-

Many of the trades should have triggered market manipulation concerns because they involved companies that were barely operating but engaging heavily in promotional activity, the SEC says.

April 5 -

David Olson, an advisor of nearly 30 years, worked at Morgan Stanley until his termination in 2016.

April 4 -

In addition to winning a $25,000 award, ex-J.P. Morgan rep Mihail Naumovski was able to expunge erroneous information on his Form U5 that he violated investment-related regulations.

April 4 -

The firm falsely claimed on his Form U5 that he deliberately changed a customer’s address from California to New Hampshire to facilitate the sale of an annuity, the broker alleged.

April 3 -

A former spiritual advisor to presidents George W. Bush and Barack Obama plans to turn himself in as his attorney vows innocence.

April 2 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

As the financial planning industry nears a fee-only, fiduciary world, independent broker-dealers will face some important choices about their future business models.

April 2 Financial Planning

Financial Planning -

She'll now be responsible for supervisory operations at one of the largest firms she once helped regulate.

March 29 -

The regional BD failed to properly document its own investigations in the matter, and couldn't answer some SEC questions about who knew what and when, the regulator says.

March 27 -

National Financial Services accused the brokers' former IBD of breach of contract in a case displaying the complexities of such moves.

March 27 -

The broker also purportedly neglected to disclose an outside real estate business to BBVA, FINRA said.

March 27 -

The accusations shed light on the massive back-office systems maintained by regulators and the difficulty of keeping the sensitive information in them private.

March 27 -

The regulator moved to eliminate a $400 fee for “explained decisions.”

March 22 -

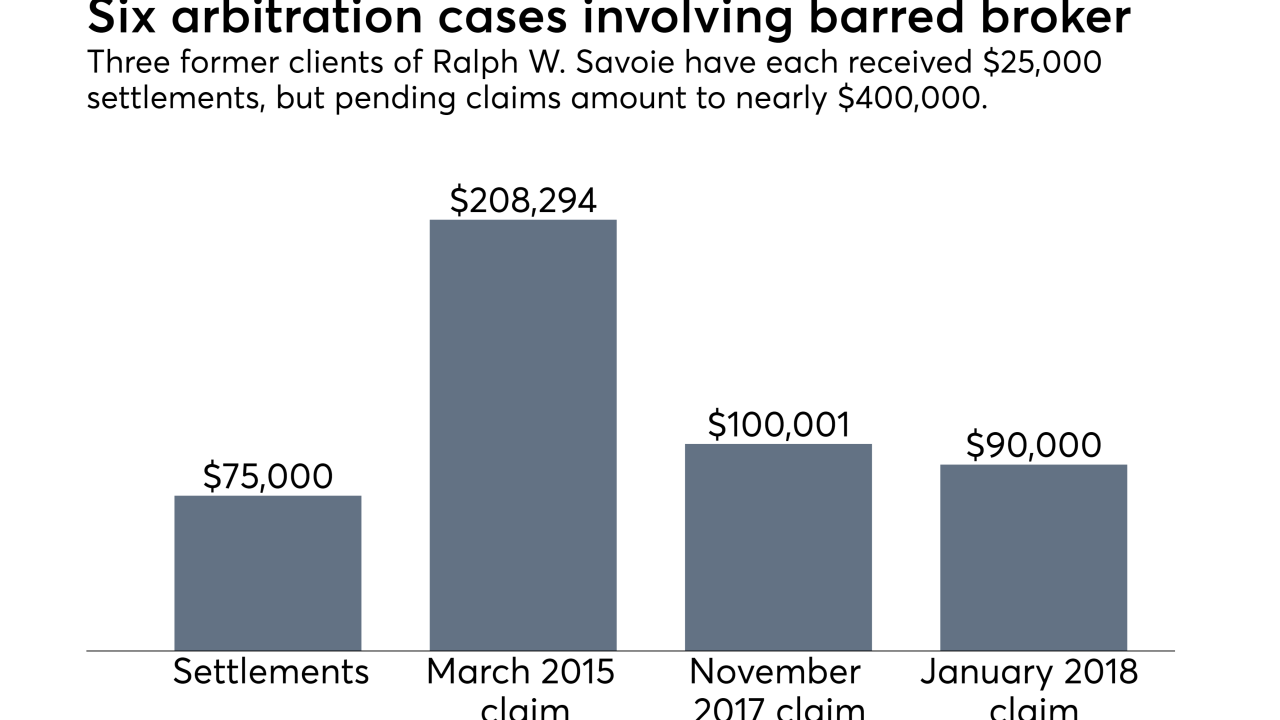

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

The trade group cautions that the SEC could outsource advisor oversight due to low examination rates.

March 20 -

Ross Gerber says he left the firm to avoid its strict oversight of his press interviews and social media.

March 19 -

While some are mainstays, there are a few new ones to add to the list this year.

March 16 -

Investors were bilked out of approximately $611,000, say federal prosecutors.

March 15 -

Fearing the broker would leave, Citi distorted incidents he had with two colleagues in order to fire him and take his $200 million book of business, the broker’s lawyer says.

March 15 -

FINRA accused the advisor of unlawfully "structuring" a total of $77,560 by depositing cash into his bank accounts in amounts just below the $10,000 reporting threshold.

March 12