Tariffs, inflation and political uncertainty have made some investors

Diversification is still the primary benefit, said Hardik Patel, founder of

"International markets can lead for extended periods, and maintaining exposure helps investors capture opportunities across different economic cycles," he said.

READ MORE:

Beyond diversification, advisors are watching how global realignment could create opportunities. Steve Kolano, chief investment officer at

He added that

"In developed non-U.S. [countries,] capital flows ... and new areas of targeted investments, such as defense, have created investment opportunities at attractive valuations," he said.

READ MORE:

How to choose international equity funds

High-quality funds stay within their stated guidelines and identified opportunity sets, said Kolano. A key factor is understanding the structure of the fund's underlying beta exposure — its sensitivity to market movements — and how that exposure fits into the portfolio, he said. Regional exposure and the fund's benchmark matter as well.

A good international equity fund typically has a low expense ratio, broad diversification and tax efficiency through low turnover, said Patel. In contrast, a less attractive fund might carry high fees, trade frequently (leading to realized gains and tax inefficiency) or concentrate too narrowly in a few countries or sectors, which can undermine diversification benefits.

Rather than trying to forecast short-term economic outcomes or currency movements, Patel said he seeks to align international exposure with each client's risk tolerance and time horizon.

"I emphasize a disciplined, diversified approach that balances risk and captures growth across global markets over time," he said.

A fund that drifts from its stated benchmark is another red flag. "Doing so creates unintended risks in the portfolio and increases unintended tracking error of the overall portfolio," Kolano said.

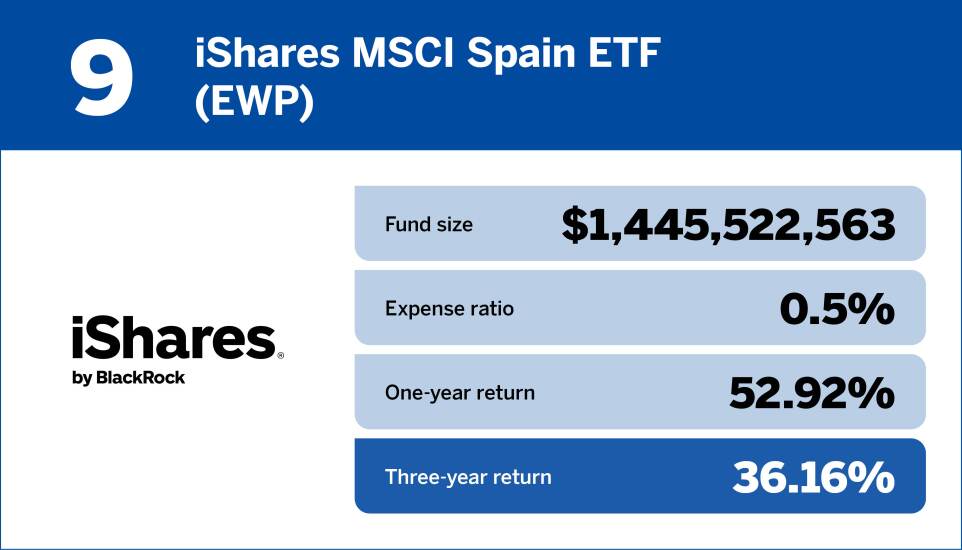

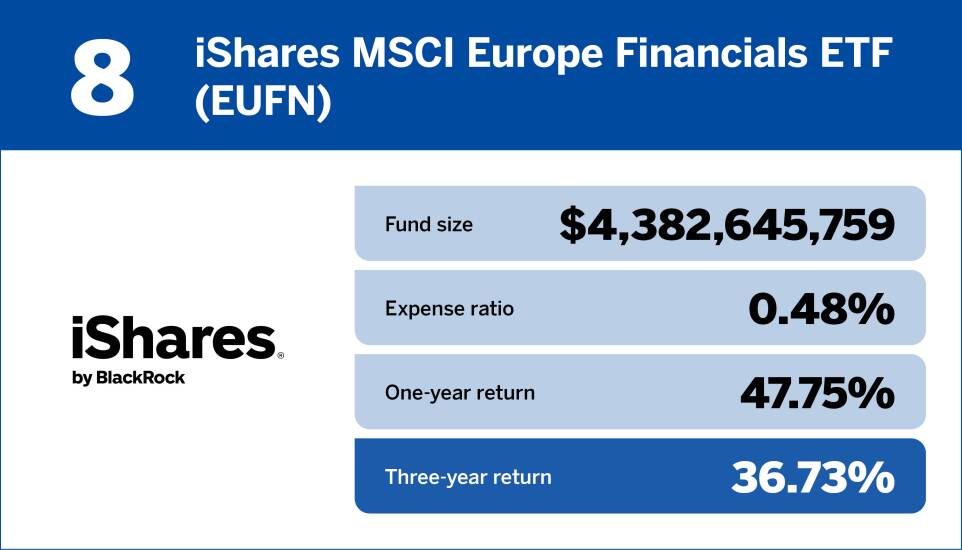

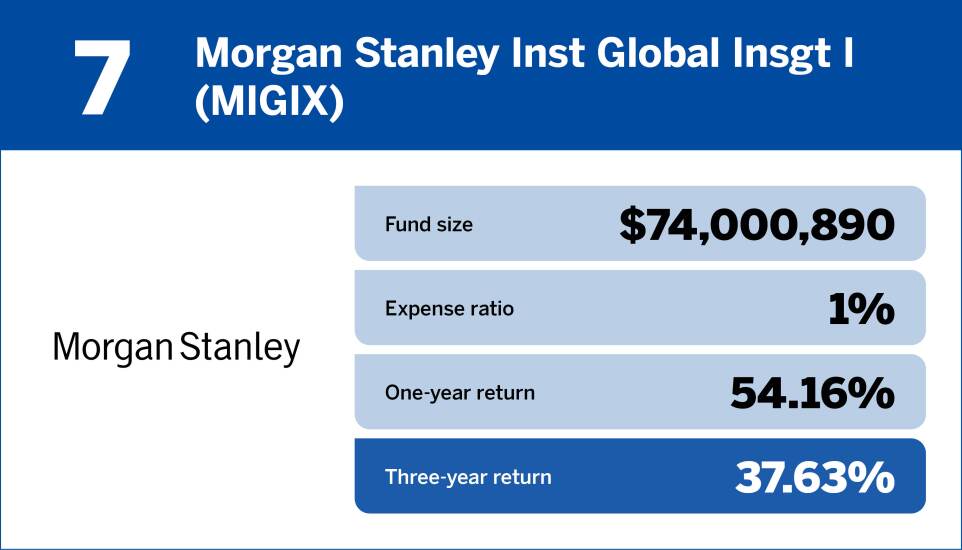

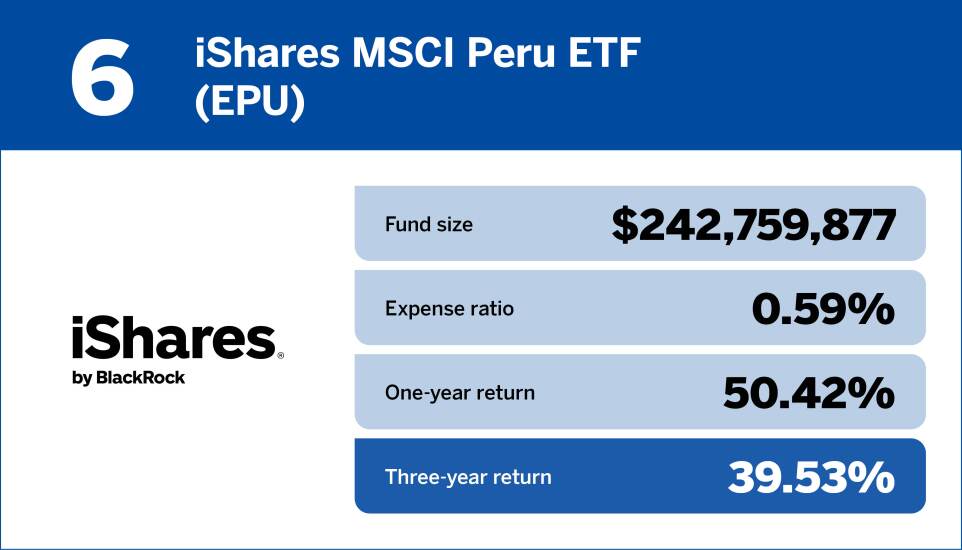

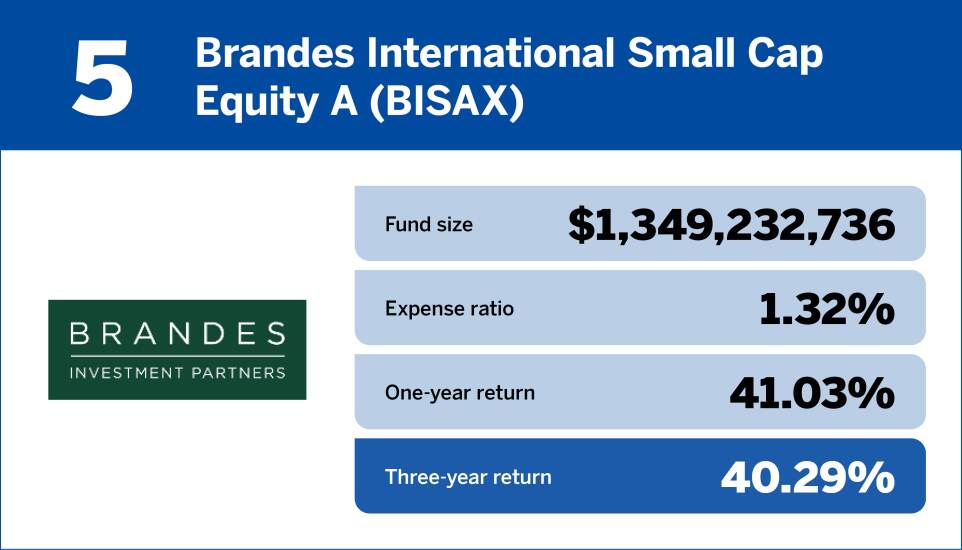

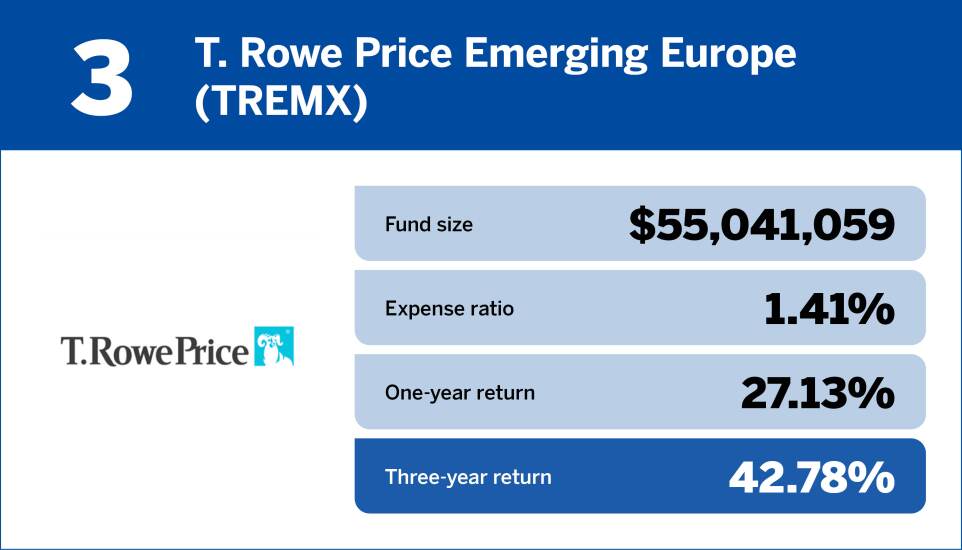

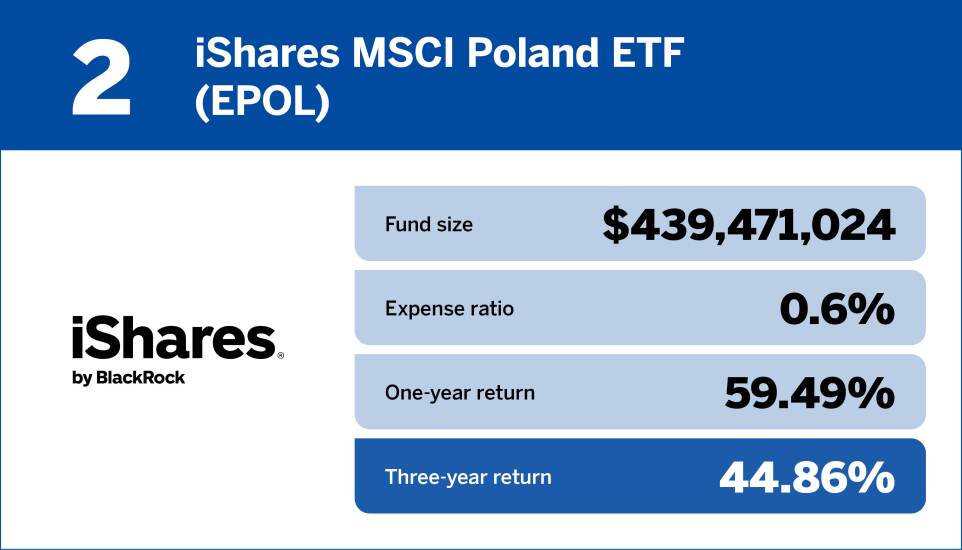

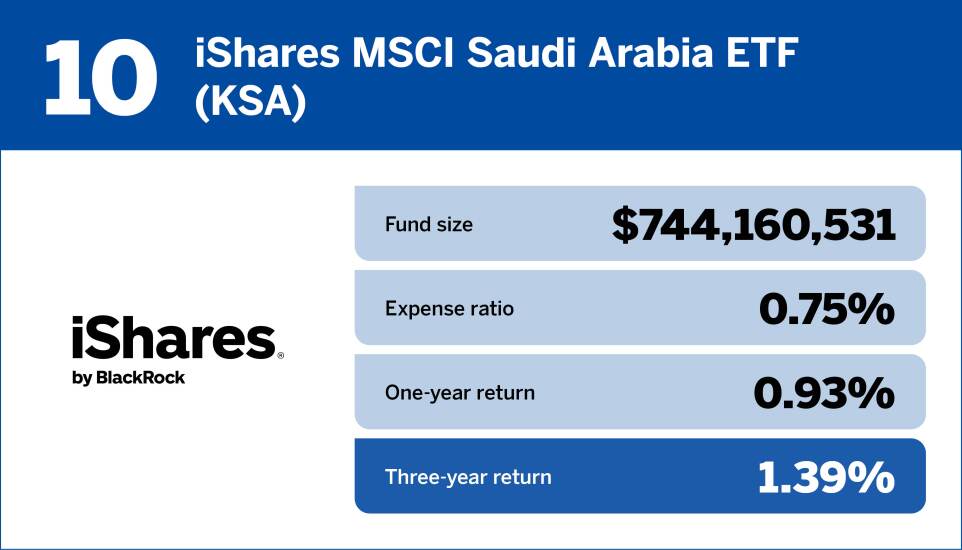

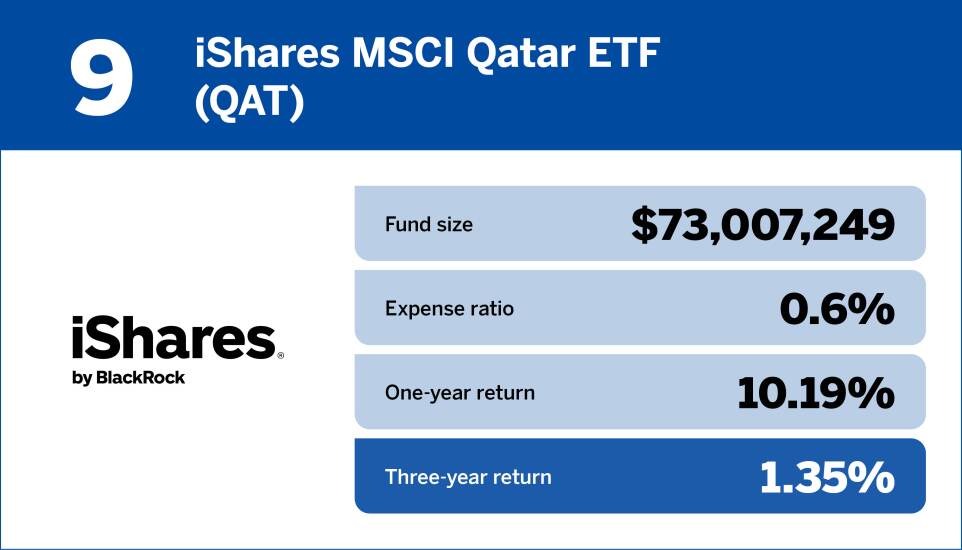

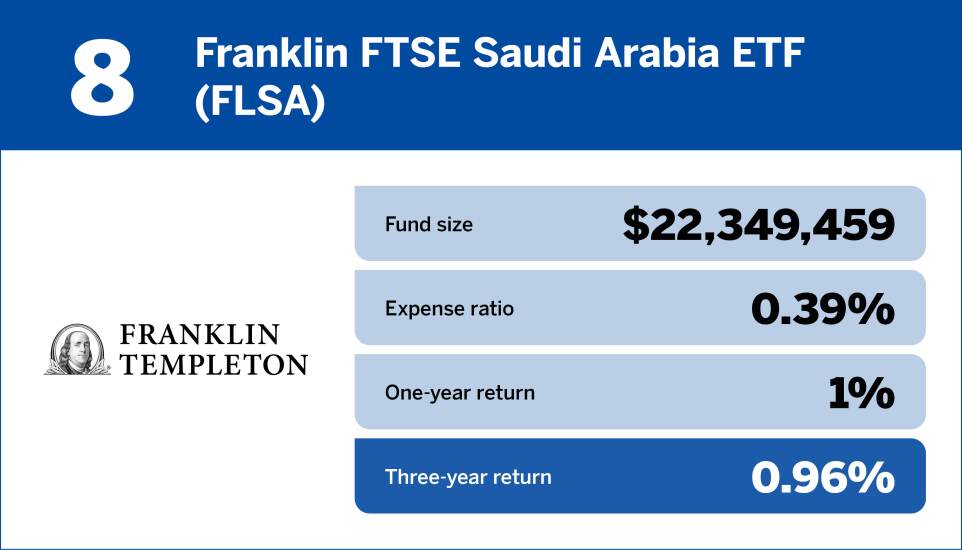

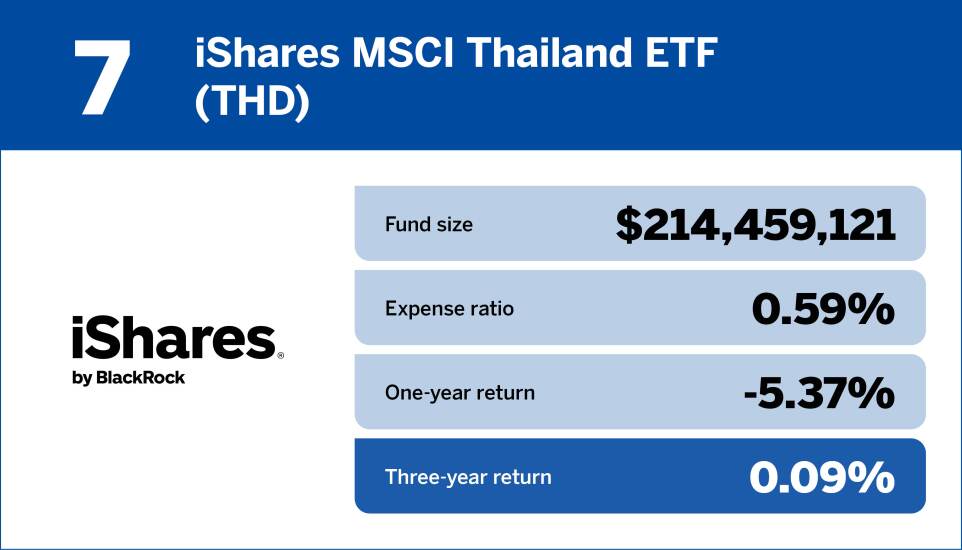

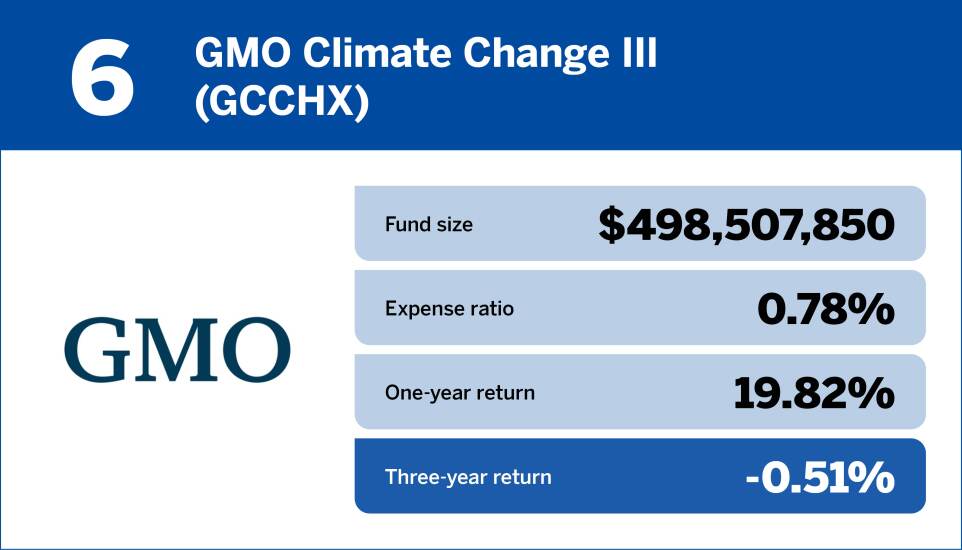

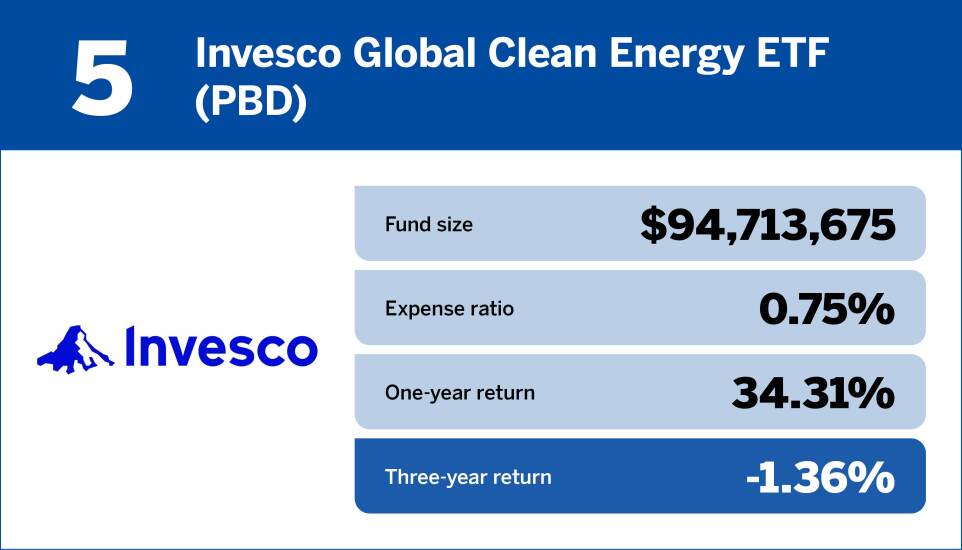

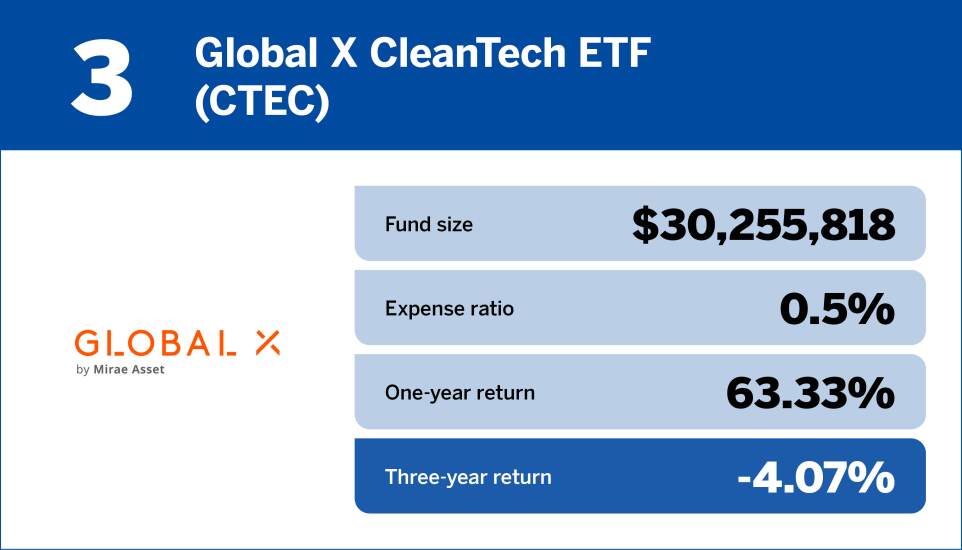

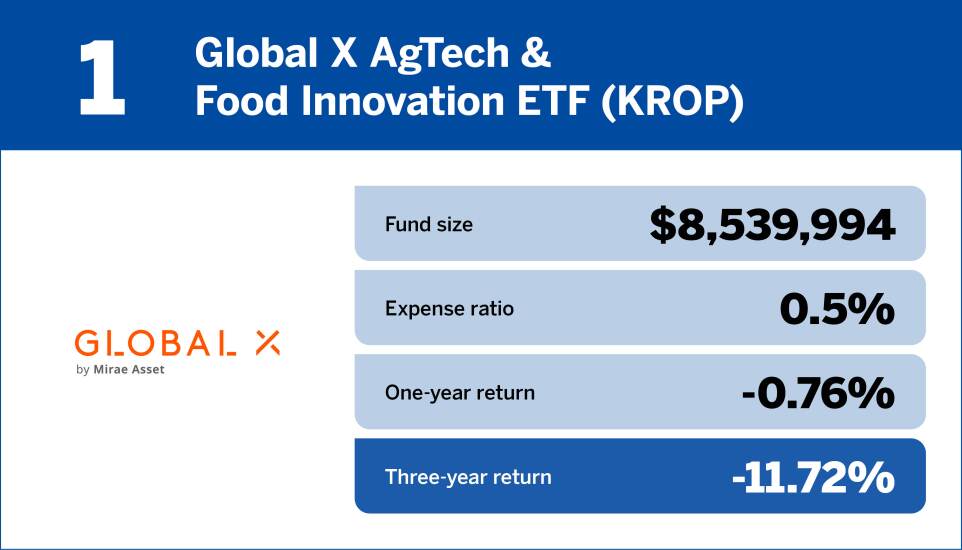

Scroll down the slideshow below to see the 10 international equity funds with the highest three-year returns and the 10 international equity funds with the lowest three-year returns as of Oct. 31, 2025. All data is from Morningstar Direct.