-

More wealth management pros are joining mastermind groups, driven by the growing realization that the isolation that comes with running a business can hold back the business’s success.

March 1 CEG Worldwide

CEG Worldwide -

The No. 1 IBD is pitching advisors on the merits of its offerings — but rivals have also added major teams from its ranks.

February 22 -

The firm adds a second $1B RIA - and its family office.

February 21 -

The CEO said his decision to resign followed a physician’s recommendation in connection with an undisclosed medical problem.

February 19 -

The hybrid RIA wants to reach $10 billion in assets within four years.

February 15 -

-

The No. 1 IBD is reaping the benefits of learning the lesson that it “can never move away from the advisor,” according to its head of business development.

February 11 -

-

Securities Service Network is pitching advisors on its tax offerings, access to management and parent-firm resources.

February 8 -

Nine banks agreed to be sold to credit unions last year. Some industry observers believe that number could double this year.

February 8 -

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

The past year brought major changes to the IBD network, including the sale of its majority stake and a structural reorganization.

February 5 -

The robo advisor scouted several cities for a second location apart from its New York City headquarters.

January 31 -

Some owners are reluctant to give away an equity stake. Here is one solution.

January 30Momentum Advisors -

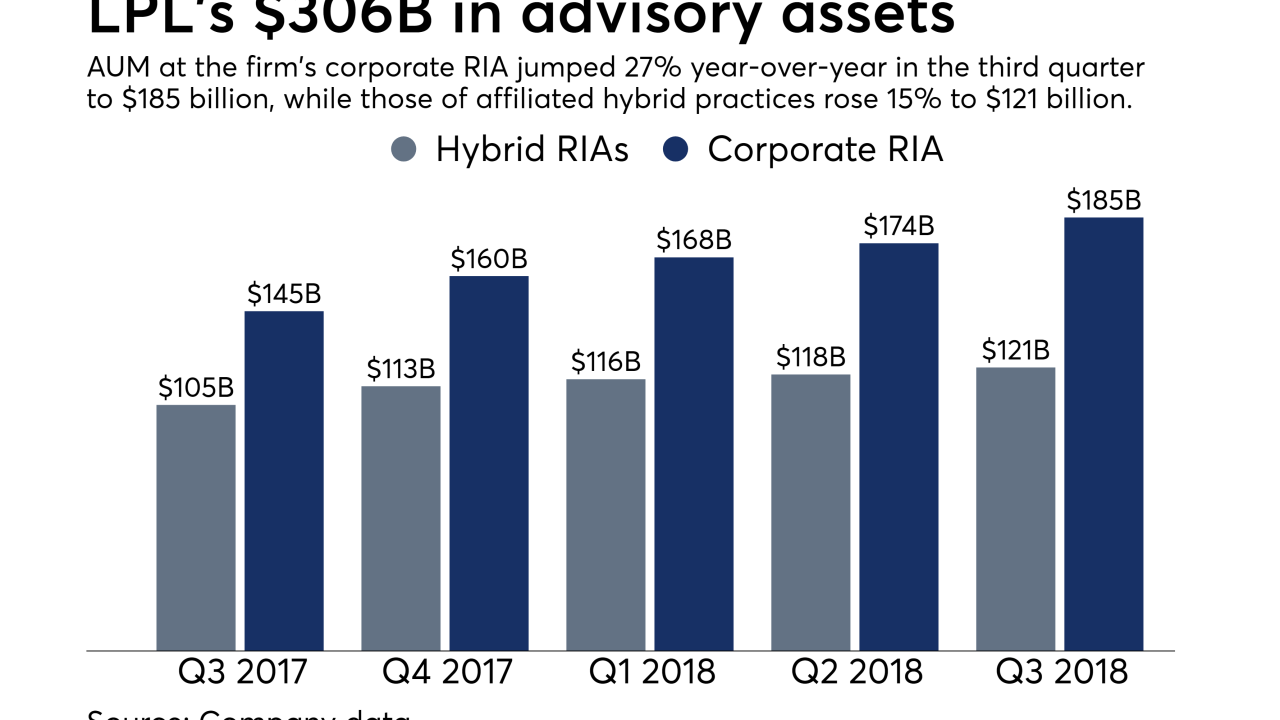

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

When they get jittery about stock swings, their worries create a huge opportunity for advisers. Here are actions to take right away.

December 14 -

The new strategy may reflect downward pressure around planning fees.

December 5 -

Executives say valuing friendliness alongside other factors is helping to drive a record $66 million in incoming production this year.

November 28 -

The need for scale is forcing a reassessment of M&A strategy.

November 28