Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

Nearly all the brokers who dropped their FINRA registration in the wake of tougher rules kept their insurance licenses, according to newly published research.

December 4 -

When a client's insurance needs change, the opportunity to sell their life policies to outside buyers should not be overlooked.

December 3 -

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Savant Wealth Management, Moneta Group Investment Advisors and EP Wealth Advisors lead a group of fee-only firms with headcounts well above their peers.

November 25 -

Experts say RIA owners often resist making themselves replaceable. But they'll have to choose between an internal or external deal someday.

November 24 -

This year the top three firms in FP's exclusive study of RIAs that do not do any commission business manage nearly $120 billion combined.

November 19 -

The printable PDF includes rankings based on the firms' AUM as well as statistics on each firm's employees, client accounts and financial advisors.

November 18 -

Fiduciary laws trace their roots to ancient times, but the terms of the Investment Company Act of 1940 and the Investment Advisers Act are still evolving today.

November 18 -

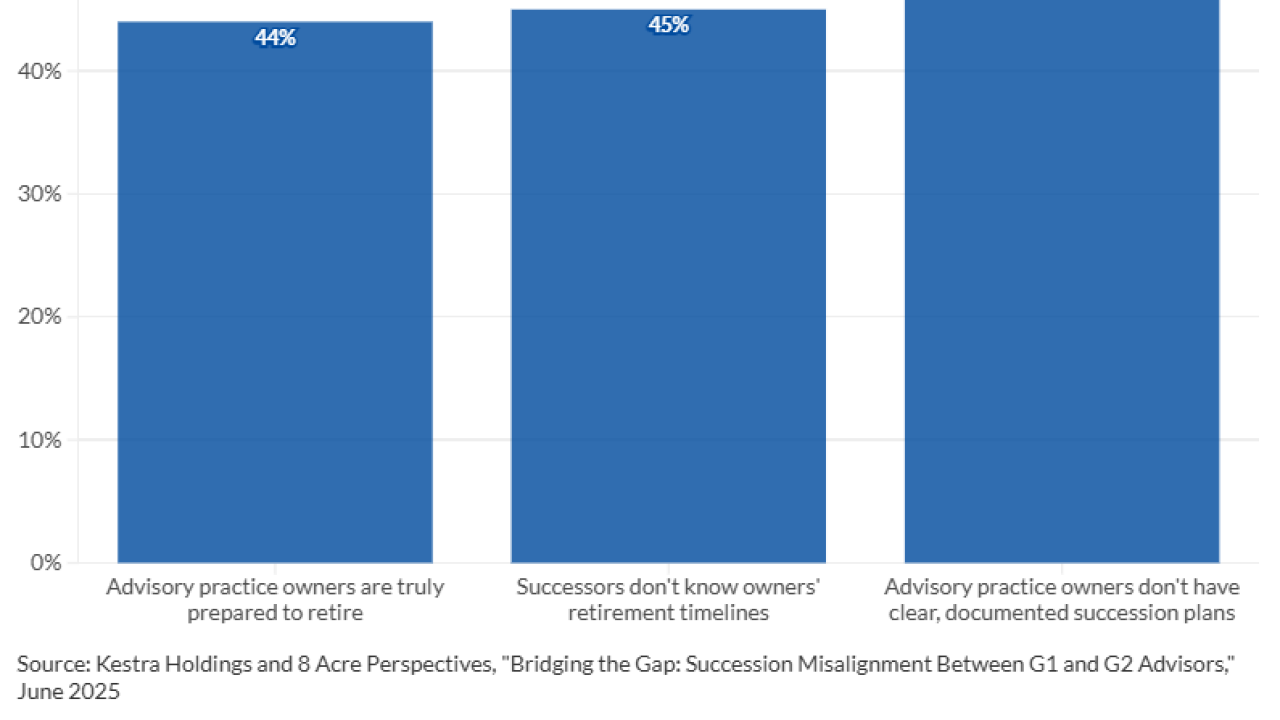

The implications to taxes, hiring and the very legacy of a financial advisor's career demand much more formal documentation than most RIAs have undertaken, experts say.

November 17 -

Financial therapist Rahkim Sabree wove his personal experiences into a detailed manual on a problem he and others say is often glossed over by the industry.

November 13 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

Minority transactions are increasingly appealing to sellers who are wary of giving up the full control of their firms. But experts say the deals do come with strings.

November 11 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

The Ensemble Practice's annual RIA compensation survey suggests that firms are paying a pretty penny for financial advisors but reaping healthy profits.

November 6 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

Deal structure, transition plans and dog and pony shows represent only a few of the thorny difficulties involved with branching into an acquisition strategy, experts say.

November 4 -

In an ever-expanding and constantly shifting profession marked by messy but important debates, can one of the field's most important organizations keep up with the times?

November 3 -

When an analyst asked about Fifth Third's $11 billion deal to buy rival Comerica, CEO Jim Cracchiolo mentioned the seller's Ameriprise "contract and agreements."

October 30