-

An extension from the agency comes amid warnings from brokerages that breaking out stock and bond analysis would threaten their own research businesses.

November 6 -

The agency floats proposal to expand regulations to accommodate new online channels, allow for third-party ratings and testimonials.

November 5 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1 -

In a little-noticed rule change, mutual funds no longer disclose their shrinking BD commission load-sharing payments.

October 16 -

The change, the regulator says, will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors.

October 10 -

A patented structure allows ETFs to report once a quarter in an effort to protect their intellectual property.

October 1 -

Wild price swings that have exceeded double-digit percentages in a single day have spurred the regulator to keep a close eye on volatility.

October 1 -

Charlie Scharf’s most immediate priorities include mending fences with regulators and getting the bank out from under a Fed-imposed asset cap.

September 27 -

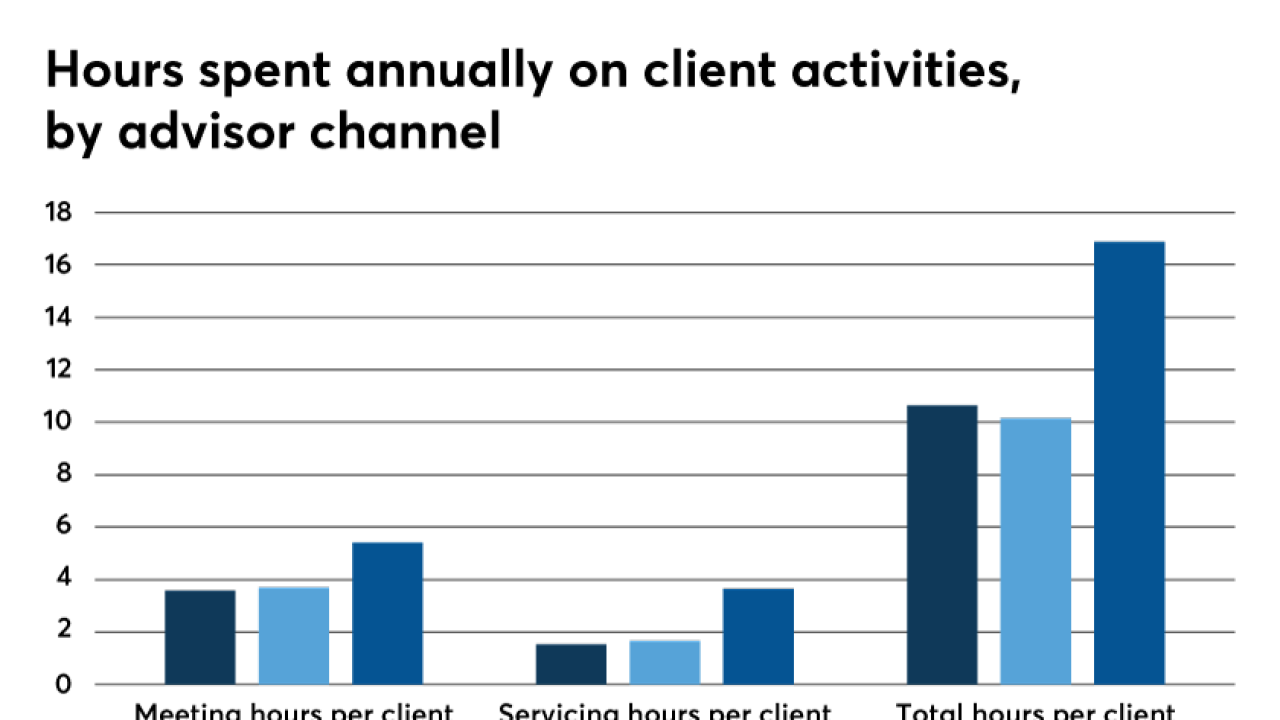

Alternative compensation structures may provide more consumer protection, and drive higher client satisfaction.

September 16 -

The rule unfairly gives brokers a leg up in the marketplace, harming the network’s 1,000 independent advisors, the firm claims.

September 10 -

After an investigation into the self-disclosure of regulatory incidents, the board is looking to strengthen the review process and clear up public confusion.

September 9 -

The first-of-its-kind product is cleared and features the same creation-and-redemption process common with traditional offerings.

September 3 -

Due to a 2010 FINRA rule change the answer is — with difficulty.

August 30 -

While the agency has publicly detailed key focus areas, some planners still don't know how it evaluates firms.

August 28 -

The regulator postponed until October a ruling on whether listing rules can change to allow two cryptocurrency funds to start trading.

August 13 -

Reports of the death of fiduciary differentiation have been greatly exaggerated, contends fiduciary advocate Knut Rostad.

August 12Institute for the Fiduciary Standard -

Prosecutors said Robert Shapiro used investor money for his $6.7 million home and $3.1 million for chartering planes and for personal travel.

August 9 -

The agency wants to hire a reputation management expert to burnish its image as it faces social media attacks.

July 31 -

Though designed to raise standards for broker-dealers, the SEC’s 564-page rule sent ripples throughout the advisory industry.

July 29 -

The commission warns practices to tighten up supervision and ensure accurate disclosures.

July 24