-

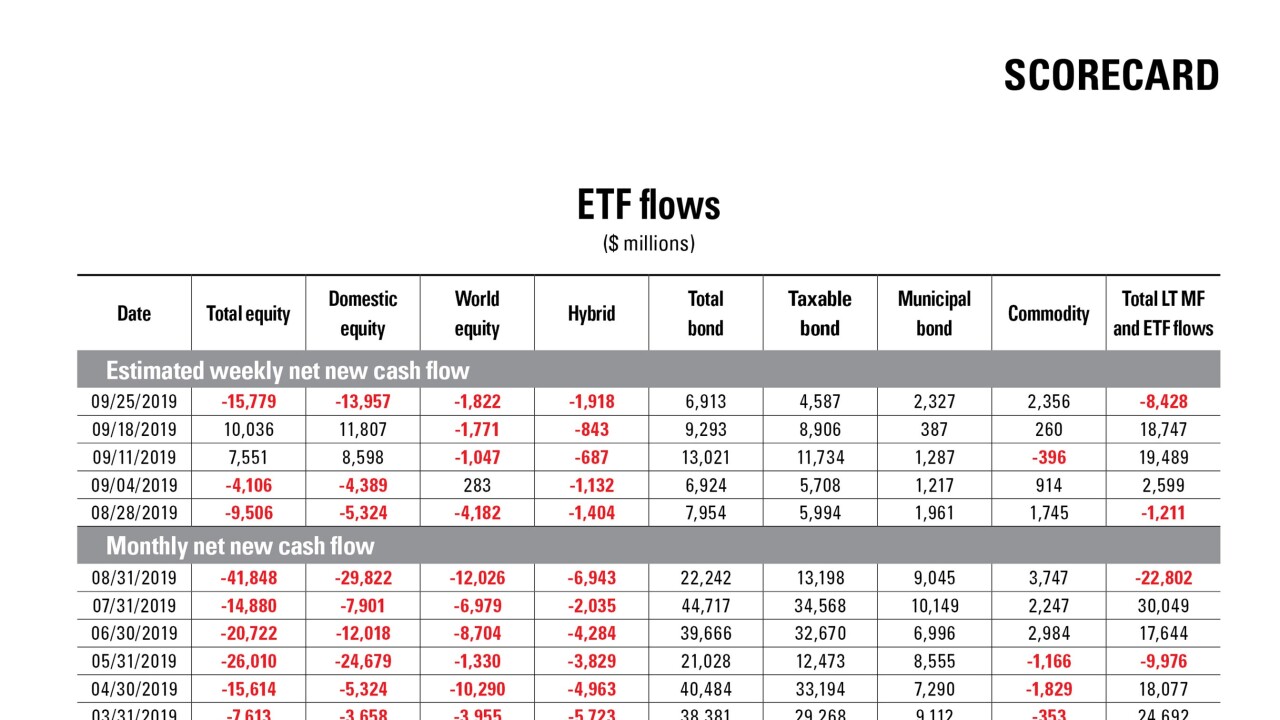

Data reported by the Investment Company Institute.

October 23 -

More than $1 trillion is invested in bond ETFs, with trading leaping 41% in 2018 from a year earlier, according to research.

October 23 -

The strategy has in theory made no money for investors 42% of the time since 2018, new research shows.

October 22 -

Broadly, hedge funds lost about 0.1% last month, paring gains for the year to about 6.2%, data show.

October 18 -

Geopolitical friction and a slowdown in global economic growth have boosted the metal’s demand despite signs of recent wavering.

October 15 -

The change, the regulator says, will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors.

October 10 -

The organization is focusing its efforts on diversity, technology and creative product development in 2020, says Jim Fitzpatrick, president and CEO of the group.

October 9NICSA -

Fee compression and commoditization of investment products over the past decade are threatening already slim margins in asset management.

October 9 Delta Data

Delta Data -

“We need someone with a deep understanding of BlackRock, our business and, above all, our culture,” CEO Larry Fink wrote in a memo.

October 8 -

Among the honors this year by NICSA are awards for operational excellence, and advances in product development and technology.

October 8 -

More than 70% of U.S. ETF assets are in funds that charge 2 basis points or less, data show. But free isn’t an automatic ticket to success.

October 8 -

For its annual NOVA awards, NICSA recognized asset managers and executives for operational excellence and product development.

October 7 -

Studies purport to have proven both that socially responsible investing hurts returns, and that it can boost performance.

October 7 -

The cost savings of peer-to-peer trading could prove appealing in a world where profits are being squeezed by a race to the bottom on fees.

October 3 -

Martin Gilbert helped build Aberdeen Asset Management through dozens of acquisitions starting in the early 1980s.

October 2 -

Financial market data — unlike photos or road traffic information or chess games — is finite, and the algorithms can learn only from past performance.

October 2 -

Wild price swings that have exceeded double-digit percentages in a single day have spurred the regulator to keep a close eye on volatility.

October 1 -

Among funds impacted so far, the Invesco China Technology ETF fell 2.8%, while the KraneShares CSI China Internet Fund lost 3.8%.

September 30 -

Funds of funds, pensions, consultants, family offices and endowments have pulled $16.4 billion from generalist long-short equity funds this year.

September 27 -

Under the proposed structure, the funds will conceal a portion of their assets and instead publish a list of securities that’s highly correlated to the performance of the portfolio.

September 26