlement and

Client Robert Cline, however, received an award for $128,000 in October for damages, costs and attorney fees, with King held “solely liable” for the payouts. Weeks later, client Kathy Walters got an award for $129,000 for damages, interests and costs, though King and the firm are “jointly” liable.

King “encouraged [Cline] to retire early and promised inflated rate of return,” according to the allegations listed about the case on BrokerCheck. Commonwealth denied both the clients’ allegations, and the awards fell far below their combined base-level requests of nearly $1.1 million.

Arbitrators rejected the 2007 claims of a client who accused King of unearned commissions, according to BrokerCheck. Another panel severed a January 2017 claim seeking $2.25 million and required the counsel to file new cases for other clients. King’s most recent disclosure is a pending claim for $640,000.

The firm recognized King as a “business experience” advisor in the top 49% of its reps in 2017,

“Between the resources heightened supervision requires and the risk/reward of the advisor, we’ve never once considered an exception to that policy,” Rooney said. “Commonwealth would prefer slower growth over a compromised community.”

The self-regulatory organization cited the firm for “extraordinary cooperation” in the mutual fund case, such as starting an internal investigation before FINRA’s probe. Hundreds of clients eligible for discounts had paid front-end or back-end sales charges or higher fees and expenses,

Share-class cases “really do stem from conflict of interest issues,” Lazaro says. “The broker and the brokerage firm are going to get paid less, depending on the share-class chosen and whether or not the breakpoints are utilized appropriately.”

Commonwealth neither admitted nor denied the allegations as part of the settlement, which placed them in an expanding group of peers: The SEC and FINRA have sanctioned more than 50 firms over allegations relating to mutual-fund share classes in the past five years.

The SEC launched a program earlier this year

FINRA is still working on what it calls its mutual fund waiver sweep aimed at cases like Commonwealth’s. Spokeswoman Michelle Ong stated in August 2017 that 35 firms had