-

The two advisors generated about $1.5 million in annual revenue, according to the No. 3 IBD.

March 13 -

The deal is only the first step in a major growth plan, according to the acquiring firm’s founder.

March 13 -

ACG Wealth’s affiliated IBD has also added teams from LPL and Merrill Lynch. Its CEO says the firm is just getting started.

March 12 -

The math works: Banks get a boost to their growth plans, while independent advisors get one more option for their succession planning.

March 9 -

Two Securities Service Network advisors have purchased 15 firms over a decade, and they plan to buy several more this year.

March 8 -

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

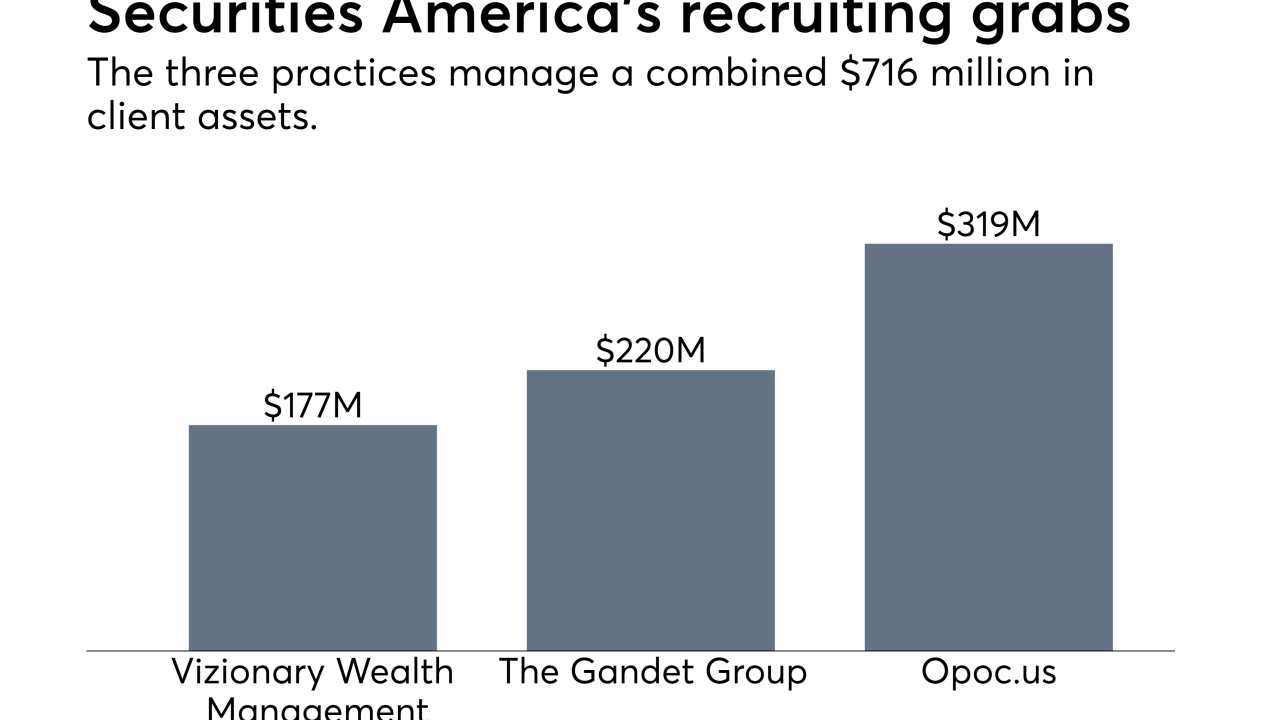

The No. 9 IBD has emerged as one of the major players in a tough recruiting fight after the massive acquisition.

March 7 -

CEO Bob Oros says the firm is focusing on recruiting more experienced advisors, among other changes at the No. 19 IBD.

March 1 -

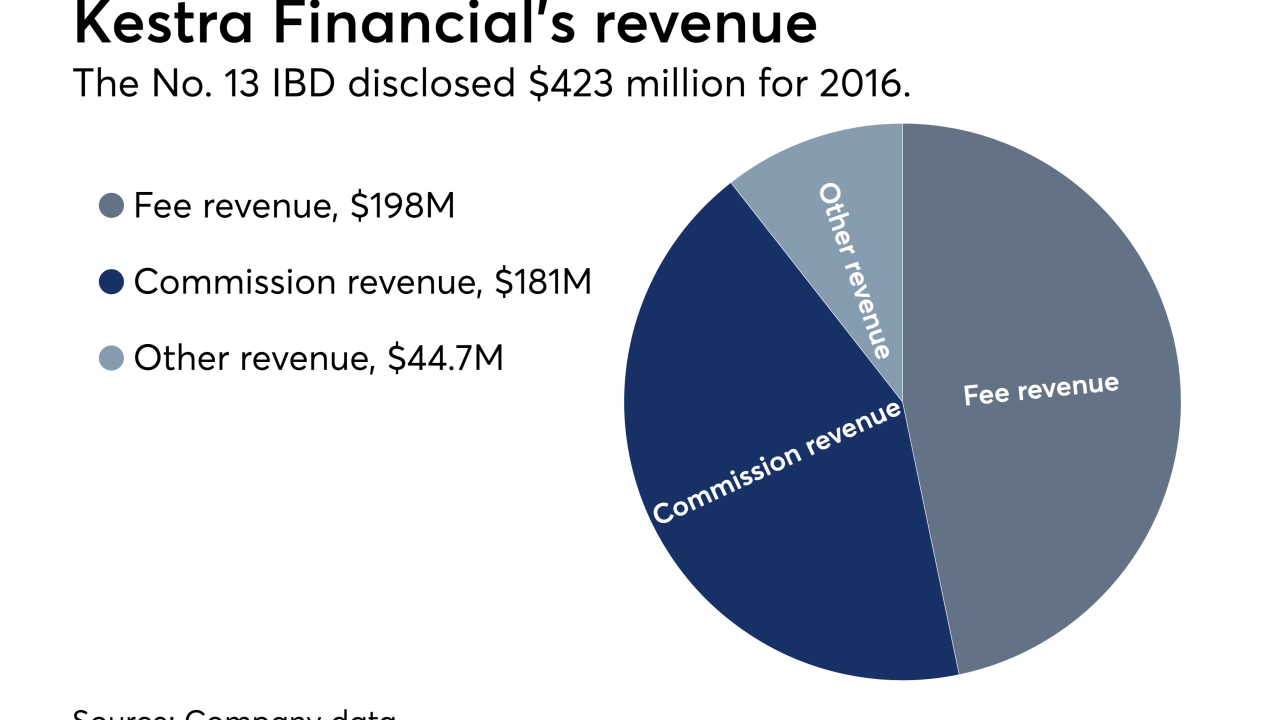

The No. 13 IBD’s hybrid RIA subsidiary also unveiled the results of its record recruiting push.

March 1 -

The IBD network has retained Goldman Sachs for a structural review that could have major implications.

February 26 -

An advisor who is a former ballplayer set ambitious goals for 2021 with an alternate take on the hybrid strategy.

February 22 -

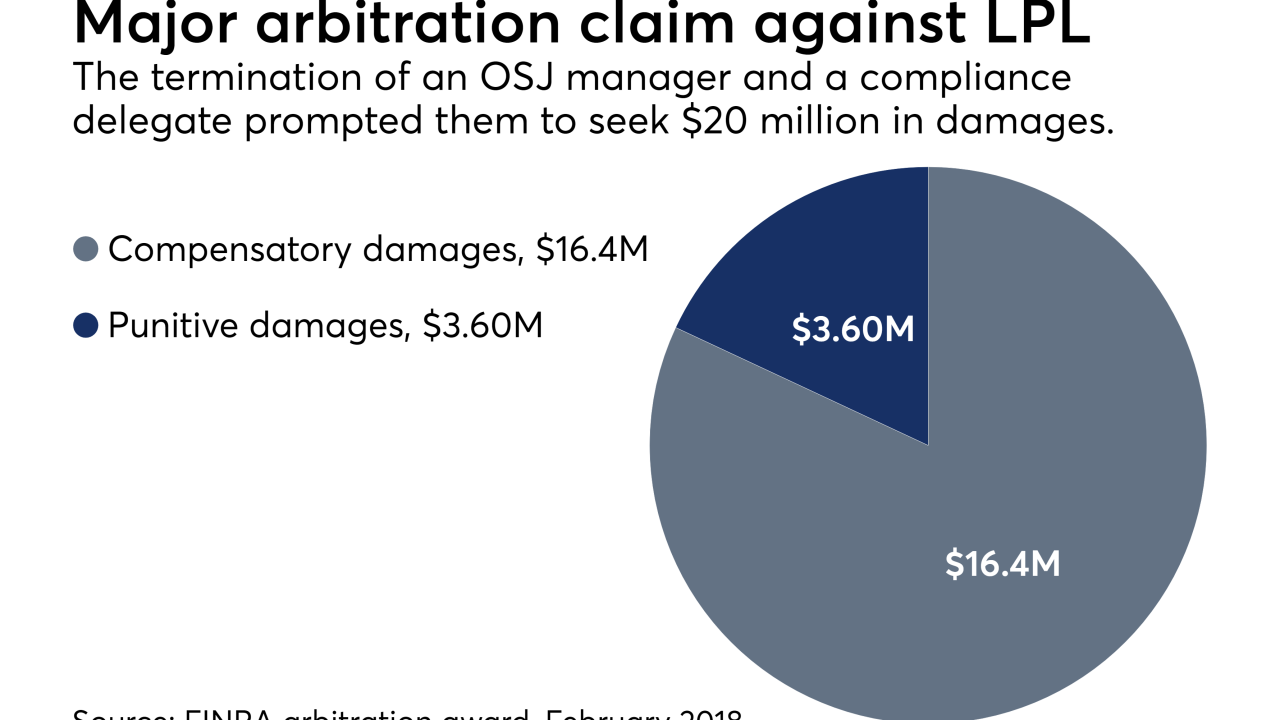

A FINRA arbitration panel concluded that the No. 1 IBD made false and defamatory statements in its U5 filings.

February 20 -

The CEO of the firm’s parent says it expects to trim hundreds more advisors from its ranks over coming months.

February 20 -

The high-net-worth and ultrahigh-net-worth segments are growing globally “faster than we can grow advisors to cover them.”

February 16 -

Artificial intelligence, digital privacy, health care and geopolitics will impact clients in "deeply personal" ways in the next decade. For advisors, that’s a huge opportunity.

February 16Schwab Advisor Services -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

Don’t worry about technology replacing advisors. On the contrary, use it to help fix the advisor shortage.

February 13

-

Private Advisor Group reported impressive growth even as other practices of its kind have left the No. 1 IBD.

February 12 -

Changes to how the group educates advisors is just one of the many transformations in the offing.

February 11 -

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7