Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

The firm followed rival wirehouses that no longer share their exact number of brokers, which is a critical metric for industry recruiting trends.

April 17 -

The case offered the latest example of a serious prison term for financial exploitation of older adults — a problem experts say is even bigger than the sobering statistics.

April 13 -

CEO Jamie Price's team is considering a range of potential strategies that could represent significant changes to the private equity-backed firm.

April 12 -

Lehman & DeRafelo offers another example of a big RIA seeking a larger partner despite turbulent economic conditions and some signs of an M&A slowdown.

April 11 -

The firm will compete against a growing group of rivals, but its founders expect to attract a billion-dollar advisory firm by the end of the year.

April 10 -

The midsize wealth management firm with 250 advisors chose to be an independent subsidiary rather than folding into a private equity firm or an RIA aggregator.

April 10 -

A 20-year veteran advisor sold more than $7 million worth of investments pitched by an accused fraudster connected to his friend from Bible study, the regulator said.

April 6 -

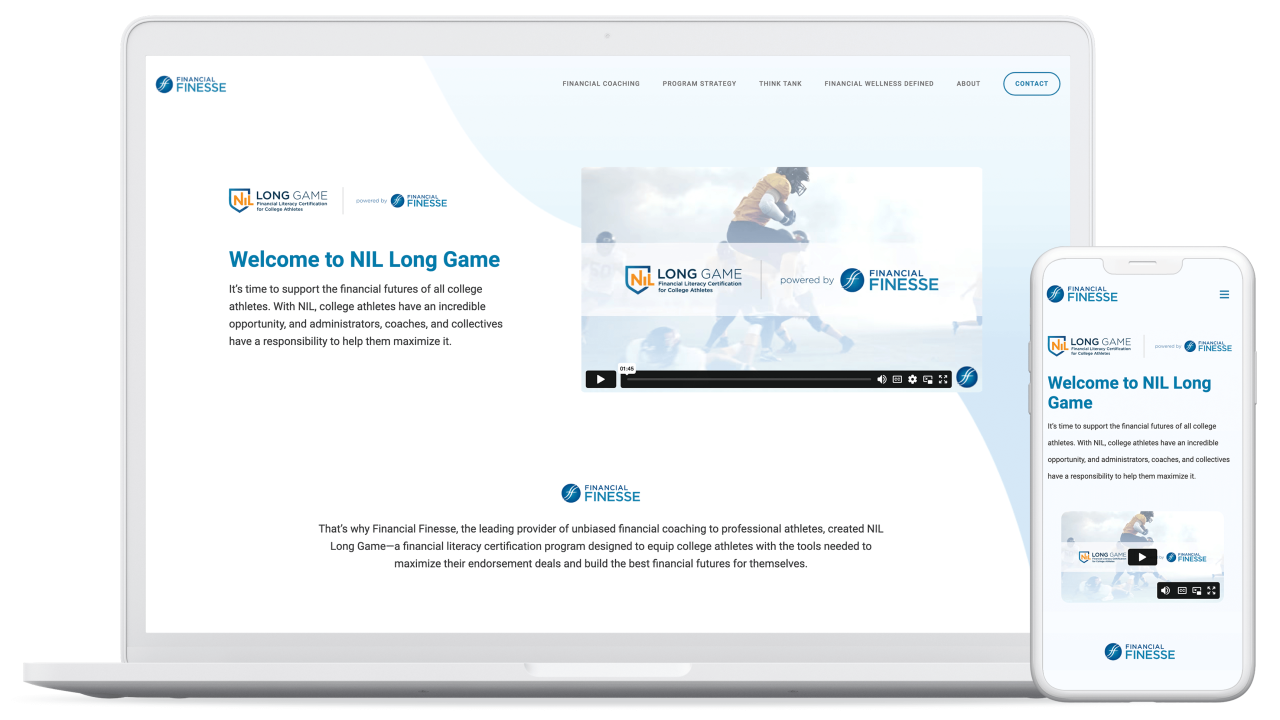

The program, offered by a financial wellness coaching service, joins a burgeoning patchwork of wealth management support systems for student-athletes.

April 5 -

Every score fell as investors gave wealth management firms ugly grades in a time of slumping stocks and bonds and fears of a recession.

April 4 -

The amount of massive advisory practices across the industry more than tripled in a decade, leaving firms like Equius Partners with scale and succession challenges.

April 3 -

As the big firms keep getting dramatically bigger, industry consultant Advisor Growth Strategies says smaller advisory practices should find scale or get a niche.

April 1 -

A Hornor, Townsend & Kent broker pitched "Future Income Payments" that turned out to be part of a $300 million scheme targeting veterans, investigators said.

March 30 -

The advisors left a firm called Regulus and aligned with AdvisorNet Financial as they seek to build a larger base of individual wealth and planning clients.

March 29 -

In the latest Independent Advisor Outlook survey from Charles Schwab, financial advisors shared the advantages and pitfalls of the industry's record RIA expansion.

March 29 -

He spoke at Future Proof after the firm unveiled its collaboration with Dynasty Financial Partners and a funding rounds that raised $80 million.

March 28 -

The independent firm told financial advisors that selling their own practices without a greenlight from the corporate office could draw FINRA scrutiny.

March 27 -

The firm launched a new service giving financial advisors more tools to guide clients through economic turbulence like the present moment.

March 24 -

Understandable expenses came out ahead of every other "want" among customers, displaying how transparent costs are an important differentiator for advisors.

March 24 -

The active ETF firm's managing partner talks about the potential for options-based strategies in times when stocks and bonds are plunging.

March 23 -

The SEC's case against a barred former broker shows why regulators and the industry often struggle to catch repeat offenders before they harm investors again.

March 23