Earnings

Earnings

-

Expenses relating to recruiting and M&A rose at a faster clip than revenue, prompting one analyst to downgrade the company’s stock.

October 29 -

CEO Ron Kruszewski predicted its independent arm will grow the way the employee brokerage has since the firm hired its first financial advisor in 1997.

October 28 -

The wealth manager’s financial advisor headcount is rising, along with the productivity of their practices.

October 28 -

The bank's reliance on debt trading caused it to miss out on revenues its peers enjoyed.

October 27 -

Despite the continuing smaller financial advisor headcount at the wirehouse, it reeled in record profits and unveiled its latest plans for further expansion.

October 26 -

Though the Providence, Rhode Island, bank is in the midst of three deals, CEO Bruce Van Saun said it remains on the lookout for other nonbank purchases that could help boost fee income and generate cross-selling opportunities.

October 20 -

The brokerage now manages $7.61 trillion across its retail and RIA custody businesses.

October 18 -

Bank of America beat 3Q Wall Street forecasts as it moves to ‘pre-pandemic pace.’

October 15 -

James Gorman says the wealth manager is seeing much better retention and recruiting due to its “multiple channels of growth” after several acquisitions.

October 14 -

The higher number of brokers in two of the megabank’s largest business segments reeled in higher client assets based on equity values and inflows.

October 13 -

After unveiling another deal for an RIA with billions in AUM, the firm is also revamping its CRM system with Salesforce as its vendor.

August 11 -

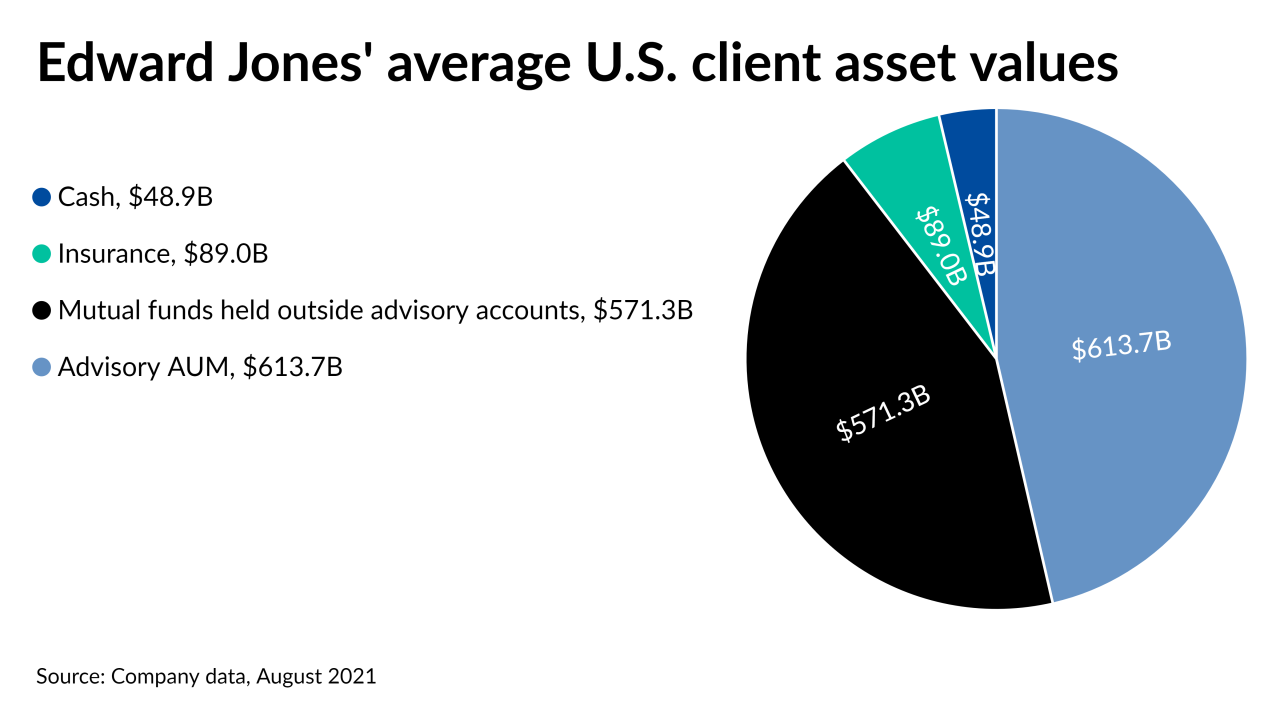

Rising equity values and incoming assets drove higher earnings despite the lower number of financial advisors at one of the largest wealth managers.

August 9 -

The wealth manager has opened more ways to affiliate with the firm by starting to tap M&A deals with a sizeable pipeline for more in the future.

August 5 -

The TAMP saw record quarterly inflows under new CEO Natalie Wolfsen, who has plans to make a splash in wealthtech M&A.

August 2 -

Despite fewer incoming advisors, CEO Ron Kruszewski says the company’s pipeline is strong and extending to the independent channel.

August 2 -

The nation’s largest independent broker-dealer aims to boost expansion even more, and it’s not ruling out launching its own bank.

July 30 -

Record-level asset management fees and investment banking revenues were credited with the increase in net revenue.

July 29 -

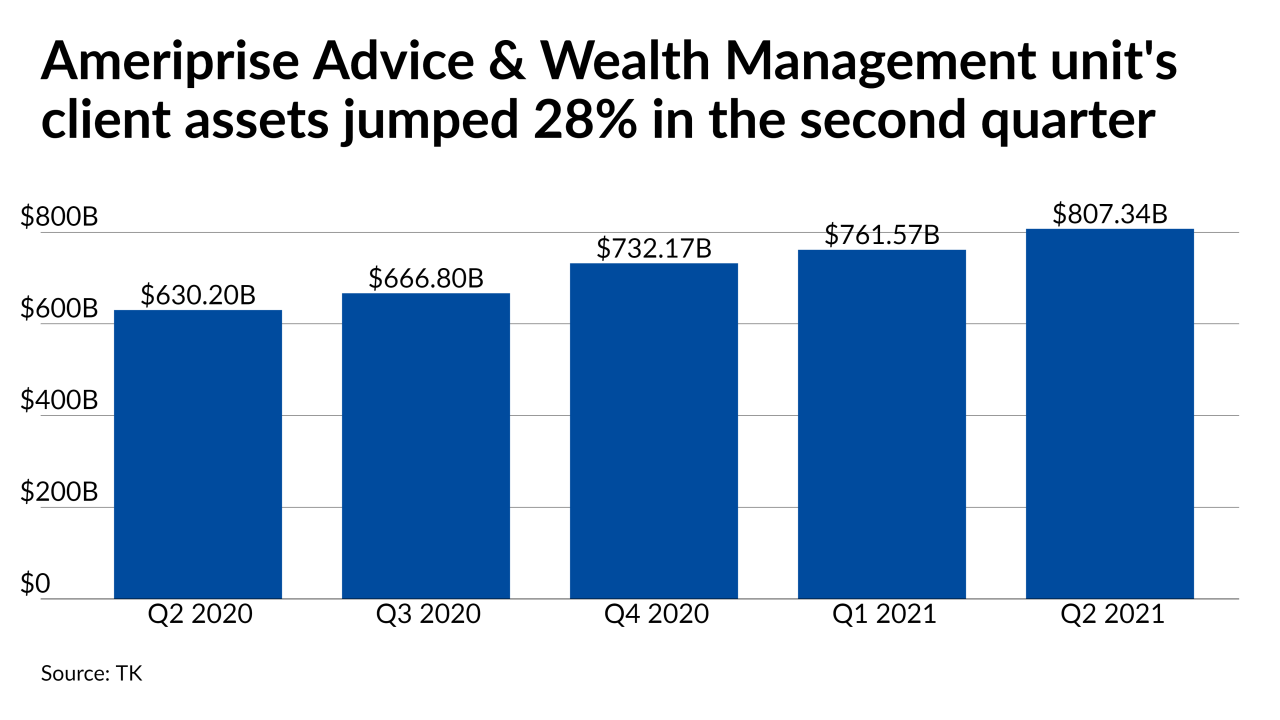

CEO Jim Cracchiolo acknowledged that the firm attracted fewer experienced reps in the second quarter, even as its headcount ticked up by 2%.

July 27 -

A new high in loan volume and a notable influx of advisory AUM drove the wirehouse’s business to more than half a billion dollars in second-quarter net income.

July 20 -

CEO James Gorman says the company has created something new by adding Solium and E-Trade to its existing force of financial advisors.

July 16